03.04.2025

Market Insights – 3/4/25

Wholesale Prices, Week Ending March 1st, 2025

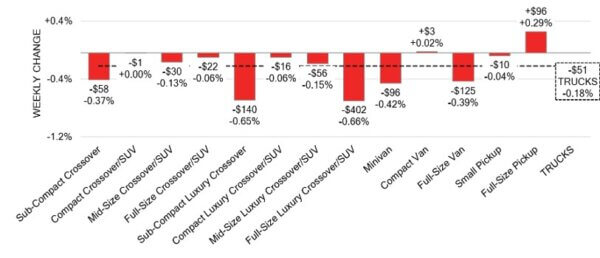

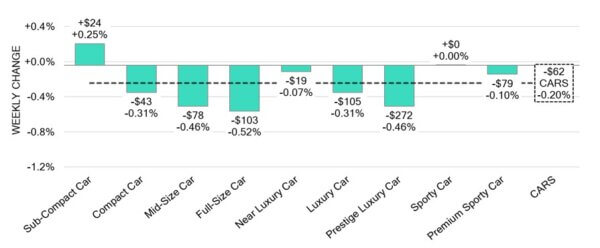

The Canadian used wholesale market experienced a decline of –0.19% in pricing for the week. Car segments prices decreased by –0.20% while the Truck/SUVs segments decreased by -0.18%. The largest increases were seen in Full size Pickup at +0.29% and Sub-Compact Car at +0.25%. The largest declines in the car segments were seen in Full-Size Car at -0.52% and Mid-Suze Car with -0.46%. The largest declines in the Truck/SUV segments were Full Size Luxury Crossover/SUV at -0.66% followed by Sub-Compact Luxury Crossover/SUV with -0.65%.

| Car segments | -0.20% | -0.23% | -0.16% |

| Truck & SUV segments | -0.18% | -0.21% | -0.21% |

| Market | -0.19% | -0.22% | -0.18% |

Car Segments

- Car segments reflected an overall depreciation of –0.20% last week. This weakening was noted across seven of the nine car sectors.

- Segments with the largest reductions were Full-Size Car (-0.52%). Mid-Size Car and Prestige Luxury Car had the same decline (-0.46%).

- One segment showed an increase. That segment was Sub-Compact Cars (+0.25%).

Truck / SUV Segments

- Truck segments reflected an overall decrease of –0.18% last week.

- Two of the thirteen segments reflected an increase in values. Those segments were Compact Van (+0.02%) and Full-Size Pickup (+0.29%).

- Eleven segments saw values depreciate. The largest was seen in Full-Size Luxury Crossover/SUV (-0.66%), Sub-Compact Luxury Crossover (-0.65%) and Minivan (-0.42%).

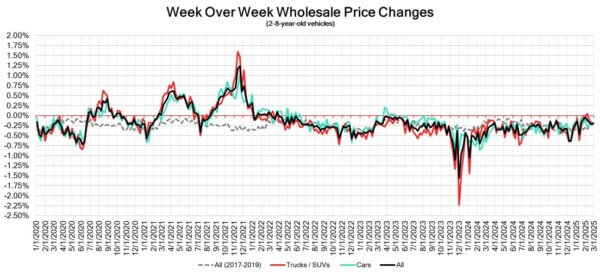

Wholesale

The Canadian market remains on a downward trend, similar to the decline in its previous week. Just over 27% of the market segments experienced an average value change of more than ±$100. The decrease in the truck segments fell to –0.18%, while the decline of the car segments also experienced a decrease, bringing its change to –0.20%. Monitored auction sale rates ranged from 52.6 to 76.1% averaging at 54.3%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including the ongoing gradual decline/change in floor prices. The increase in supply entering the wholesale market continues to slow down, however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

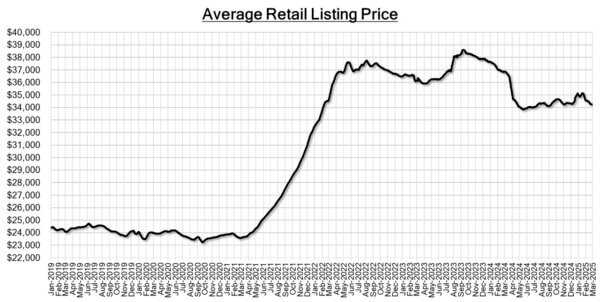

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $34,000. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The Canadian GDP increased by 0.6% in the quarter ending December 2024,

after a revised increase of 0.3% in the previous quarter. - The S&P Global Canada Manufacturing PMI dropped to 47.8 in February 2025,

down from 51.6 the previous month. This was a significant decline compared to

the market expectations of 51.9. - Canada’s current account deficit increased to $5.0 billion in the fourth quarter of

2024, up from a revised $3.6 billion in the third quarter and significantly higher

than the anticipated $3.2 billion deficit. - The yield on the Canadian 10-year government bond decreased to 2.95%.

- The Canadian dollar is around $0.694 this Monday morning, representing a

decrease from $0.703 a week prior.

U.S. Market

- Currently, stability is the name of the game, with early indications of rising prices in select segments suggesting that spring is near. The previous week’s overall market downturn mirrored that of the prior week, remaining less severe than the typical seasonal declines for this period.

Industry News

- Tariffs on Mexico and Canada have been said to begin March 4th, with the 25% level impact currently undecided. As President Trump commends both regions on decreasing the flow of fentanyl into U.S. borders but failing to eliminate it.

- Ontario’s provincial government voted in the Progressive Conservative party for a third time as a majority party last week. Doug Ford will remain Premier of Ontario as well as a strong supporter for the auto industry’s global investment in the province with key successes during his last term.

- Following an exit from the market at a national level proceeding the pandemic, online Used vehicle retailer, Clutch is looking to regain its status across the country as it received a $50 million group investment to help fund its current operations and future growth.

- Concluding the 2025 Canadian International Auto Show onFebruary 23rd, overall attendance this year was down 13% from last year at 323,521. Battling winter storms early on in the 10-day event slowed the start and contributed to lesser traffic during the first few days.

- Zero-emission vehicle (ZEV) share in 2024 generated a record fourth quarter, at 18.9% on its way to a high of 15.4% for the year. Both measures up 40% over last year as the market demand rose towards the end of the year pending the decrease/end of multiple rebate programs for consumers provincially and federally.

- January ZEV share fell from the fourth quarter due to the removal of rebate programs. Coming in at 13.3% for the month, it’s a far cry from the end of 2024, but still up nationally by 2.9%.