04.30.2024

Market Insights – 4/30/2024

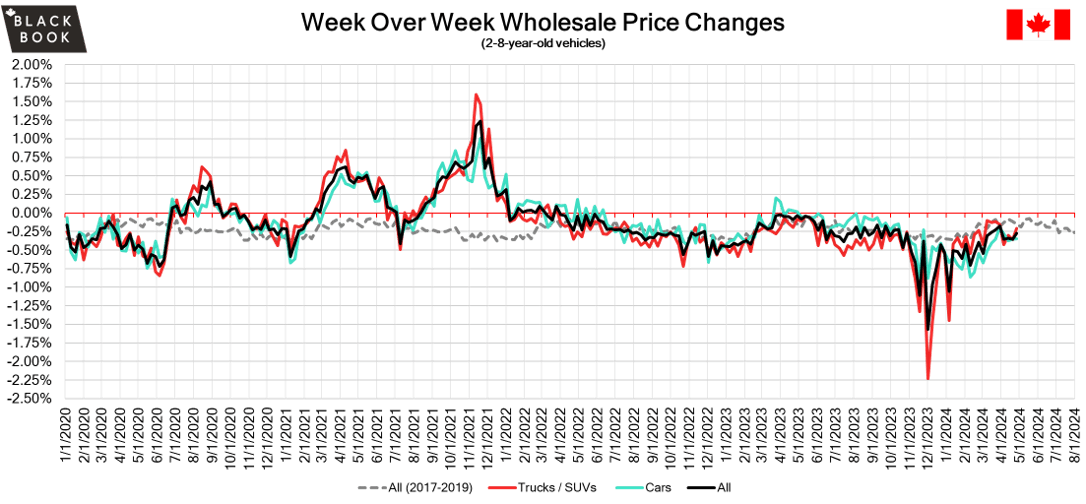

Wholesale Prices, Week Ending April 27th, 2024

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.35% | -0.35% | +0.14% |

| Truck & SUV segments | -0.21% | -0.36% | -0.15% |

| Market | -0.27% | -0.36% | -0.15% |

The Canadian used wholesale market saw a decline in prices for the week at –0.27%. The Car segment fell by –0.35% and the Truck/SUVs segment prices declined –0.21%. 4 out of 22 segments’ values have increased for the week. The top 2 being Premium Sporty Car with an increase of 0.06% and Full-Size Crossover/SUV segment which rose by 0.20%. The segments with the largest declines were Sub Compact Car at –1.20% followed by Compact Car at –1.08%.

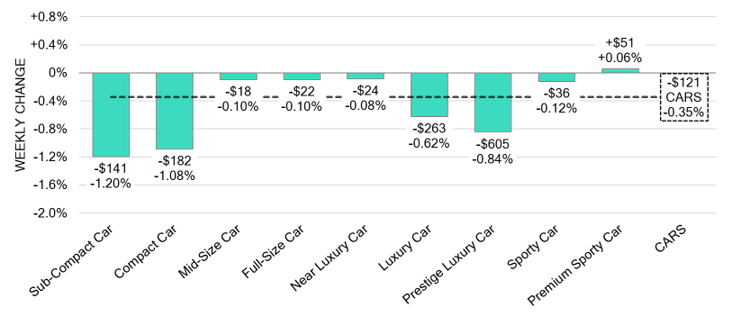

Car Segments

- There was an overall decrease of -0.35% within the Car segments last week. This decrease was noted across all but one of the nine segments.

- The most significant decline was seen in Sub-Compact Car with (-1.20%) and Compact Car at (-1.08%).

- The only segment to show an increase in pricing was Premium Sporty Car at (+0.06%) followed by Near Luxury Car at (-0.08%). Both Full-Size Car and Mid-Size Car decreased by (-0.10%).

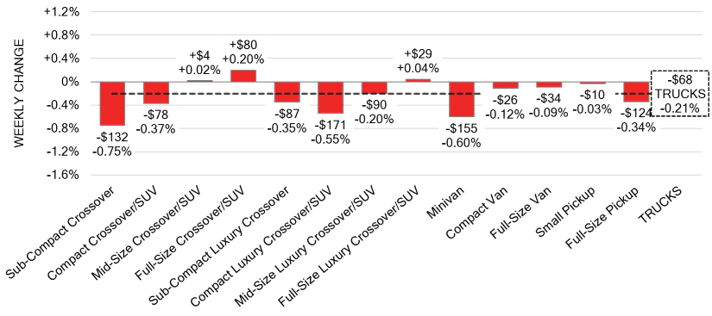

Truck / SUV Segments

- Truck segments showed an overall decrease of -0.21% last week.

- Segments with the largest declines were Sub-Compact Crossover (-0.75%), Minivan (-0.60%) and Compact Luxury Crossover/SUV(-0.55%).

- Three segments reflected a slight increase. Those were Full-Size Crossover/SUV (+0.20%), Full-Size Luxury Crossover/SUV (+0.04%) and Mid-Size Crossover/SUV (+0.02%).

Wholesale

The Canadian market continued to decrease, with declines that were similar to the prior week. Supply is building with stable demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of less than $120 this week as the Car and Truck segments fell at similar levels. Conversion rates were slightly improved this past week with some observed sell rates were as low as 8% and as high as 74% but most were between 25-40%. Last week we saw less sellers dropping floors, which has been contributing to more lanes with lower sell rates.

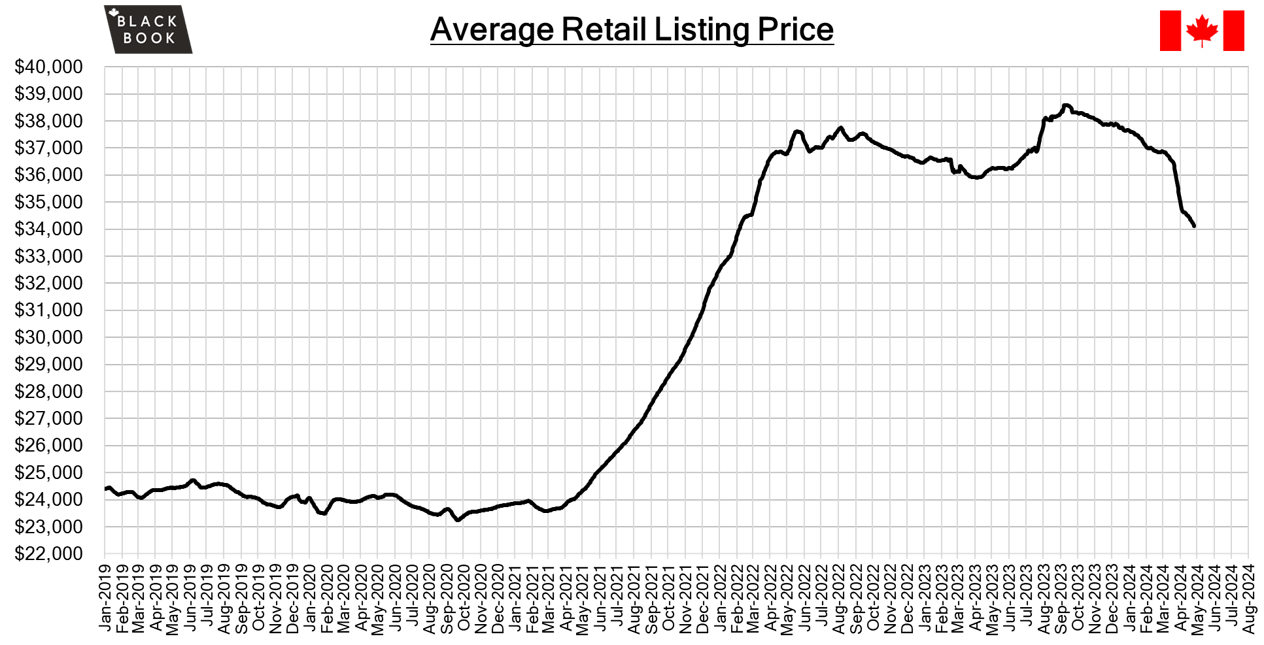

Used Retail Prices & Listing Volume

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $34,300. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s government budget surplus decreased to 8.34 billion dollars in February 2024 from 9.53 billion dollars in the same month of the previous year, andmarking the first surplus since June.

- Retail sales in Canada likely remained unchanged over a month in March 2024, according to preliminary data.

- Average weekly earnings of non-farm payroll employees in Canada increased by 4.5% year-on-year to $1,232 in February 2024, with 13 out of 20 sectors reporting gains.

- The yield on the Canadian 10-year government bond increased slightly to 3.87%.

- The Canadian dollar is around $0.732 this Monday morning up from $0.73 a week prior.

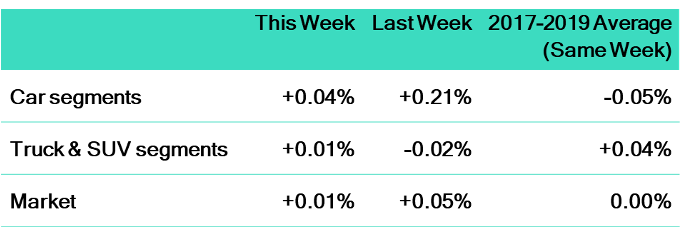

U.S. Market

- Last week was characterized as “stable”, as the overall market saw a slight uptick of 0.01%. However, attention should be directed towards the luxury segments, Full-Size Vans, and electric vehicles (EVs), as they have been experiencing a continued downward trend.

Industry News

- Honda Motor Company has committed $15 billion to building a facility in Ontario to reside along its current operations in Alliston, as the automaker looks to develop new battery-cell and EV assembly plants where it currently builds its Civic and CR-V. Scheduled to open in 2028, creating 1,000 new jobs and retaining 4,200 already working at the site.

- The world’s biggest EV battery maker, CATL, has developed a new Lithium Iron Phosphate (LFP) battery that can reach 1,000km in range, targeted at concerns around range anxiety and current shortcomings around charging infrastructure.

- For the first-time in its long history, the Toyota Tacoma will have a hybrid powertrain available for the 2024MY redesign. Making 326hp and a “full-size pick-up” like 465lb.ft. of torque, the 2.4 litre turbocharged 4-cylinder engine will improve performance and efficiency. With the powertrain starting at the Limited trim, the base price for an equipped Tacoma is $67,021, while the range-topping Trailhunterstarts at $86,581.

- Full model changes are abound as Infiniti and Nissan bring out new versions of their QX80 and Kicks for 2025MY – where the Infiniti makes more power with less cylinders as it changes to a V6, and the Kicks receives a larger body and available AWD.

- Kia is bringing the all-new K4 to market in 2025MY and this model replaces the long-standing Forte, coming in a touch larger as it supports the exit of the K5/Optima sedan that was discontinued last year. The K4 will also bring forth another EV model to the lineup when it launches the EV4 on the same platform in the future.