04.29.2025

Market Insights – 4/29/25

Wholesale Prices, Week Ending April 26th, 2025

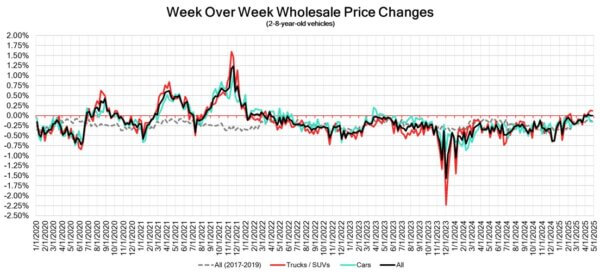

The Canadian used wholesale market was flat with a change of 0.00% in pricing for the week. Car segments prices decreased by –0.15% while the Truck/SUV segments increased by +0.12%. The largest increases were seen in Full Size Pickup at +0.54% and Full-Size Crossover/SUV at +0.41%. The largest declines in the Car segments were seen in Prestige Luxury Car at -0.21% and Near Luxury Car with -0.21%. The largest declines in the Truck/SUV segments were Compact Van at -0.18% followed by Sub-Compact Luxury Crossover/SUV with -0.15%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.15% | -0.15% | -0.14% |

| Truck & SUV segments | +0.12% | +0.13% | -0.15% |

| Market | +0.00% | -0.01% | -0.15% |

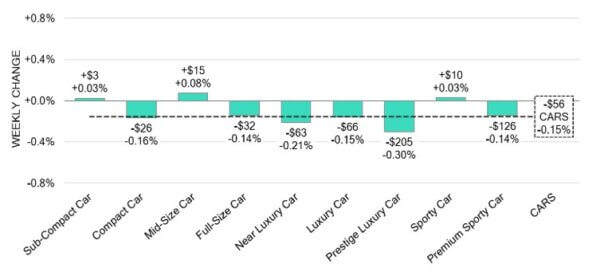

Car Segments

- There was an overall depreciation of –0.15% seen in car segments last week. This decline was reflected in six of the nine segments.

- Those with the largest depreciation were Prestige Luxury Car (-0.30%), followed by Near Luxury Car (-0.21%) and Compact Car (-0.16%).

- Three segments had a slight gain in values. Mid-Size Car (+0.08%), Sub-Compact Car and Sporty Car had the same increase (+0.03%).

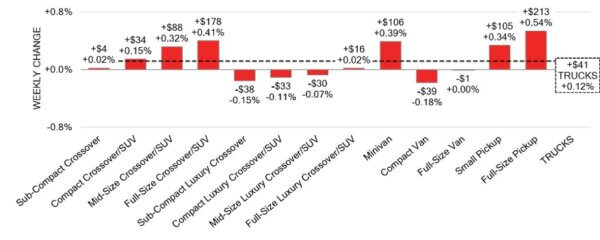

Truck / SUV Segments

- Truck segments showed an overall increase of +0.12% last week. This change was reflected in eight of the thirteen segments.

- Segments with the largest gains were Full-Size Pickup (+0.54%) followed by Full-Size Crossover/SUV (+0.41%) and Minivan (+0.39%).

- Five segments showed a decrease in values. Those with the largest were Compact Van (-0.18%), Sub-Compact Luxury Crossover (-0.15%) and Compact Luxury Crossover/SUV (-0.11%).

Wholesale

The Canadian market experienced slight decrease in pricing for the week, with cars segment values remaining the same at -0.15% while trucks decreased overall by 0.01 bringing its change to +0.12%. Just under 23% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 25.4% to 59.9% averaging at 38.6%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing political variances and the gradual change in floor prices. Supply has remained high in comparison to prior weeks; however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,900. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Mark Carney’s Liberal party narrowly won on election day, resulting in him leading

a minority government. - In March 2025, industrial producer prices in Canada increased by 0.5%, following

a revised rise of 0.6% in February. This was higher than the market predictions of

a 0.3% increase. - Retail sales in Canada are expected to have increased by 0.7% in March 2025

compared to the previous month, based on preliminary estimates. - The yield on the Canadian 10-year government bond decreased to 3.18%.

- The Canadian dollar is around $0.723 this Monday morning, representing a slight

decrease from $0.726 a week prior.

U.S. Market

- The wholesale market continues to report gains larger than traditional levels. Traditionally, this would be the time of year the gains in the market due to the spring/tax season would begin to slow. However, with tariffs still in place on imported vehicles and upcoming tariffs on production supplies, the market remains strong. Expectations of rising new vehicle prices and reduced new vehicle inventories are likely to further boost demand for used vehicles.

Industry News

- Pending the outcome of the Federal election in Canada, the Conservative Party pledged to remove the national ZEV mandate that requires 20% of sales to be zero-emission vehicles by 2026, 60% by 2030, and 100% by 2035; otherwise, carmakers would face financial penalties per non-compliant vehicle sold.

- In a rare uniting of all 3 Detroit car brands, General Motors, Ford, and Stellantis, along with multiple parts suppliers and dealer associations across the U.S.; a letter was written to the Trump administration urging the repeal of imposed tariffs on the global auto industry.

- In a move to mitigate the impact of tariffs, Hyundai Canada will shift some of the production of its popular Tucson crossover from the U.S. to Mexico. In Q1 of this year, there were no Mexican-built Tucson’s sold in Canada.

- Subaru has also announced a plan to shift production of Canadian destined units away from the U.S. said Subaru Canada CEO, Tomohiro Kubota. The company sold one quarter of its vehicles in 2024 from U.S. production facilities.

- Porsche is scheduled to open its first Canadian Porsche Experience Centre (PEC) in June. This facility will join the sportscar makers 9 other locations, 2 of which are in the U.S. The 20-hectare location in Pickering will offer driving packages from $140-$850.