04.09.2024

Market Insights – 4/9/2024

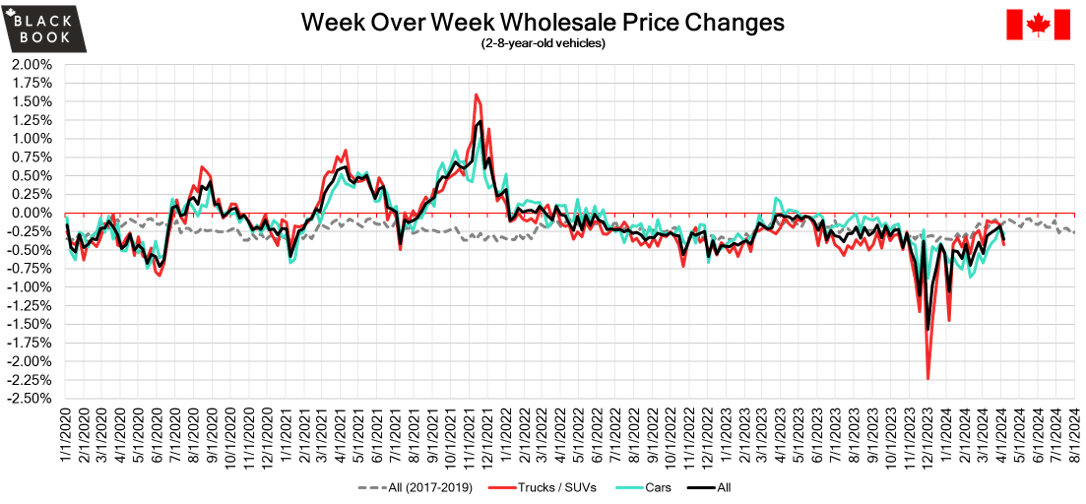

Wholesale Prices, Week Ending April 6th, 2024

The Canadian used wholesale market saw a decline in prices for the week at –0.36%. The Car segment fell by –0.28% and the Truck/SUVs segment prices declined –0.43%. 2 out of 22 segments’ values have increased for the week. The Small Pickup segment increased by 0.43% followed by the Compact Luxury Crossover/SUV segment which rose by 0.01%. The segments with the largest declines were Sub-Compact Crossover at –1.64% followed by Full-Size Van at –1.20%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.28% | -0.19% | -0.14% |

| Truck & SUV segments | -0.43% | -0.16% | -0.11% |

| Market | -0.36% | -0.17% | -0.13% |

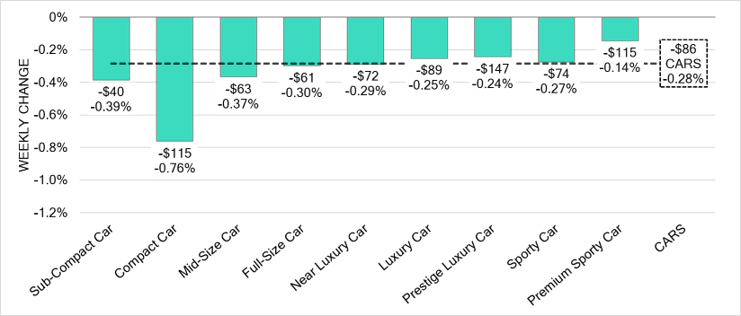

Car Segments

- There was an overall decrease of -0.28% seen in Car segments last week. This decrease was noted across all nine segments.

- Compact Car showed the most significant decline with (-0.76%) followed by Sub-Compact Car at (-0.39%) and Mid-Size Car at (-0.37%).

- The Segments with the least decreases were Premium Sporty Car at (-0.14%) and Prestige Luxury Car at (-0.24%).

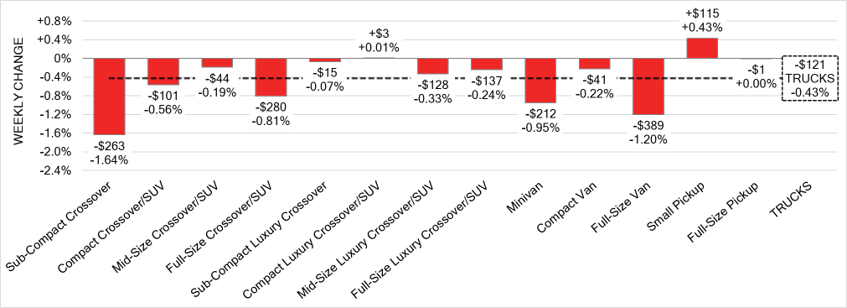

Truck / SUV Segments

- Last week truck segments reflected an overall decrease of -0.43%.

- Those with the largest decreases were Sub-Compact Crossover (-1.64%) followed by Full-Size Van (-1.20%) and Minivan (-0.95%).

- Two segments had an increase, Small Pickup (+0.43%) and Compact Luxury Crossover (+0.01%) had a minimal uptick.

Wholesale

The Canadian market continued to decrease, with declines that were slightly more than the prior week. Supply is building with stable demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of less than $120 this week as the Truck segments fell the most which flips the recent trend. Conversion rates were slightly improved this past week with some observed sell rates were as low as 15% and as high as 82% but most were between 25-45%. Last week we saw more sellers dropping floors, which has been contributing to more lanes with higher sell rates.

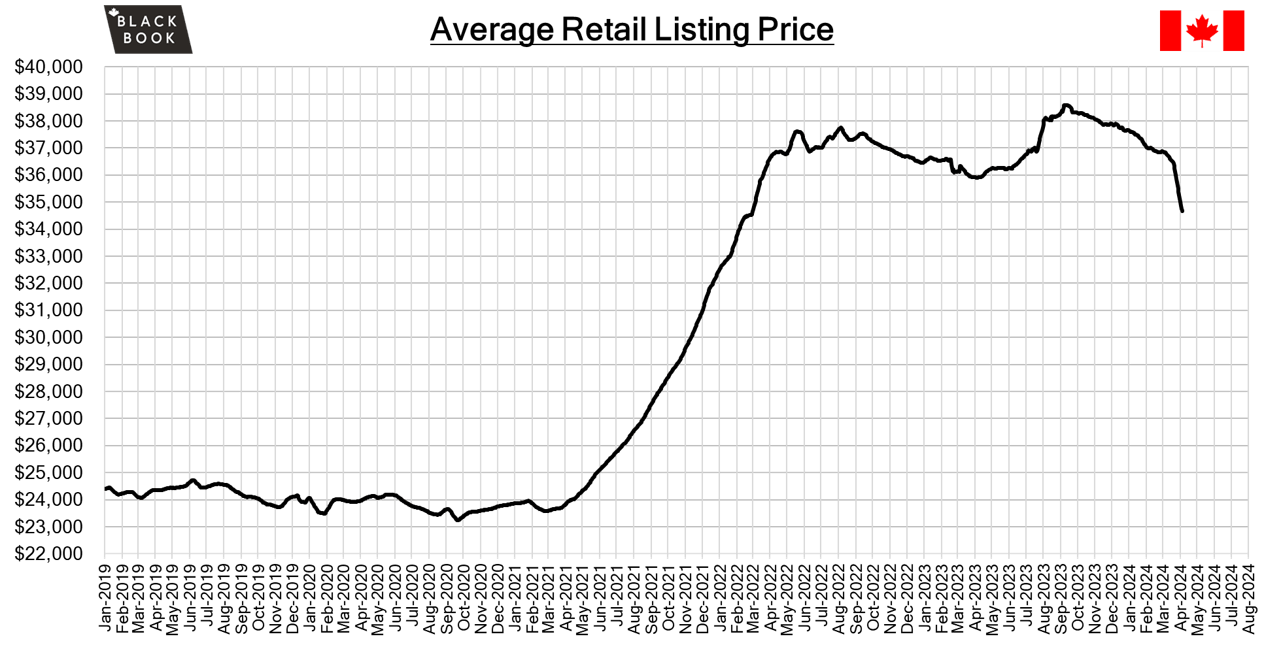

Used Retail Prices & Listing Volume

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $34,700. Analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The unemployment rate in Canada jumped to 6.1% in March of 2024 from 5.8% in the earlier month, the highest since October of 2021, and sharply above market expectations of 5.9%.

- The S&P Global Canada Manufacturing PMI edged 0.1 point higher from the previous month to 49.8 in March of 2024, pointing to the eleventh consecutive contraction in the Canadian factory activity, albeit the slowest decrease in the current sequence.

- In February, significant growth was observed in Canada’s merchandise exports and imports. Exports increased 5.8%, while imports rose 4.6%.

- The yield on the Canadian 10-year government bond increased slightly to 3.64%.

- The Canadian dollar is around $0.735 this Monday morning similar to $0.737 a week prior.

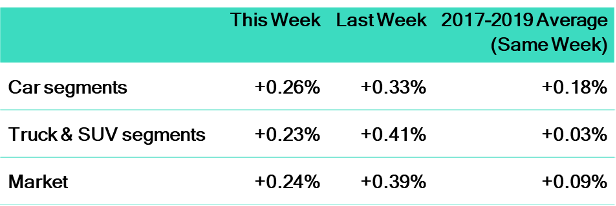

U.S. Market

- Last week, the wholesale market still showed an uptrend with prices incrementally increasing. Yet, the pace of those increases moderated, evidenced by a +0.24% gain compared to a +0.39% gain the week prior. The conversion rate also experienced a minor decline, reflecting heightened buyer prudence following a period of quick price escalation. For context, the equivalent week before the onset of COVID-19 witnessed a much smaller increase of +0.09%.

Industry News

- Toyota 4Runner fans can rejoice! The automaker released the first teaser images and the 2025 4Runner looks to keep its boxy and rugged shape, along with its segment exclusive power retractable rear windshield. The 4Runner has long been a retained value highlight in the industry.

- Ford will be delaying its EV plans for its Oakville, ON plant for 2 years, as the automaker responds to the lack of interest in its fully electric models and bears down on hybrid models which it plans to offer within each of its model lineups.

- The Halifax Autoport strike has come to an end after 37 days, as Unifor ratified a 3-year deal with the shipping port. Although union workers continued operations, the strike slowed shipments of new vehicles into Canada and ended on April 5th.

- The tally on Federal iZEV incentives for January and February have been summed up, and total 23,821. With numbers led by the province of Quebec, the top BEV models were the Tesla Model Y, Volkswagen ID.4, and Hyundai Kona EV. The top plug-in hybrids were the Mitsubishi Outlander PHEV, Toyota Rav4 Prime, and Toyota Prius Prime.

- CEO of Stellantis, Carlos Tavares outlined what needs to happen for EV’s as adoption builds and material scarcity concerns develop. The key areas for improvement are around battery weight, which could be cut in half in the next decade, as well as new chemistries necessitating a smaller requirement for raw materials per vehicle.