04.23.2024

Market Insights – 4/23/2024

Wholesale Prices, Week Ending April 20th, 2024

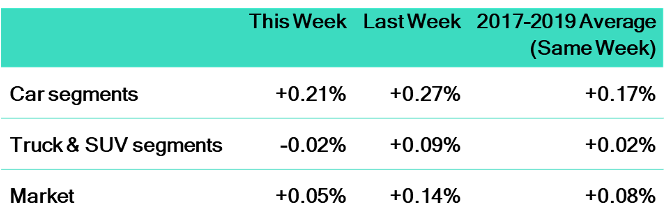

The Canadian used wholesale market saw a decline in prices for the week at –0.36%. The Car segment fell by –0.35% and the Truck/SUVs segment prices declined –0.36%. 2 out of 22 segments’ values have increased for the week. The Compact Van Segment increased by 0.57% followed by the Small Pickup segment which rose by 0.57% as well. The segments with the largest declines were Compact Car at –1.11% followed by Compact Crossover/SUV at –0.85%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.35% | -0.38% | +0.04% |

| Truck & SUV segments | -0.36% | -0.30% | -0.27% |

| Market | -0.36% | -0.34% | -0.12% |

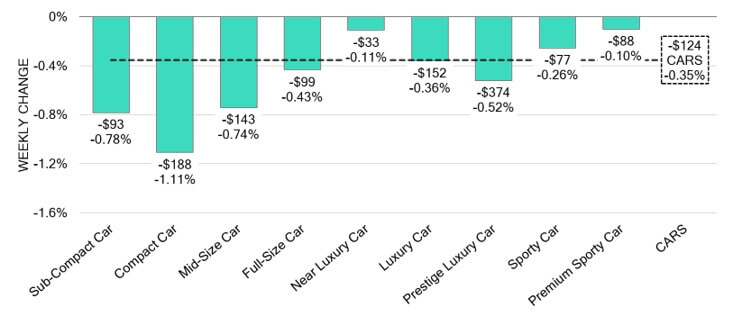

Car Segments

- Last week there was an overall decrease of -0.35% within the Car segments. This decrease was noted across all nine of the segments.

- The Segments to show the least decline were Premium Sporty Car with (-0.10%) followed closely by Near Luxury Car at (-0.11%).

- The most significant decline was shown by Compact Cars with (-1.11%) and Sub-Compact Car at (-0.78%) tailed by Mid-Size Car at (-0.74%).

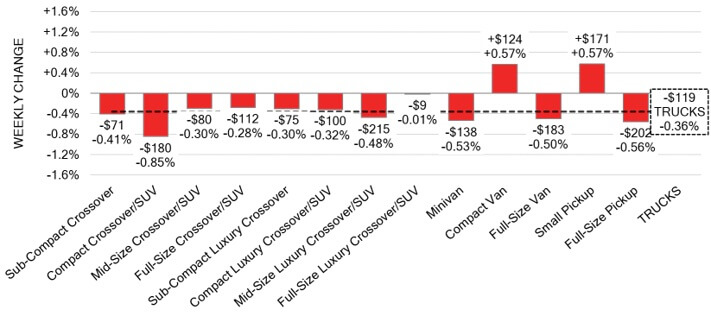

Truck / SUV Segments

- Truck segments showed an overall decrease of -0.36% last week.

- Segments with the largest decreases were Compact Crossover/SUV (-0.85%), Full-Size Pickup (-0.56%), Minivan (-0.53%) and Full-Size Van (-0.50%).

- Two segments had the same increase. Those were Compact Van and Small Pickup (+0.57%).

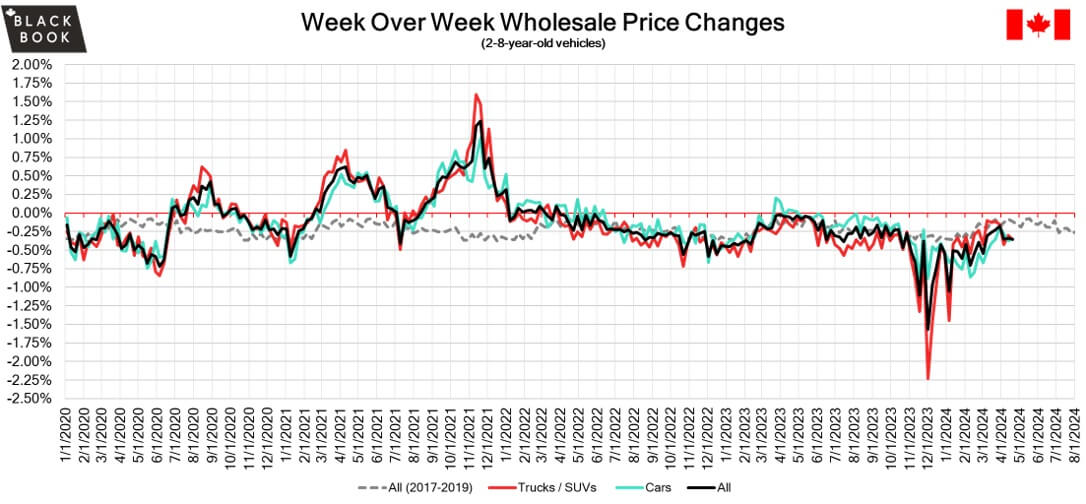

Wholesale

The Canadian market continued to decrease, with declines that were similar to the prior week. Supply is building with stable demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of less than $120 this week as the Car and Truck segments fell at similar levels. Conversion rates were slightly improved this past week with some observed sell rates were as low as 19% and as high as 80% but most were between 25-40%. Last week we saw less sellers dropping floors, which has been contributing to more lanes with lower sell rates.

Used Retail Prices & Listing Volume

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $34,300. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics and Government

- The annual inflation rate in Canada rose to 2.9% in March of 2024 from the eight-month low of 2.8% in February, roughly in line with the Bank of Canada’s forecast of 3% in the first half of 2024.

- Foreign investors reduced their exposure to Canadian securities by a net $8.78 billion in February 2024, reversing from a net investment of $8.88 billion in January and missing market forecasts of $10.1 billion.

- Industrial producer prices in Canada rose by 0.8% over a month in March 2024, matching market forecasts and marking the second consecutive period of gain albeit at a softer pace.

- The yield on the Canadian 10-year government bond increased slightly to 3.78%.

- The Canadian dollar is around $0.73 this Monday morning up from $0.725 a week prior.

U.S. Market

- Signs of a spring market slowdown are emerging, as the overall market appreciated barely +0.05% last week, and the Trucks & SUVs category saw a slight -0.02% dip. Additionally, the average auction conversion rate nationwide experienced a minor decrease, indicating that buyers are starting to proceed with more caution.

Industry News

- The Chatanooga, TN Volkswagen plant has joined the UAW as it voted in favor of unionizing last week. Finally successful after its third attempt in the past decade to unionize – this is the first UAW win in any of the southern U.S. states.

- Toyota has officially launched its 2025 Toyota Camry, which now comes with one powertrain, a hybrid-electric 4 cylinder paired to either front-wheel-drive or all-wheel-drive drivetrains. Closing the economy gap towards its smaller sister in the lineup (the Prius), the Camry starts at $37,931 including freight & PDI.

- As Chinese EV companies look to put roots down in the Americas, the U.S. is pressuring Mexico to refrain from allowing these companies to receive incentives through reduced land costs and taxes, fearing they become unable to compete with the entrance of such affordably priced EVs.

- Honda has been eyeing an Ontario location to increase EV capacity, logically to accompany its Alliston, ON vehicle and engine assembly plant. A deal is anticipated to be announced shortly which will provide details on a proposed multi-billion-dollar commitment to process cathode active materials and assemble batteries and the brands EVs.

- In the ongoing search for more efficient electric vehicles, engineers in the industry have found improvements within the technology used for heat pumps. These improvements focus on generating more heat from other EV components and providing it to the heat pump, which could improve cold weather performance specifically.