04.08.2025

Market Insights – 4/8/25

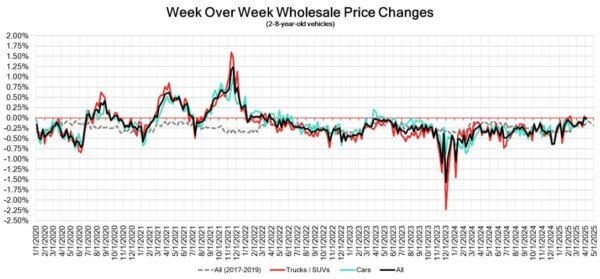

Wholesale Prices, Week Ending April 8th, 2025

The Canadian used wholesale market experienced a decline of -0.02% in pricing for the week. Car segments prices decreased by –0.04% while the Truck/SUVs segments decreased by -0.01%. The largest increases were seen in minivan at +0.62% and Full-Size Car at +0.29%. The largest declines in the Car segments were seen in Sub-Compact Car at -0.24% and Premium Sporty Car with -0.13%. The largest declines in the Truck/SUV segments were Full-Size Luxury Crossover/SUV at -0.44% followed by Compact Van with -0.33%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.04% | -0.03% | -0.14% |

| Truck & SUV segments | -0.01% | 0.04% | -0.11% |

| Market | -0.02% | 0.01% | -0.13% |

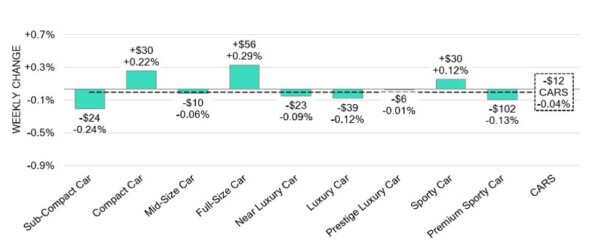

Car Segments

- Car segments reflected an overall depreciation of –0.04%last week. This decline was reflected across six of the nine car segments.

- Sub-Compact Car (-0.24%) showed the biggest decline, followed by Premium Sporty Car (-0.13%) and then Luxury Car (-0.12%).

- Three segments displayed an increase. Full-Size Car (+0.29%) exhibited the largest. Followed by Compact Car (+0.22%)and lastly Sporty Car (+0.12%).

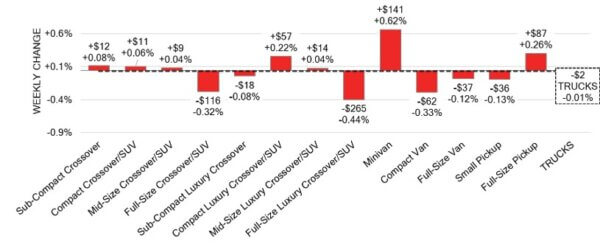

Truck / SUV Segments

- Truck segments had a minimal overall decrease of -0.01% last week. Six of the thirteen segments reflected this change.

- Those with the largest decreases were Full-Size Luxury Crossover/SUV (-0.44%), Compact Van (-0.33%) and Full-Size Crossover/SUV (-0.32%).

- Seven segments showed an increase in values. The largest was seen in Minivan (+0.62%), Full-Size Pickup (+0.26%) and Compact Luxury Crossover/SUV (+0.22%).

Wholesale

The Canadian market has resumed its downward trajectory, with a decline far less pronounced than compared to previous weeks. Just over 13% of the market segments experienced an average value change of more than ±$100. The change in truck segments reflected a slight decrease, sitting at -0.01%, while the decline of the car segments experienced an increase, bringing its change to –0.04%. Monitored auction sale rates ranged from 15.3 to 67.6% averaging at 45.5%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing changes in recent political variances and the gradual change in floor prices. An increase in supply entering the wholesale market has been noted in comparison to prior weeks, however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $35,500. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada reported a trade deficit of $1.5 billion in February 2025, moving from a

revised 32-month high surplus of $ 3.1 billion in January and falling short of the

expected $3.4 billion surplus. - In March 2025, the S&P Global Canada Manufacturing PMI dropped to 46.3 from

47.8 in the previous month, indicating a continued decline in factory activity which

was the most significant since late 2023. This downturn was driven by reductions

in both production and new orders. - Canada’s employment decreased by 33,000 in March, the first drop since January

2022, which went against the anticipated increase of 12,000. This decline was

primarily due to the loss of 62,000 full-time jobs, a 0.4% reduction, negating

previous gains. - The yield on the Canadian 10-year government bond held at 2.99%.

- The Canadian dollar is around $0.704 this Monday morning, representing a slight

decrease from $0.695 a week prior.

U.S. Market

- Following the implementation of tariffs last week, the market maintained its recent strength, with auction activity intensifying later in the week. On Thursday and Friday, several lanes reported 100% conversion rates and robust sales prices driven by highly competitive bidding.

Industry News

- With March auto sales estimated at 185,000, an increase of 11.4%, Q1 volume was up 3.7% to 385,616 according to Desrosiers Automotive Consultants. Concerns over impending price increases spurred on by the threat of U.S. tariffs kept new car sales up year-over-year.

- As of April 3rd, the U.S. Government imposed tariffs on goods into the region for many countries globally, including Canada, who received slightly better news contingent on the compliance of its products under the current USMCA.

- Canadian Prime Minister Mark Carney fired back to the U.S. on this news with his own reciprocal tariffs matching those of the U.S. with the same USMCA contingency.

- Stellantis has said that due to the imposed tariffs it will force the brand to idle production at its Windsor, ON assembly plant, starting April 7th.

- While plants in Canada and Mexico are said to continue running at normal capacity, General Motors will be increasing production of light duty trucks at its Fort Wayne, Indiana assembly plant in response to tariffs.

- Canadian Conservative Party leader, Pierre Poilievre pledged that if elected Prime Minister he’ll remove the 5% sales tax on vehicles, while urging Canada’s Premiers to follow his lead provincially, in response to tariffs.

- The list continues to lengthen on Canadian provinces ending EV rebates for Tesla models, with the Yukon now joining others who black-listed the brand with its affiliation of Elon Musk, senior adviser President Donald Trump.