04.16.2024

Market Insights – 4/16/2024

Wholesale Prices, Week Ending April 13th, 2024

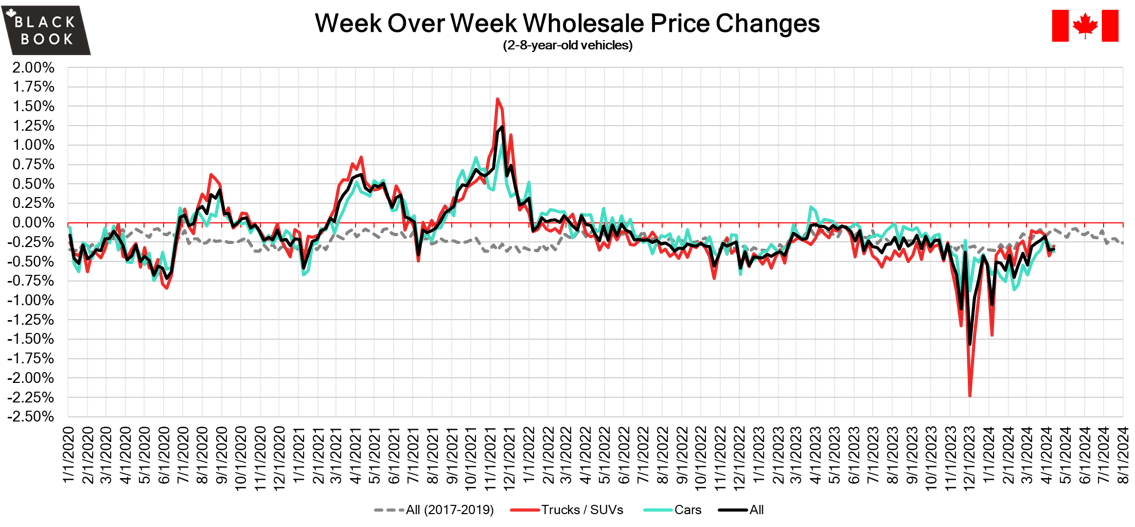

The Canadian used wholesale market saw a decline in prices for the week at –0.34%. The Car segment fell by –0.38% and the Truck/SUVs segment prices declined –0.30%. 2 out of 22 segments’ values have increased for the week. The Mid-Size Luxury Crossover/SUV segment increased by 0.18% followed by the Sporty Car segment which rose by 0.03%. The segments with the largest declines were Compact Car at –1.19% followed by Prestige Luxury Car at –1.12%.

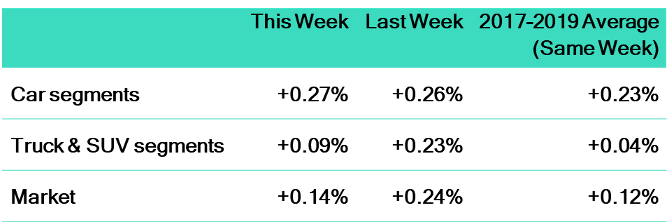

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.38% | -0.28% | -0.09% |

| Truck & SUV segments | -0.30% | -0.43% | -0.07% |

| Market | -0.34% | -0.36% | -0.08% |

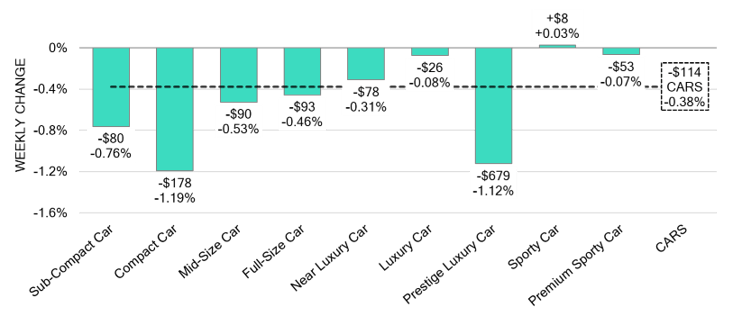

Car Segments

- There was an overall decrease of -0.38% seen in Car segments last week. This decrease was noted across all but one of the nine segments.

- The most significant decline was shown in Prestige Luxury Cars with (-1.12%) followed closely by Compact Car at (-1.19%).

- The only segment to show an increase in pricing was Sporty Car at (+0.03%), trailed by Premium Sporty Car at (-0.07%) and Luxury Car at (-0.08%) .

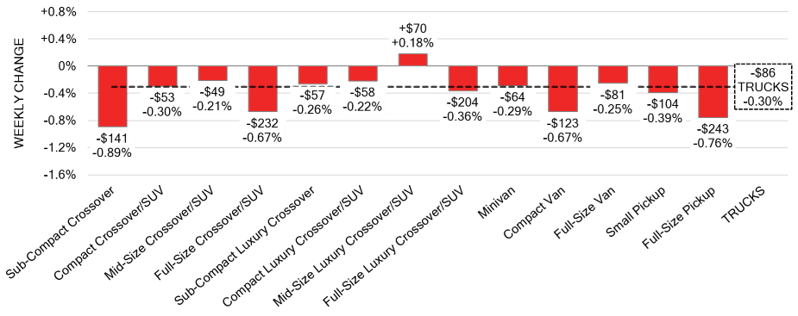

Truck / SUV Segments

- Last week truck segments reflected an overall decrease of -0.30%.

- Same as the previous week Sub-Compact Crossover (-0.89%) showed the largest decline, followed by Full-Size Pickup (-0.76%). Compact Van and Full-Size Crossover/SUV had the same decrease (-0.67%).

- One segment had an increase. That segment was Mid-Size Luxury Crossover/SUV (+0.18%).

Wholesale

The Canadian market continued to decrease, with declines that were similar to the prior week. Supply is building with stable demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of less than $120 this week as the Car segments fell the most which flips the recent trend. Conversion rates were slightly improved this past week with some observed sell rates were as low as 10% and as high as 69% but most were between 25-40%. Last week we saw less sellers dropping floors, which has been contributing to more lanes with lower sell rates.

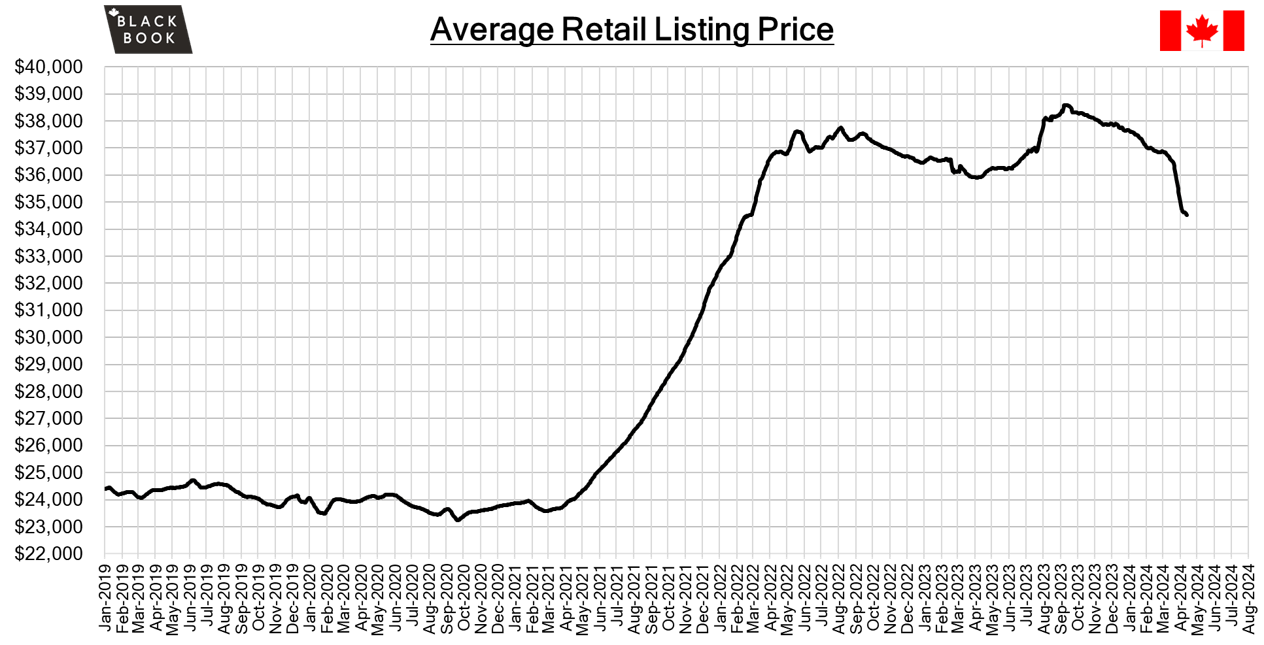

Used Retail Prices & Listing Volume

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $34,500. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The Bank of Canada held its key rate at 5% in April, as largely expected, and refrained from giving any hints on the start of rate cuts due to persistent upside risks to inflation.

- Canada’s manufacturing sales rose by 0.7% from a month earlier to $71.6 billion in February of 2024, matching the preliminary estimate and accelerating from a 0.2% increase in the prior month.

- Wholesale sales in Canada were flat month-over-month at $82.2 billion in February 2024, compared to a preliminary reading indicating a 0.8% rise and following a revised 0.2% decrease in the prior month.

- The yield on the Canadian 10-year government bond increased slightly to 3.7%.

- The Canadian dollar is around $0.725 this Monday morning down from $0.735 a week prior.

U.S. Market

- The overall market is still experiencing growth, yet there is a noticeable deceleration in the pace of these gains, and a growing number of segments are beginning to see a reversal into negative trends. Notably, the luxury segments have exhibited a widespread downturn across all categories last week, with the Sub-Compact Luxury Crossover segment standing out as the sole exception to this declining trend.

Industry News

- Luxury segment sales are down, while mainstream sales are up, cites Desrosiers Automotive Consultants. As consumers are focused on higher value, lower cost models, and longer-term loans. This has given way to YoY decline for many luxury makes driving them to bring more incentives back to market and to try and reclaim lease buyers that exited the market by buying out their lease.

- Fisker Inc. has dropped the price of the Ocean Extreme in Canada by $31,000, following its drop in the U.S. – from $79,799 to $48,799. The inventory currently available is for 2023MY and this comes after news that the automaker is in financial trouble.

- Acura’s MDX has undergone a refresh for 2025MY, where the front fascia gets more streamlined along with an improvement to interior tech and layout. Gone is the brands controversial touchpad in favour of a touchscreen interface.

- Pricing for the eagerly awaited Chevrolet Silverado EV was released for Canada, with a starting price of $74,699 for the 3WT trim (WT standing for Work Truck). While the First Edition RST starts at $117,499. The usable ranges are 724km and 708km for the two trims respectively, and the Truck can accelerate to 60 mph in as quick as 4.5 seconds.

- Mercedes-Benz has updated its flagship EV, the EQS Sedan for 2025MY with the updated model dropping at dealers in the second half of 2024. This year the battery increases in size to 118kWh and range to 560km, making the luxury sedan more competitive. The grille also receives treatment through a new design.