03.19.2024

Market Insights – 3/19/2024

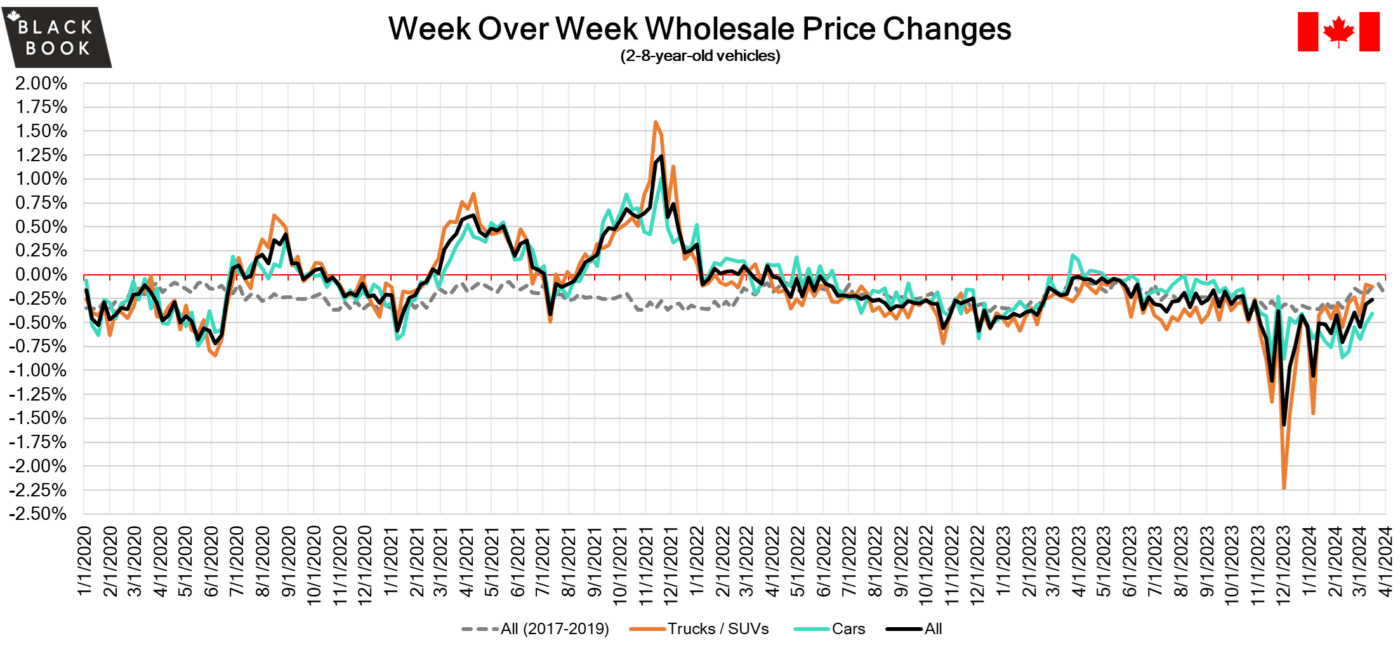

Wholesale Prices, Week Ending March 16th

The Canadian used wholesale market saw a decline in prices for the week at –0.26%. The Car segment fell by –0.40% and the Truck/SUVs segment prices declined –0.13%. 3 out of 22 segments’ values have increased for the week. The Full-Size Crossover/SUV segment increased by 0.47% followed by the Compact Crossover/SUV segment which rose by 0.26%. The segments with the largest declines were Sub-Compact Car at -1.45% followed by Compact Car at –0.91%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.40% | -0.51% | -0.12% |

| Truck & SUV segments | -0.13% | -0.10% | -0.13% |

| Market | -0.26% | -0.31% | -0.13% |

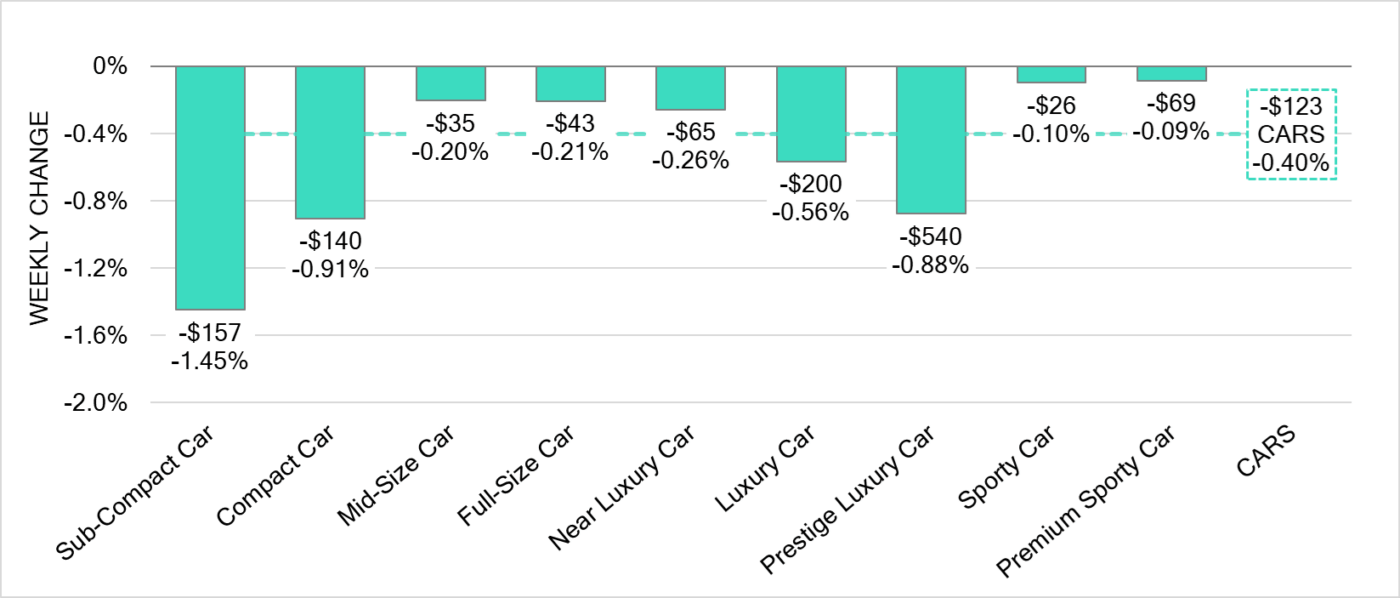

Car Segments

- There was an overall decrease of -0.40% seen in Car segments last week.

- Those with the least amount of a decline were Premium Sporty Car at (-0.09%), followed closely by Sporty Car with (-0.10%).

- Sub-Compact Car showed the most significant decline at (-1.45%) followed by Compact Car at (-0.91%) and Prestige Luxury car at (-0.88%).

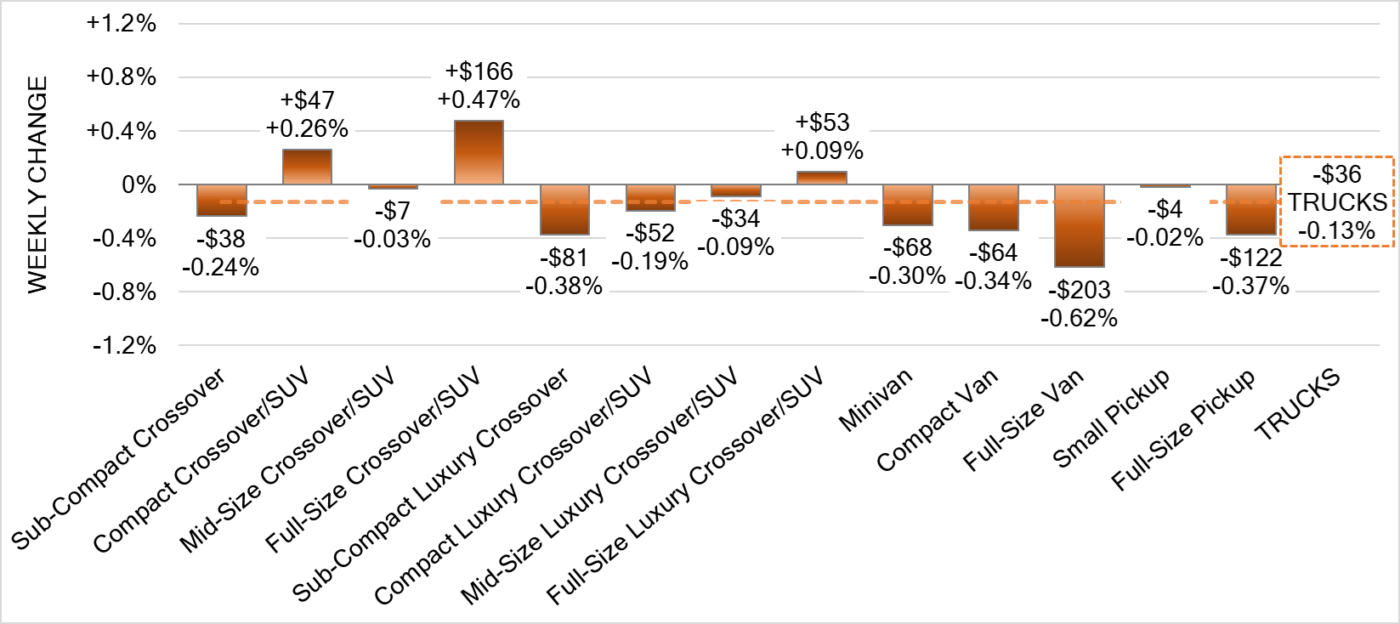

Truck Segments

- Last week truck segments reflected an overall decrease of -0.13%.

- The segments with the most notable decline were Full-Size Van (-0.62%), Sub-Compact Luxury Crossover (-0.38%) and Full-Size Pickup (-0.37%).

- Three segments had an increase. Those were Full-Size Crossover/SUV (+0.47%), Compact Crossover/SUV (+0.26%) and Full-Size Luxury Crossover/SUV (+0.09%).

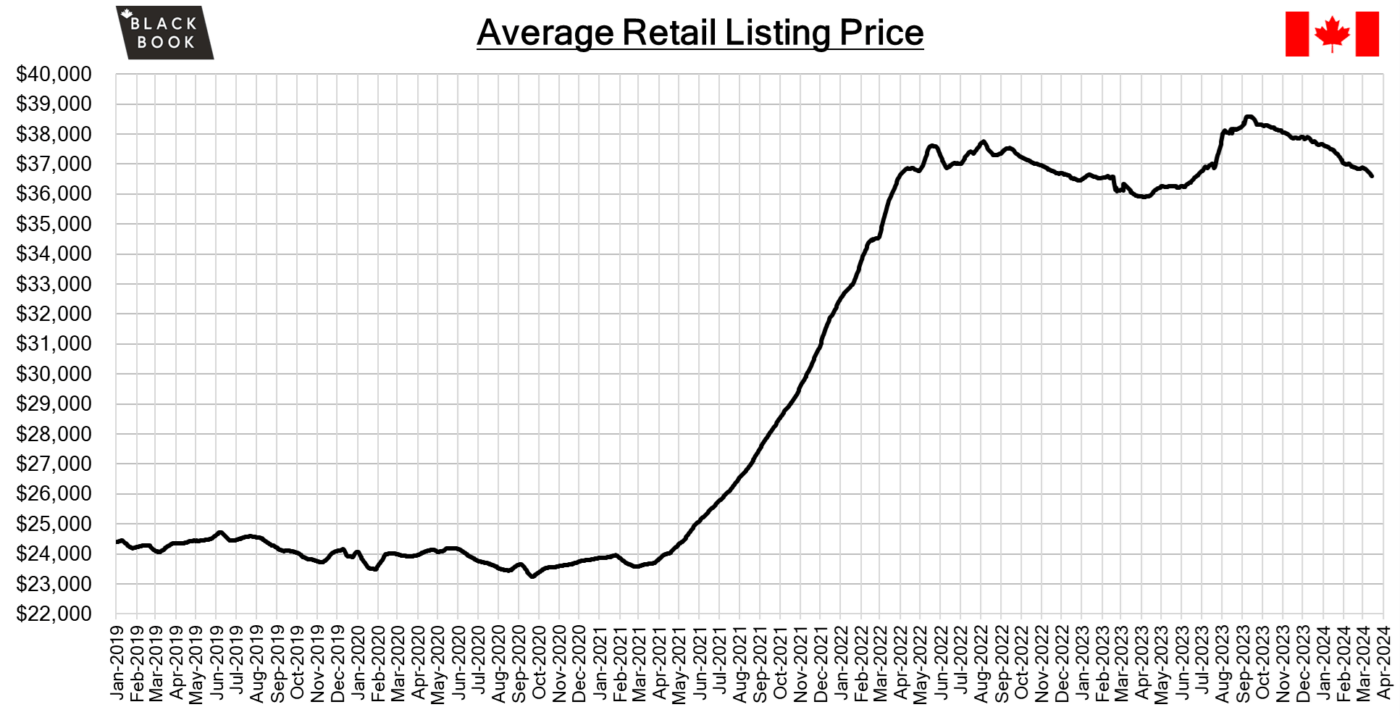

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $36,600. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, with declines that were close to the prior week. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of less than $100 this week as the Car segments fell the most which continues the recent trend. Conversion rates were stable this past week with some observed sell rates were as low as 18% and as high as 71% but most were between 25-45%. Last week we saw more sellers dropping floors, which has been contributing to more lanes with higher sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Canadian investment in building construction declined 0.9% to $19.7 billion in January.

- Industrial producer prices in Canada rose by 0.7% over a month in February 2024, above market forecasts of a 0.1% increase and following four consecutive months of declines.

- The Raw Materials Price Index in Canada went up 2.1% month-over-month in February 2024, accelerating from a 1.2% increase in January and coming above market forecasts of a 0.8% rise.

- The yield on the Canadian 10-year government bond increased to 3.60%.

- The Canadian dollar is around $0.739 this Monday morning down from $0.741 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments increased +0.17% last week; the prior week decreased by -0.05%.

Volume-weighted Car segments increased +0.02%, compared to the prior week’s -0.14% decrease:

- Last week, the Mid-Size Car segment experienced the most substantial growth among all car categories, recording a 0.35% rise, an uptick from the previous week’s modest 0.01% increase. Specifically, Mid-Size Cars aged between 8 to 16 years saw an even higher gain of 0.44%.

- The Prestige Luxury Car segment persists in witnessing significant decreases, with a notable drop of 0.68% last week, which is larger compared to the 0.35% decline observed the week before.

- While Sporty Cars aged 2 to 8 years old experienced a decrease of 0.16%, other age categories of Sporty Cars are on the rise, with the newest models (0 to 2 years old) increasing by 0.10% and the older models (8 to 16 years old) seeing a slight increase of 0.02%.

Volume-weighted Truck segments increased by +0.24%; the previous week decreased -0.02%:

- Last week, the Minivan segment posted the most substantial rise, with a gain of 0.59%, which is a slight improvement over the previous week’s increase of 0.38%.

- Although the broader Truck market saw growth, both the Mid-Size and Full-Size Luxury Truck segments experienced decreases last week, with declines of 0.05% and 0.40%, respectively.

- The Full-Size Pickup segment saw a modest increase of 0.06% last week, marking its first gain in forty weeks. This is a noteworthy change from the sharp depreciation experienced last November, when values declined over 2% in just one week.

- The Compact Van segment is diverging from other Van categories, experiencing another week of depreciation with a decrease of 0.07% last week, continuing a downward trend for the forty-ninth consecutive week.

Industry News

- Zero-emission vehicle registrations in Canada topped 10% for the first time in 2023, as finalized numbers for Q4 came in last week. A total of 184,578 ZEV’s were sold last year, representing 10.8% of the total market. B.C. led adoption for ZEV’s at 20.2% of sales, while Quebec and Ontario followed up with 18.6% and 7.4% respectively. Share of BEV’s dominated against plug-ins, accounting for 75.6% of all ZEV registrations.

- Quebec is planning to remove rebates for zero-emission vehicles come 2027, as “consumers have shown growing interest in these vehicles” says the province. This comes amidst an affordability crisis for new and used vehicles, where the province currently offers the strongest ZEV rebate for new electric vehicles in the country.

- As the GM Canada team transitions to new leadership in Kristian Aquilina, they have now named Shane Peever as Kristian’s replacement in the position of Vice President of Sales, Service and Marketing effective April 1st. This brings Peever back to Canada after a stint as Director of Sales for GM Energy since November 2022 which followed his time as Managing Director of Cadillac Canada.

NRCan data shows a notable increase in EV chargers as of March 1st, resulting in EV drivers now accessing 27,181 charging ports at 11,077 stations across the country, 82% of which are Level 2 while only 18% are at Level 3. This accounts for a 32.7% increase over last year, or average growth of 18 chargers a day.