04.22.2025

Market Insights – 4/22/25

Wholesale Prices, Week Ending April 19th, 2025

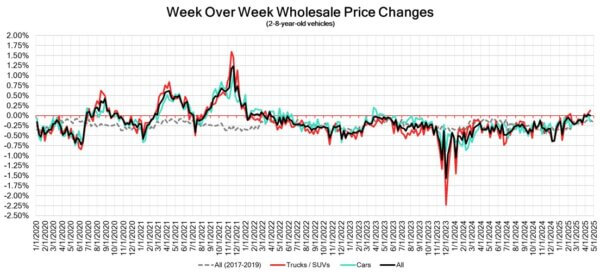

The Canadian used wholesale market experienced a decrease of -0.01% in pricing for the week. Car segments prices decreased by –0.15% while the Truck/SUV segments increased by +0.13%. The largest increases were seen in Sub-Compact Luxury Crossover/SUV at +0.61% and Full-Size Crossover/SUV at +0.58%. The largest declines in the Car segments were seen in Sub-Compact Car at -0.46% and Full-Size Car with -0.44%. The largest declines in the Truck/SUV segments were Compact Van at -1.09% followed by Minivan with -0.32%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.15% | -0.01% | +0.04% |

| Truck & SUV segments | +0.13% | +0.07% | -0.27% |

| Market | -0.01% | +0.03% | -0.12% |

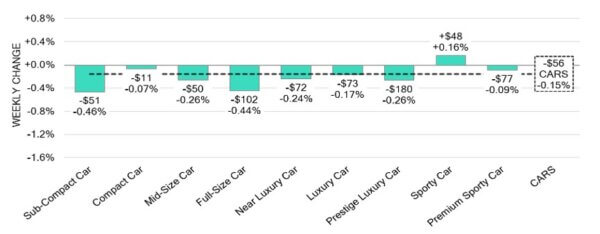

Car Segments

- There was an overall depreciation of –0.15% seen in car segments last week. Thissoftening wasreflected ineight of the nine car segments.

- The largest drop was seen in Sub-Compact Car (-0.46%), followed byFull-Size Car (-0.44%).Mid-Size Car and Prestige Luxury Car had the same decrease (-0.26%).

- One segment had an increase. That segment was Sporty Car (+0.16%).

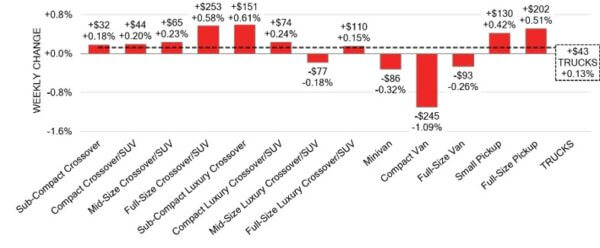

Truck / SUV Segments

- Truck segments showed an overall increase of +0.13% last week. This change was reflected in nine of the thirteen segments.

- Those with the largest upswing were Sub-Compact Luxury Crossover (+0.61%) followed by Full-Size Crossover/SUV (+0.58%) and Full-Size Pickup (+0.51%).

- Four segments showed a decrease in values. The largest was seen incompact Van (-1.09%), Minivan (-0.32%) and Full-Size Van (-0.26%).

Wholesale

The Canadian market continued its trajectory from last week, with cars dropping in value by -0.15% while trucks rose by 0.13%. Just over 35% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 34% to 67% averaging at 54.3%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing political variances and the gradual change in floor prices. Supply has remained high in comparison to prior weeks; however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,500. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In March 2025, Canada’s annual inflation rate decreased to 2.3%, down from an

eight-month peak of 2.6% in February. This drop was lower than market

predictions and central bank forecasts, which anticipated it would hold steady at

2.6% and 2.5%, respectively. - The Bank of Canada kept its benchmark interest rate steady at 2.75% during its

decision in April 2025. This move was anticipated and comes after a series of

seven consecutive rate cuts totaling 2.25 percentage points. - In March 2025, Canadian housing starts saw a decrease of 3.3% from the

previous month, totaling 214,155 units compared to February’s 221,405 units.

This figure fell short of the market expectations, which were set at 242,500 units. - The yield on the Canadian 10-year government bond increased to 3.237%.

- The Canadian dollar is around $0.726 this Monday morning, representing a slight

increase from $0.721 a week prior.

U.S. Market

- For the first time since November 2021, all twenty-two reporting segments monitored by Black Book experienced growth within the same week. The rise in the wholesale market and heightened activity in the lanes resemble conditions from four years ago, when the industry faced challenges related to new vehicle inventory availability.

Industry News

- Auto industry suppliers are finding it very difficult and time consuming to calculate costs implicated by the steel and aluminum tariffs more than anything else. With companies drilling down several layers deep into their supply chain to determine what is impacted and at what capacity.

- Toyota is now considering producing the next generation RAV4 in Kentucky, as a response to tariffs. Originally it planned production of the vehicle to be built in its other two plants in Canada and Japan.

- Many brands have been monitoring the situation as decisions on price changes remain “fluid”, but brands that will realize the greatest impact are those originating from the U.S., like GM, Ford, and Stellantis. No brands have alluded to any immediate impacts on price.

- Mazda will pause production on the U.S. built CX-50 crossover with tariffs now imposed. This model sold 10,759 units in Canada; all produced from its shared Alabama plant with Toyota.

- Tim Reuss, President of the Canadian Auto Dealers’ Association (CADA) urges Canadian OEMs to support their dealer bodies by forgoing dealer development programs in the effort to support them on the vehicle sales side, as tariff impacts become clearer.

- Dianne Craig, who has led the Lincoln brand globally since 2022 will be retiring after 38 years with Ford Motor Company. She will be replaced by Joaquin Nuno-Whelan who joined the company in 2024 after positions held at GM and Rivian.