04.01.2025

Market Insights – 4/1/25

Wholesale Prices, Week Ending March 29th, 2025

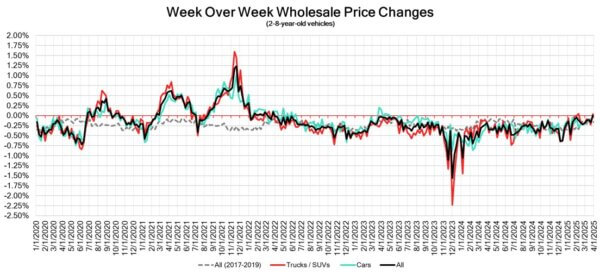

The Canadian used wholesale market was completely flat at 0% change in pricing for the week. Car segments prices decreased by –0.03% while the Truck/SUVs segments increased by +0.04%. The largest increases were seen in Sub-Compact Luxury Crossover/SUV at +0.93% and Compact Crossover/SUV at +0.50%. The largest declines in the Car segments were seen in Full-Size Car at -0.67% and Near Luxury Car with -0.16%. The largest declines in the Truck/SUV segments were Full-Size Van at -0.61% followed by Minivan with -0.25%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.03% | -0.11% | -0.09% |

| Truck & SUV segments | 0.04% | -0.22% | -0.27% |

| Market | 0.01% | -0.17% | -0.18% |

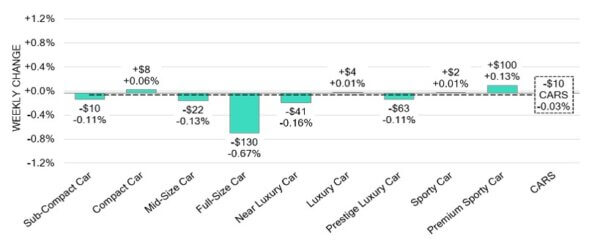

Car Segments

- Car segments reflected an overall depreciation of –0.03%last week. This decline was reflected across five of the nine car segments.

- Full-Size Car (-0.67%) showed the biggest drop, followed by Near Luxury Car (-0.16%) and Mid-Size Car (-0.13%).

- Four segments had an increase. Premium Sporty Car (+0.13%) had the largest. Compact Car (+0.06%) displayed the next notable uptick.

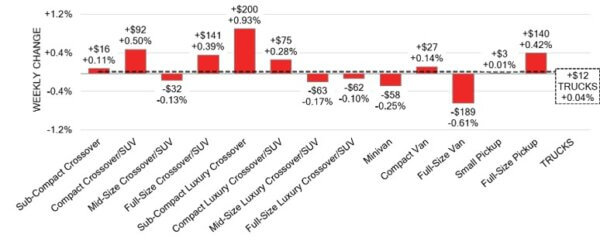

Truck / SUV Segments

- Truck segments had an overall increase of +0.04% last week. Eight of the thirteen segments reflected this change.

- Sub-Compact Luxury Crossover (+0.93%) showed the most significant surge, followed by Compact Crossover/SUV (+0.50%) and Full-Size Pickup (+0.42%).

- Five sectors displayed a decrease. The largest was seen in Full-Size Van (-0.61%) and Minivan (-0.25%).

Wholesale

The Canadian market has begun to reflect a shift in values with an upward trend, in contrast to its behavior from prior weeks. Just under 23% of the market segments experienced an average value change of more than ±$100. For the first time this year the change in truck segments reflects an increase, sitting at +0.04%, while the decline of the car segments experienced a decrease, bringing its change to –0.03%. Monitored auction sale rates ranged from 28.3 to 85.7% averaging at 47.9%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing changes in recent political variances and the gradual change in floor prices. An increase in supply entering the wholesale market has been noted in comparison to prior weeks, however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

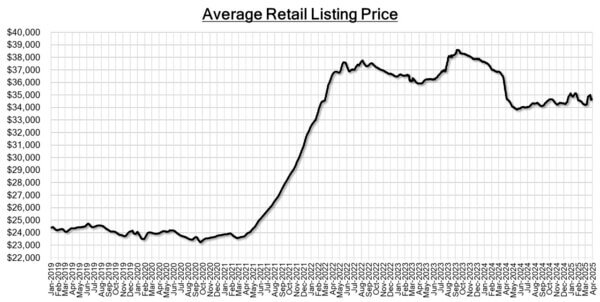

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $34,750. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The Canadian GDP remained virtually unchanged from the previous month in

February 2025, with growth in the manufacturing and finance and insurance

sectors being counterbalanced by declines in the real estate, rental and leasing

sector, the oil and gas extraction subsector, and the retail trade sector, according

to a preliminary estimate. - In January 2025, Canada’s government budget showed a deficit of 5.13 billion

Canadian dollars, an increase from the 2.06 billion Canadian dollars deficit

reported in January 2024. - Wholesale sales in Canada are expected to have grown by 0.4% month-overmonth

in February 2025, following an increase of 1.2% in the previous month,

according to preliminary estimates. - The yield on the Canadian 10-year government bond decreased to 2.99%.

- The Canadian dollar is around $0.695 this Monday morning, representing a slight

decrease from $0.698 a week prior.

U.S. Market

The rate of increase slowed last week but remains above pre-pandemic levels of appreciation for this time of year. As we move into this week, with the anticipated 25% tariff on all imported vehicles into the U.S., we will be closely monitoring the market, expecting to see a rise in demand for used vehicles.

Industry News

- Quebec has reinstated the “Roulez vert” ZEV incentive program and will bring back the $4,000 applied to new ZEV vehicles, as long as they undercut the $65,000 price threshold.

- Toyota and Honda have both said they firmly stand behind their Canadian manufacturing operations as the U.S. is set to impose significant tariffs on vehicles made outside of their borders.

- The 5 Canadian manufacturing facilities in Ontario are all reporting more than 50% U.S. content in their assembled vehicles, which by following the USMCA requirements, does abide by the possible reduced tariff impact disclosed by U.S. Secretary of Commerce, Howard Lutnick to Ontario Premier, Doug Ford on March 27th.

- The Federal Government has frozen $43 million in rebate payments to Tesla, who made a rush of claims prior to removing the iZEV rebate to the amount of 8,669 vehicles within 3 days. It amounted to 88.7% of all claims during that period as the rush was inclusive of other brands as well.

- In a well-timed announcement from Hyundai, the Korean carmaker will be investing $21 billion through 2028, which will increase vehicle production while creating 14,000 new jobs and building a $5.8 billion steel plant in Louisiana.

- The Vancouver Auto Show set an attendance record this year of 138,773 visitors, up from129,033 last year. During the 5-day event that showcased 30 brandsit also broke its single day record where 42,761 visitors descended on the Vancouver Convention Centre.