05.14.2024

Market Insights – 5/14/2024

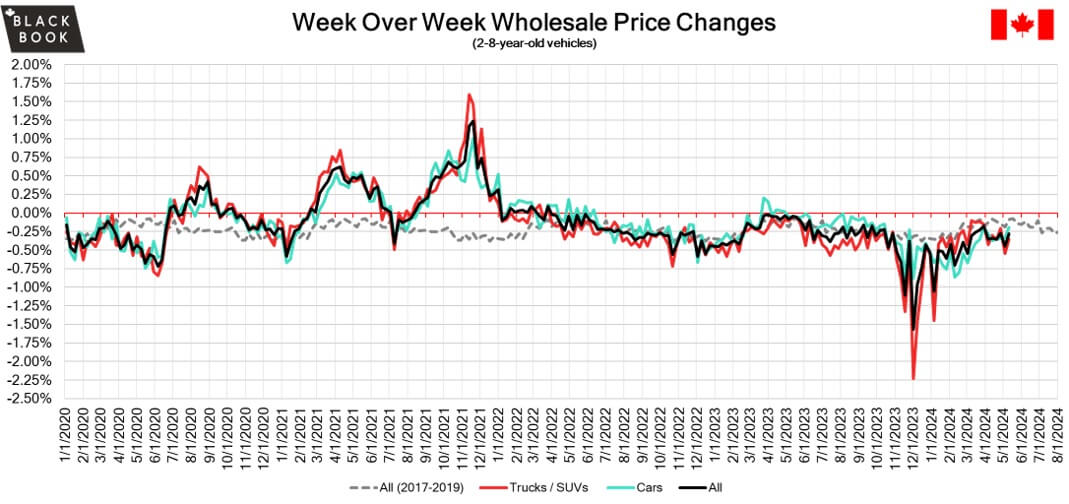

Wholesale Prices, Week Ending May 11th, 2024

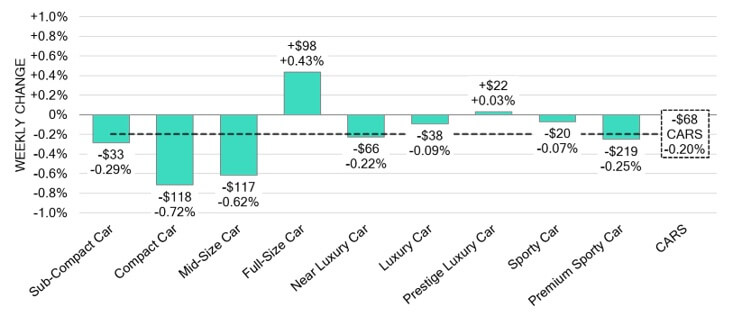

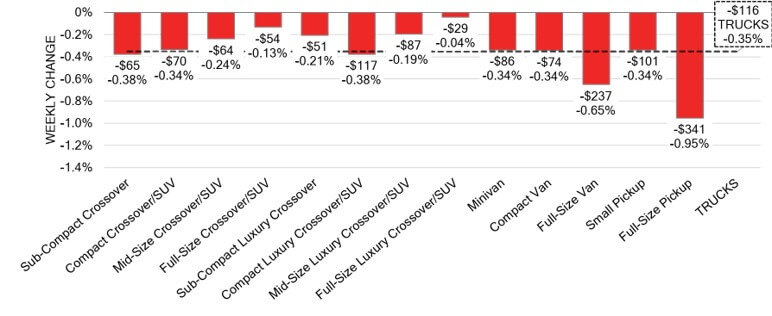

The Canadian used wholesale market saw a decline in prices for the week at –0.28%. The Car segment fell by –0.20% and the Truck/SUVs segment prices declined –0.35%. There were 2 segments with increased values for the week, Full- size car at +0.43% followed by Prestige Luxury Car at +0.03%. The car segments with the largest declines were Compact Car at –0.72% followed by Mid-Size Car at –0.62%. The largest declines for the Truck/SUV segments were, Full Size Pickup at –0.95% followed by Full-Size Van at –0.65%.

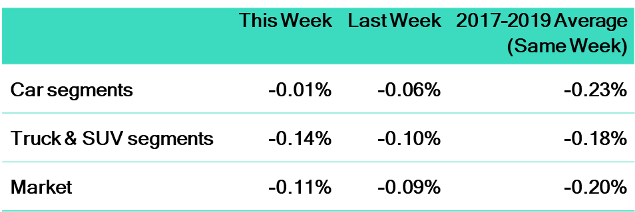

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.20% | -0.33% | -0.10% |

| Truck & SUV segments | -0.35% | -0.54% | -0.09% |

| Market | -0.28% | -0.44% | -0.09% |

Car Segments

- Last week there was an overall decrease of -0.20% within the Car segments.

- This decrease was noted across all but two of nine segments.

- The most significant decline seen was from Compact Cars at (-0.72%), followed by Mid-Size Car at (-0.62%).

- Full-Size Car and Prestige Luxury Car are the only two segments to show an increase in pricing with (+0.43%) & (+0.03) respectively.

Truck / SUV Segments

- Last week truck segments showed an overall depreciation of -0.35%.

- Same as in the previous week, all segments reflected a weakening. Those with the most significant were Full-Size Pickup (-0.95%) and Full-Size Van (-0.65%).

- Sub-Compact Crossover and Compact Luxury Crossover/SUV had the same decrease (-0.38%). Compact Crossover/SUV, Minivan, Compact Van and Small Pickup also reflected equal decline percentages (-0.34%).

Wholesale

The Canadian market continued to decrease, with declines that was less than the prior week. Supply is building with stable demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $120 this week, as the Truck segments fell at more than the Car segments. Conversion rates were less than last week, but some observed sell rates were still as low as 14% while the high end was up to 59%; the average being between 25-45%. We also saw less sellers dropping floors last week, which has been contributing to more lanes with lower sell rates.

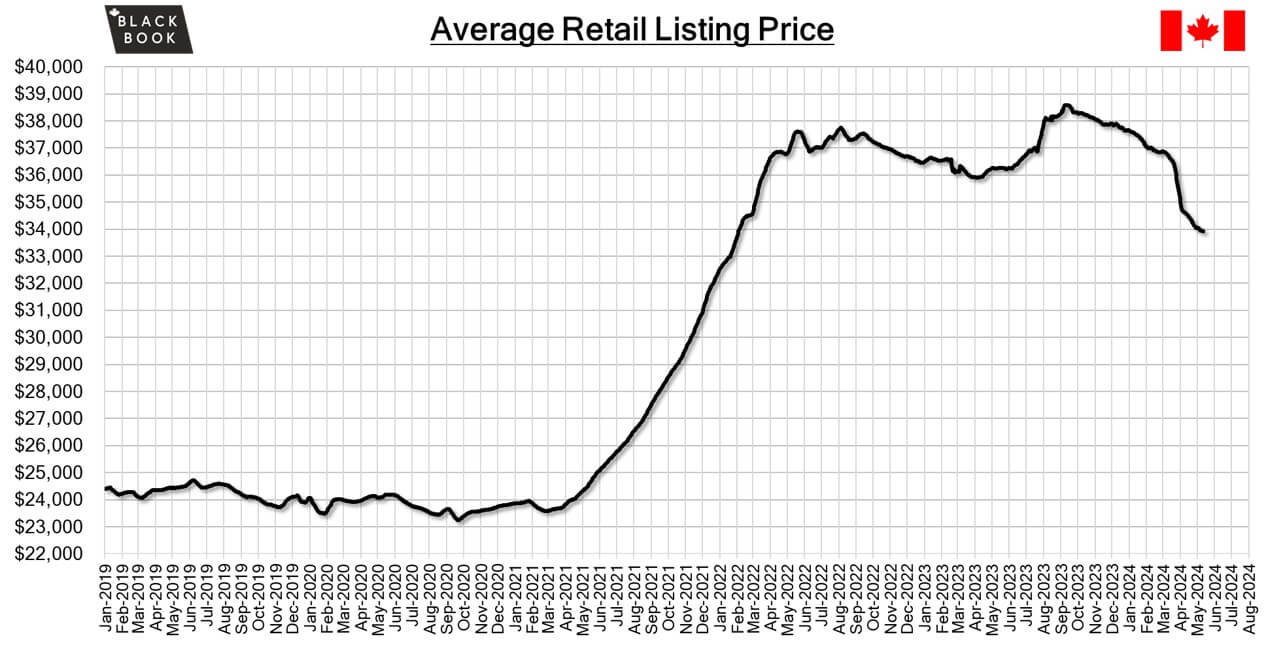

Used Retail Prices & Listing Volume

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $33,900. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics and Government

- The unemployment rate in Canada was at 6.1% in April of 2024, remaining unchanged from the two-year high from the earlier month, and slightly below market expectations of 6.2%.

- Employment in Canada rose by 90.4K in April 2024, the most in 15 months, following a 2.2K decrease in March and surpassing forecasts of 18K..

- The total value of building permits in Canada decreased by 11.7% month-on-month to $10.5 billion in March 2024, from an 8.9% increase in February and significantly lower than market expectations of a 4.6% decline.

- The yield on the Canadian 10-year government bond fell to 3.65%.

- The Canadian dollar is around $0.731 this Monday morning, similar to $0.732 a week prior.

US Market

- The current market is being described as stable, flat, and unchanging, as we observe a slow and consistent dip after what looks to be the end of the Spring market period. The market segment for 2-to-8-year-old Cars remained unchanged, whereas both the newer used vehicles and the oldest model years saw slight increases, rising by +0.03% and +0.10%, respectively. Conversely, the Truck market, across all age categories, experienced slow declines.

Industry News

- Another historical nameplate exits the car market, as GM ends the production of the Chevrolet Malibu in favour of retooling its Fairfax assembly plant to build Cadillac XT4 and the next-gen Chevrolet Bolt. The Malibu was the last passenger car in GM’s lineup, which currently starts with the Trax and Trailblazer sub-compact crossovers.

- Toyota Motor Corp. set record results for profit, revenue, and production as it concluded its most recent fiscal year under the leadership of CEO Koji Sato, who has since stated it will invest its earnings into growth technologies for the long-term success of the brand.

- Honda has organized its EV strategy to ensure it is vertically integrated to take on the quickly maturing market by bringing battery development, EV production and assembly in-house as it recently announced its $15 billion dollar investment into Canada’s auto assembly segment. Plans to accelerate hybrid sales to raise cash for this next chapter for the brand are already underway.

- Federal EV incentives rose to over 18,000 claims in March, led by Tesla Model Y and 3, followed by Ford and its Mach-E as it surged to double its February result and take the 2nd brand spot away from Hyundai. Quebec is the top province with over half of all claims in March and so far this year. While the Mitsubishi Outlander PHEV leads all plug-in hybrids.