04.15.2025

Market Insights – 4/15/25

Wholesale Prices, Week Ending April 12th, 2025

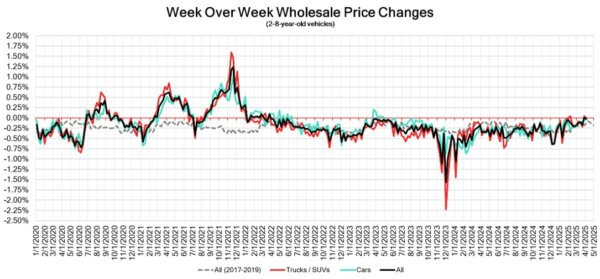

The Canadian used wholesale market experienced an increase of +0.03% in pricing for the week. Car segments prices decreased by –0.01% while the Truck/SUV segments increased by +0.07%. The largest increases were seen in Compact Van at +0.71% and Compact Crossover/SUV at +0.37%. The largest declines in the Car segments were seen in Mid-Size Car at -0.19% and Sub-Compact Car with -0.16%. The largest declines in the Truck/SUV segments were Minivan at -0.56% followed by Full-Size Crossover/SUV with -0.32%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.01% | -0.04% | -0.09% |

| Truck & SUV segments | +0.07% | -0.01% | -0.07% |

| Market | +0.03% | -0.02% | -0.08% |

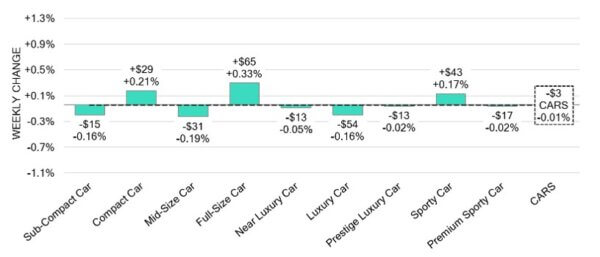

Car Segments

- Car segments reflected a slight overall depreciation of –0.01%last week. This decline was reflected across six of the nine car segments.

- Mid-Size Car (-0.19%) showed the largest decline, followed by Sub-Compact Car and Luxury Car with the same drop (-0.16%).

- Three segments displayed an increase. Full-Size Car (+0.33%) had the largest. Followed by Compact Car (+0.21%) and Sporty Car (+0.17%).

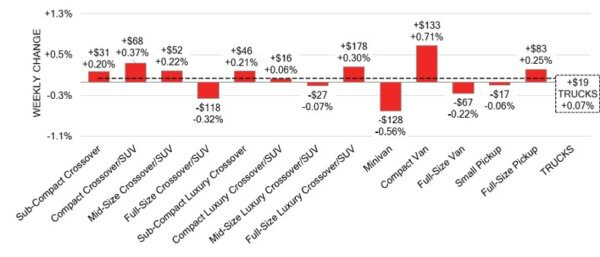

Truck / SUV Segments

- Truck segments showed an overall increase of +0.07% last week. Eight of the thirteen segments reflected this change.

- Those with the largest uptick were Compact Van (+0.71%), Compact Crossover/SUV (+0.37%) and Full-Size Pickup (+0.25%).

- Five segments showed a decrease in values. The largest was seen in Minivan (-0.56%), Full-Size Crossover/SUV (-0.32%) and Full-Size Van (-0.22%).

Wholesale

The Canadian market experienced a slight shift in trajectory, with notable increases compared to previous weeks. Just over 18% of the market segments experienced an average value change of more than ±$100. The change in truck segments reflected an increase, bringing its change to +0.07%. While the decline of the car segments decreased resulting in a change of –0.01%. Monitored auction sale rates ranged from 36.4 to 80% averaging at 54.4%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing changes in recent political variances and the gradual change in floor prices. An increase in supply entering the wholesale market has been noted in comparison to prior weeks, however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $36,300. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The S&P/TSX Composite Index climbed almost 1% to surpass 23,750 on Monday, driven by advancements in the technology sector and financial institutions. Investors reacted positively to President Trump’s decision to exclude certain tech products like smartphones, laptops, and other electronics from the 145% tariffs specific to China and the general 10% tariffs.

- The Ivey Purchasing Managers Index in Canada dropped to 51.3 in March 2025 from a seven-month peak of 55.3 recorded in February, falling short of the market forecasts which anticipated a figure of 53.2.

- The yield on the Canadian 10-year government bond increased to 3.129%.

- The Canadian dollar is around $0.721 this Monday morning, representing a slight decrease from $0.704 a week prior.

U.S. Market

- The announcement of tariff implementation spurred increased activity at the auctions. Although some tariffs were later reduced, those affecting the automotive industry remained in place. This prompted buyers to flock to auctions, aiming to secure inventory in anticipation of reduced new vehicle availability driving higher demand for used vehicles.

Industry News

- While President Trump once again delays his imposed tariffs for another 90-days, it’s important to highlight that the auto industry will not be included. 25% duties will still be applied to auto imports into the U.S. with Canada’s reciprocal tariffs in return, affecting only those models that do not comply with the USMCA.

- BMW is considering boosting production by 80,000 units at its Spartanburg, South Carolina assembly plant as a way to improve their image to the Trump Administration. Currently the plant exports roughly half its production and makes the X3, X4, X5, X6, and X7 Crossovers.

- GM’s CAMI assembly plant in Ingersoll, Ont., which assembles the electric BrightDrop commercial van will lay idle for 5 months. 1,200 workers will be on layoff throughout the summer as current demand for the vehicles is weak, selling only 292 units in Q1 this year.

- Clutch, the digital used vehicle retailer opened a new reconditioning facility in Toronto that will allow operations to scale the business. The organization currently purchases roughly $2 million worth of inventory daily.