03.26.2024

Market Insights – 3/26/2024

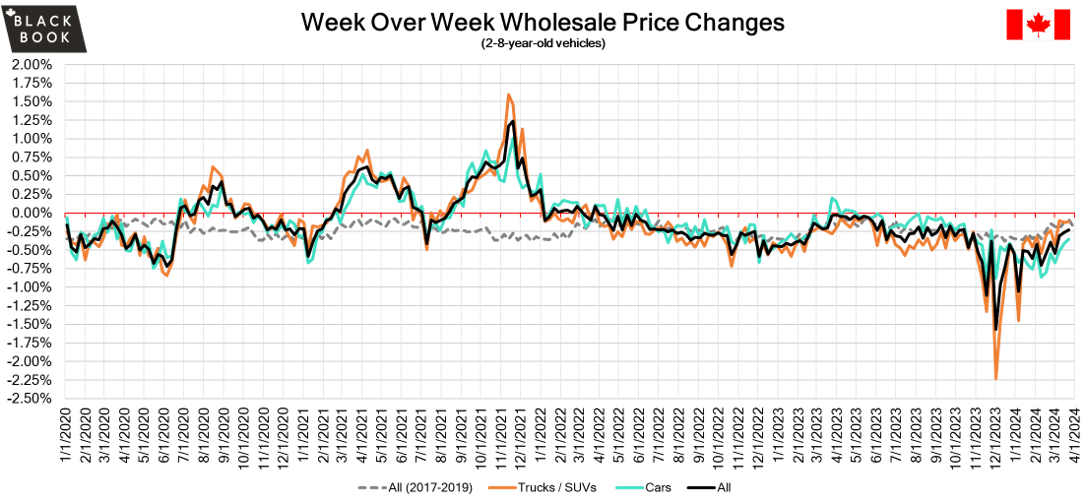

Wholesale Prices, Week Ending March 23rd, 2024

The Canadian used wholesale market saw a decline in prices for the week at –0.23%. The Car segment fell by –0.35% and the Truck/SUVs segment prices declined –0.11%. 4 out of 22 segments’ values have increased for the week. The Full-Size Luxury Crossover/SUV segment increased by 0.56% followed by the Mid-Size Crossover/SUV segment which rose by 0.50%. The segments with the largest declines were Compact Van at -1.50% followed by Sub-Compact Car at –0.98%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.35% | -0.40% | +0.01% |

| Truck & SUV segments | -0.11% | -0.13% | -0.19% |

| Market | -0.23% | -0.26% | -0.09% |

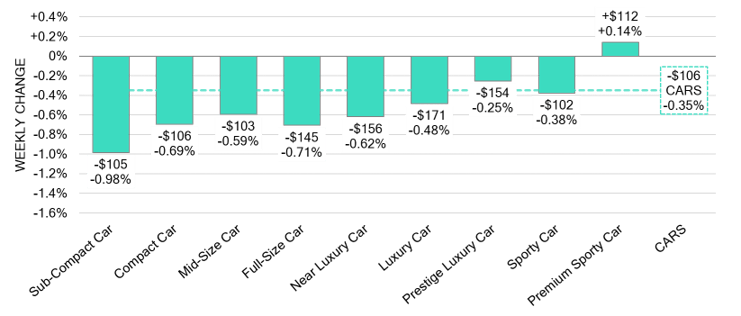

Car Segments

Car Segments

- There was an overall decrease of -0.35% seen in Car segments last week. This decrease was noted across all but one of the nine segments.

- Sub-Compact Car showed the most significant decline at (-0.98%) followed by Full-Size Car at (-0.71%) and Compact Car at (-0.69%).

- The only segment to show an increase in pricing was Premium Sporty Car at (+0.14%).

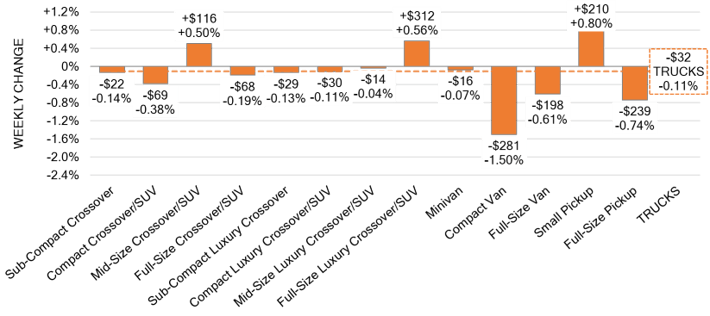

Truck / SUV Segments

- Truck segments showed an overall decrease of -0.11% last week.

- Segments with the largest depreciations were Compact Van (-1.50%), Full-Size Pickup (-0.74%) and Full-Size Van (-0.61%).

- There were three segments with an increase: Small Pickup (+0.80%), Full-Size Luxury Crossover/SUV (+0.56%) and Mid-Size Crossover/SUV (+0.50%).

Wholesale

The Canadian market continued to decrease, with declines that were close to the prior week. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of less than $120 this week as the Car segments fell the most which continues the recent trend. Conversion rates were stable this past week with some observed sell rates were as low as 14% and as high as 60% but most were between 25-45%. Last week we saw more sellers dropping floors, which has been contributing to more lanes with higher sell rates.

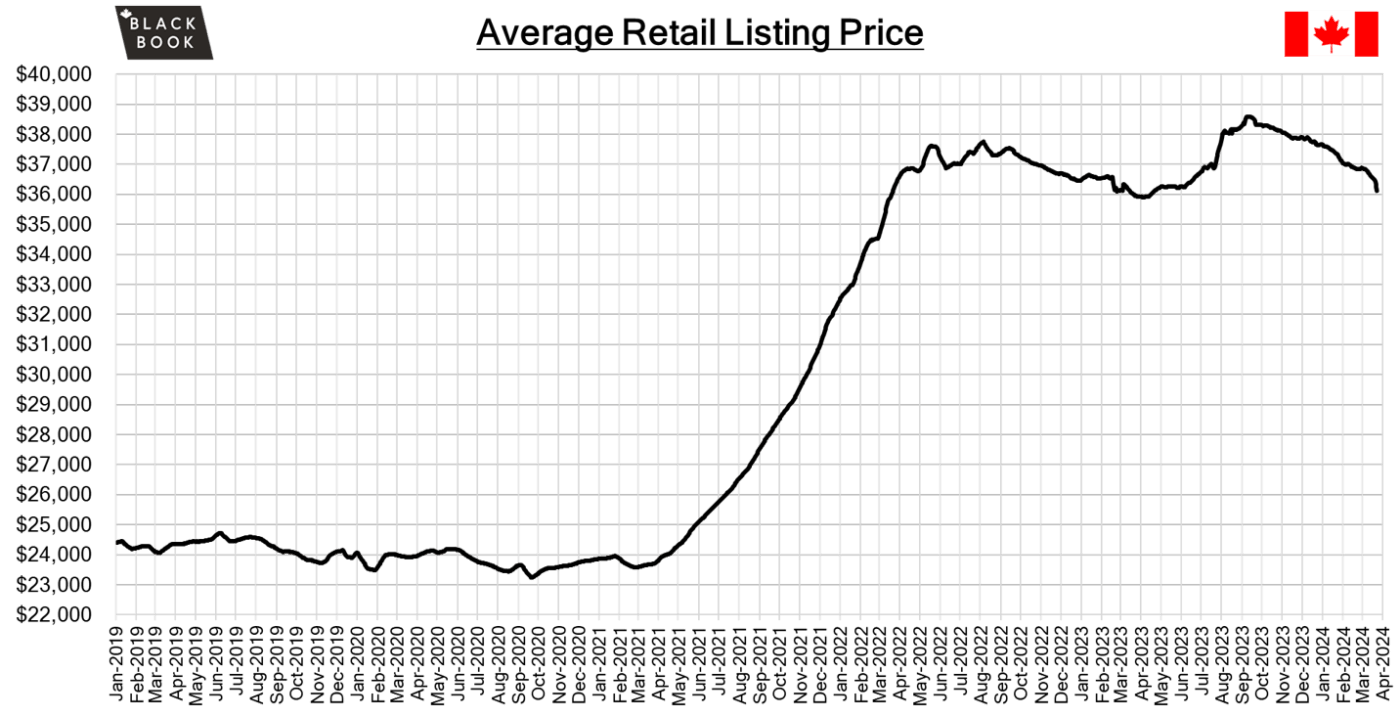

Used Retail Prices & Listing Volume

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $36,600. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The annual inflation rate in Canada slowed further to 2.8% in February 2024 from 2.9% in January 2024 and marking the lowest reading since June 2023.

- New home prices in Canada edged up by 0.1% month-on-month in February 2024, rebounding from a 0.1% decrease in the prior month.

- Retail sales in Canada are expected to have edged up by 0.1% in February of 2024, according to preliminary data.

- The yield on the Canadian 10-year government bond increased slightly to 3.63%.

- The Canadian dollar is around $0.735 this Monday morning down from $0.749 a week prior.

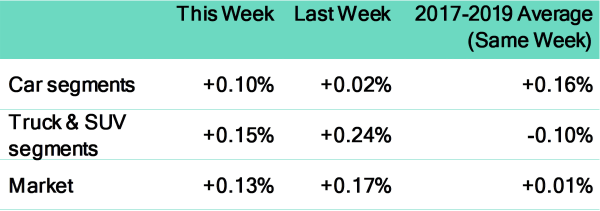

U.S. Market

Market conditions are reflecting a positive trend and a shift back to traditional patterns in areas such as vehicle valuations, auction attendance, the supply of inventory, and auction conversion rates. The broader market has seen another week of growth with a +0.13% increase in values, marking the second successive week of gains. Last week, all vehicle age groups experienced an uptick in value, with the youngest category (0-to-2 years) growing by +0.05% and the older group (8-to-16 years) by a more significant +0.15%.

Industry News

- As automakers scale back plans on transitioning their lineups to EV, Ford Motor Co. has announced delays for its 3-row electric SUVs as its focus turns to more affordable small EV’s and expects to launch a small crossover and pick-up truck with the first one arriving in late 2026.

- As Honda Canada prepares to receive more expensive EV models in their lineup, they plan on trimming dealer margins by as much as 44%, sparking backlash from the dealer body who has engaged the Canadian Auto Dealers Association to represent them in pushing for a “different outcome”.

- British Columbia is planning 500 new EV chargers to come online in the province with the goal of prioritizing applications that would fill gaps in the geographical charging network as it aims to operate 10,000 public charging stations by 2030.

- A common issue among EV owners utilizing the public charging infrastructure is slowly eroding, as of June the British Columbia Utilities Commission will shift from a pay per minute to an energy-based pay plan, allowing users to now fully benefit from what they pay for while at a charging station.