03.05.2024

Market Insights – 3/5/2024

Wholesale Prices, Week Ending March 2nd

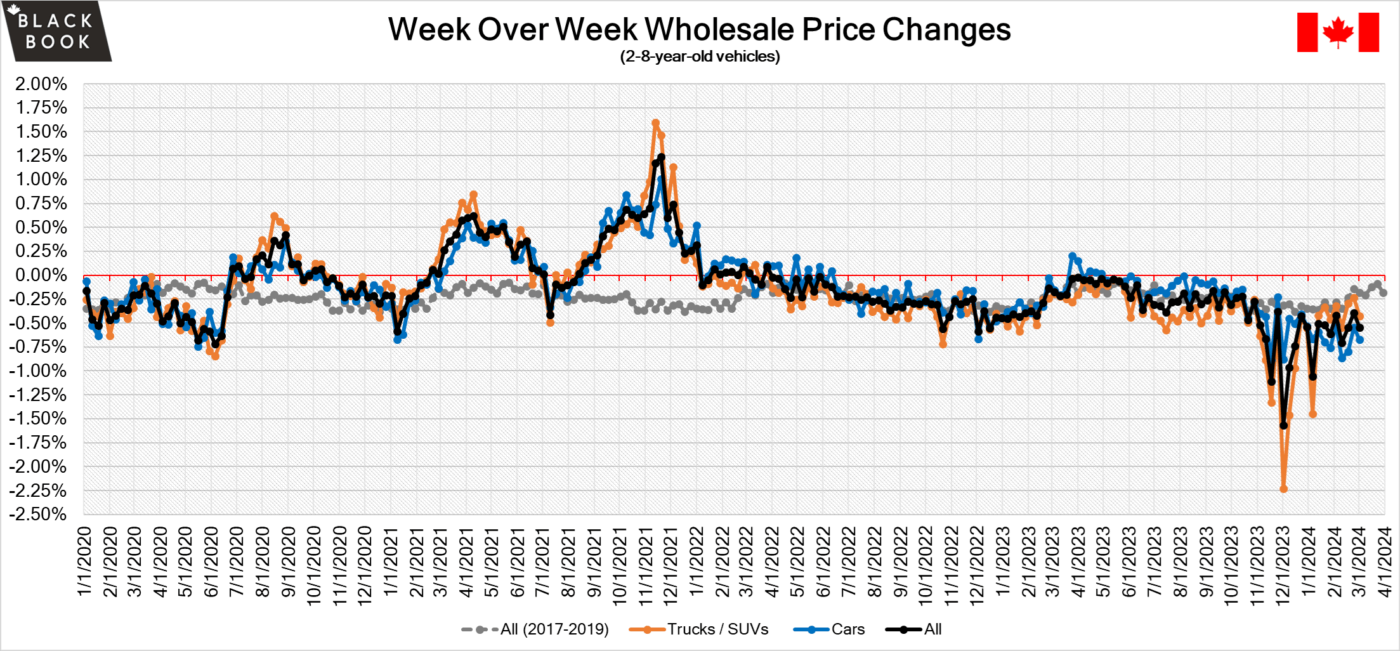

The Canadian used wholesale market saw a decline in prices for the week at –0.55%. The Car segment fell by –0.67% and the Truck/SUVs segment prices declined –0.42%. 2 out of 22 segments’ values have increased for the week. The Full-Size Luxury Crossover/SUV segment increased by 0.86% followed by the Minivan segment which rose by 0.01%. The segments with the largest declines were Subcompact Car at -1.92% followed by Compact Van at –1.50%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.67% | -0.55% | -0.16% |

| Truck & SUV segments | -0.42% | -0.24% | -0.21% |

| Market | -0.55% | -0.39% | -0.18% |

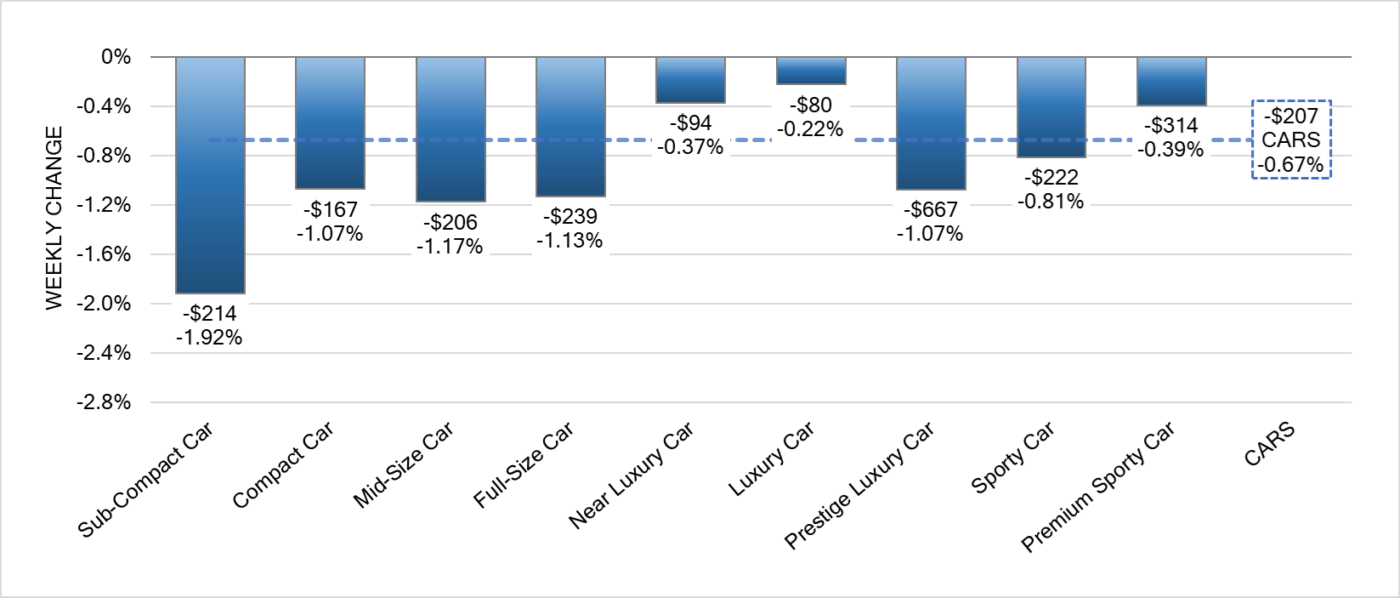

Car Segments

- There was an overall decrease of -0.67% seen in Car segments last week.

- The least of the decreases noted were from Luxury Car at (-0.22%) followed by Near Luxury Car at (-0.37%) & Premium Sporty Car with (-0.39%).

- Sub-Compact Car showed the most significant decline at (-1.92%) followed by Prestige Luxury Car & Compact Car, both at (-1.07%).

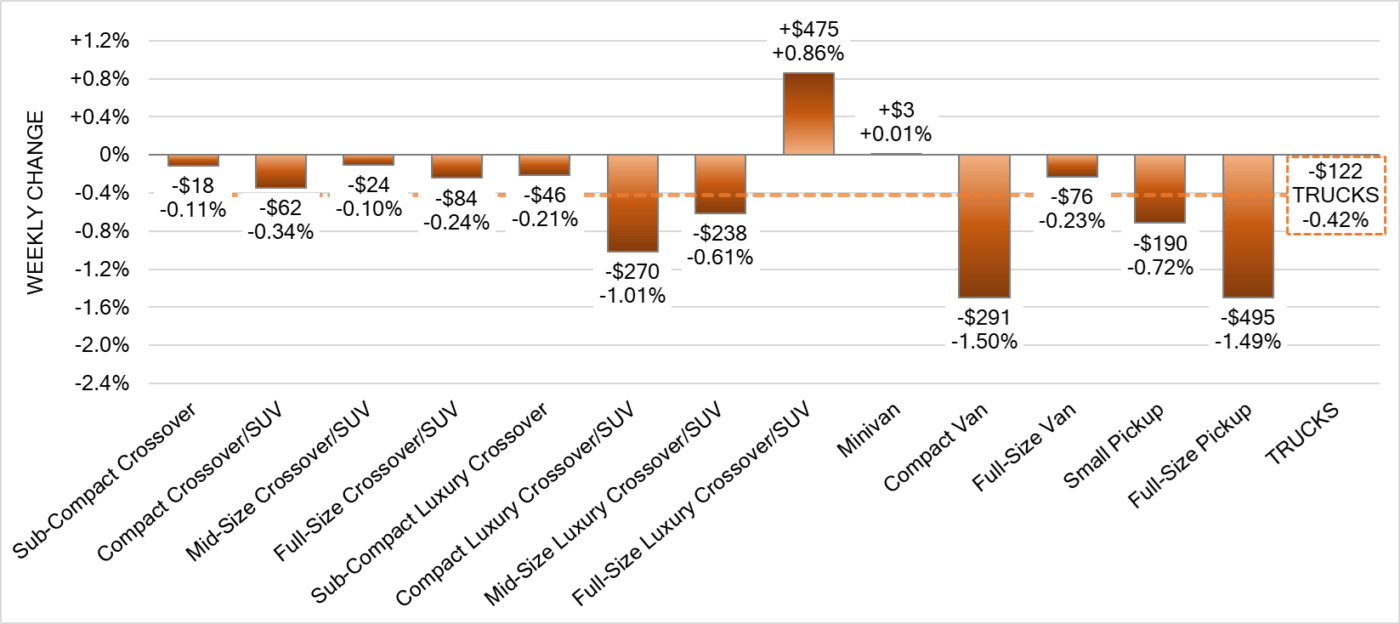

Truck Segments

- Truck segments had an overall decline of -0.42% last week.

- Segments with the most notable depreciations were Compact Van (-1.50%), Full-Size Pickup (-1.49%) and Compact Luxury Crossover/SUV (-1.01%).

- There were two segments with an increase, Full-Size Luxury Crossover/SUV (+0.86%) and Minivan (+0.01%).

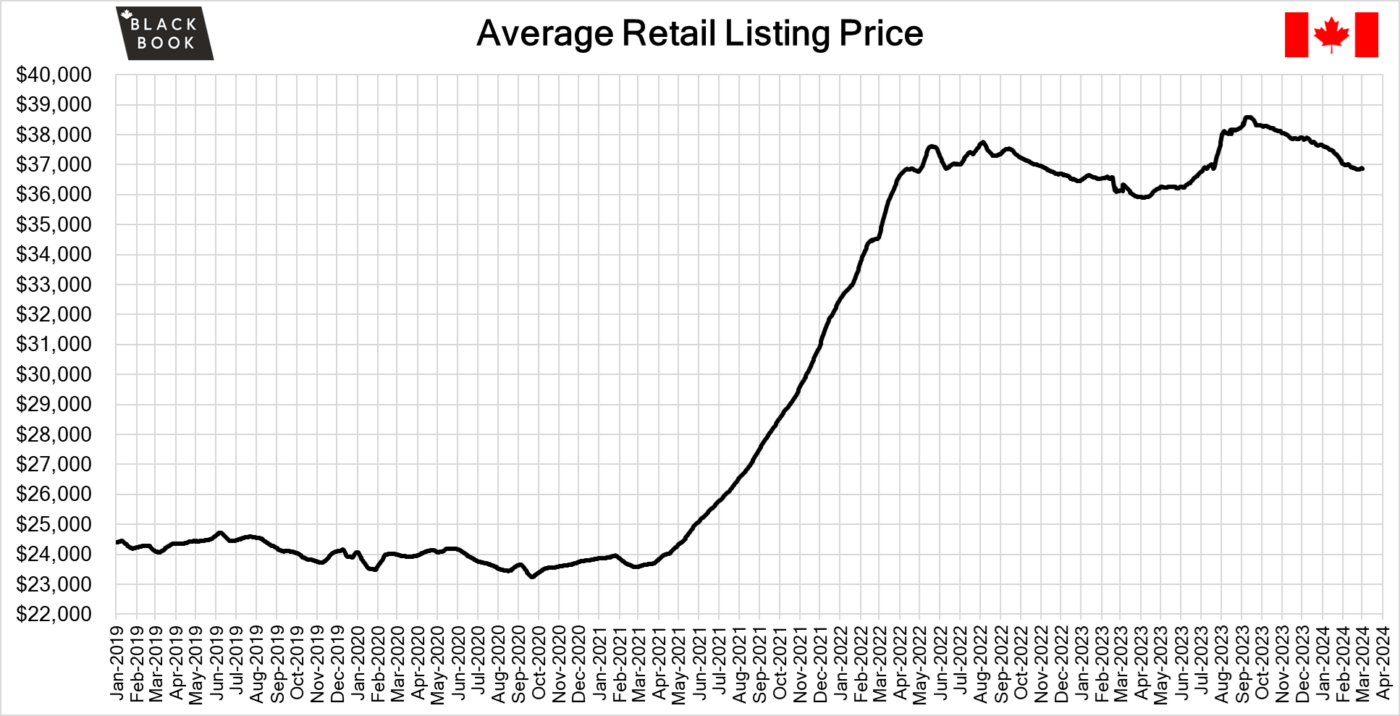

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $36,900. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, with declines increasing slightly from the prior week. Supply is building with decreasing demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $100 this week as the Car segments fell the most which continues the recent trend. Conversion rates were stable this past week with some observed sell rates were as low as 23% and as high as 58% but most were between 40-50%. Last week we saw more sellers dropping floors, which has been contributing to less lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The Canadian GDP expanded by 0.2% in the fourth quarter of 2023, recovering from a revised 0.1% contraction in the previous period, helped by higher exports.

- Canada’s seasonally adjusted current account deficit narrowed to 1.62 billion in the fourth quarter of 2023 from the upwardly revised gap of 4.74 billion in the previous period, the lowest since Q2 2022, but slightly above market expectations of a 1.25 billion deficit.

- Consumer confidence is down in February at 47.38 from 49.46 a month prior according to an Ipsos poll.

- The yield on the Canadian 10-year government bond maintained at 3.50%.

- The Canadian dollar is around $0.737 this Monday morning down from $0.740 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.16% last week; the prior week decreased by -0.19%.

Volume-weighted Car segments decreased -0.10%, compared to the prior week’s -0.25% decrease:

- The Compact Car segment saw its value rise for the eighth week in a row, with an increase of +0.41%—the biggest one-week gain for the segment since mid-April 2023. Moreover, Compact Cars of all ages experienced growth last week, with vehicles aged 0-to-2 years going up by +0.38% and those aged 8-to-16 years seeing a smaller, yet positive, uptick of +0.05%.

- The Near Luxury and Prestige Luxury Car segments both continued to experience significant drops last week, with each segment depreciating by -0.58%.

- The rate of depreciation for the Sporty Car segment is slowing down, with a modest decrease of -0.05% last week, which is an improvement from the -0.10% decline noted the previous week.

Volume-weighted Truck segments decreased by -0.18%; the previous week decreased -0.16%:

- The Minivan segment’s upward momentum picked up speed last week, with a notable increase of +0.30%, compared to the more modest rise of +0.01% during the previous week.

- Following four weeks of average growth at +0.17% per week, the Full-Size Crossover/SUV segment experienced a downturn last week, with a decline of -0.28%.

- The Small Pickup segment continued its upward trend last week, registering a +0.05% increase. This marks the third time in the last four weeks that the segment has seen a rise in value.

- Each of the Luxury Crossover segments experienced significant drops last week, with the Compact Luxury Crossover/SUV segment leading the downturn with the largest decline of -0.50%.

Industry News

- A new Electric Vehicle Tax is planned for Alberta that will require a $200 fee to be paid by all existing EV owners as of January 1, 2025. The provincial tax is aimed at generating funding for excess “wear and tear on provincial roadways” due to additional weight inherent of EV’s that necessitates greater need for road repair.

- February new vehicle sales hit a record estimate of 129,000, 24.4% higher than last year and over 2020 numbers by 2.4% as well. This marks the 16th consecutive YoY sales increase and marks the Canadian SAAR at 2.11 million units – the highest since January 2018, says Desrosiers Automotive Consultants.

- Ford has become a partner with Tesla to provide free Supercharger adapters until June 30th for its vehicles to easily connect to their charging network, accessing 15,000 chargers in North America. After this date, the adapters will be available for sale at $230 USD.

- Unifor has announced a strike action late in February for Halifax’s Autoport, possibly delaying deliveries of import vehicles from 6 European brands as the organization has come to the bargaining table but recognized the dialogue of options as “not serious about reaching a fair agreement”.

- Toyota has been working on a technology to capture carbon emissions from the atmosphere along with emitting only very small amounts, effectively cleaning the air as it drives. This shows that the future for automotive propulsion is likely a hybrid of multiple powertrains, possibly including ICE’s.