05.20.2025

Market Insights – 5/20/25

Wholesale Prices, Week Ending May 17th, 2025

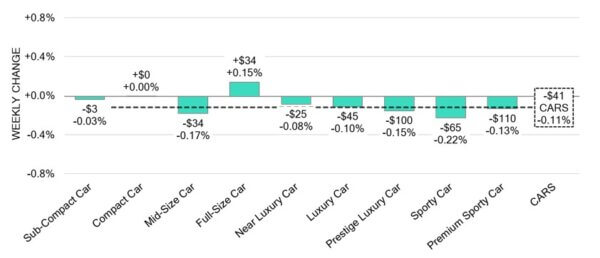

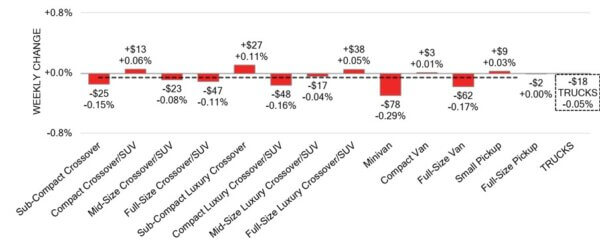

The Canadian used wholesale market saw a decline of -0.08% in pricing for the week. Car segments prices decreased by –0.11% while the Truck/SUV segments decreased by -0.05%. The largest increases were seen in Full Size Car at +0.15% and Sub Compact Luxury Crossover/SUV +0.11%. The largest declines in the Car segments were seen in Sporty Car at -0.22% and Mid Size Car with -0.17%. The largest declines in the Truck/SUV segments were Minivan at -0.29% followed by Full Size Van with -0.17%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.11% | -0.20% | -0.07% |

| Truck & SUV segments | -0.05% | -0.01% | -0.08% |

| Market | -0.08% | -0.10% | -0.07% |

Car Segments

- Last week there was an overall decline of –0.11% seen in car segments. This softening was reflected in seven of the nine segments.

- Segments with the largest depreciations were Sporty Car (-0.22%), Mid-Size Car (-0.17%) and Prestige Luxury Car (-0.15%).

- One segment had an increase. That segment was Full-Size Car (+0.15%).

Truck / SUV Segments

- There was a slight overall depreciation of –0.05%seen in truck segments last week. This change was reflected in eight of the thirteen segments.

- Those with the largest declines were Minivan (-0.29%), Full-Size Van (-0.17%) and Compact Luxury Crossover/SUV (-0.16%).

- Five segments showed an increase in values. Sub-Compact Luxury Crossover (+0.11%) and Compact Crossover/SUV (+0.06%) had the most notable.

Wholesale

The Canadian market reflected a slight decrease in pricing, less pronounced than in its prior week. The decline in car segment values decreased by 0.09% resting at -0.11%, while the decline in truck segment prices increased overall by 0.04% bringing its change to -0.05%. Just over 9% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 30.4% to 74.3% averaging at 39.2%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing political variances and the gradual change in floor prices. Supply has remained high in comparison to prior weeks; however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,920. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The annual inflation rate in Canada declined to 1.7% in April of 2025 from 2.3% in

the previous month. It was slightly above market expectations of 1.6%.

Nonetheless, it still signaled the softest growth in consumer prices in seven

months. - In April 2025, the unemployment rate in Canada increased from 6.7% to 6.9%,

reaching its highest level in more than three years (since November of last year).

The increase was larger than market expectations of 6.8%. - The IPSOS Consumer Confidence in Canada sank to 47.70 in April from 48.20 in

March of 2025. It’s the lowest reading since July 2024 as a trade war with the

United States has created uncertainty in the market. - The yield on the Canadian 10-year government bond increased to 3.293%.

- The Canadian dollar is around $0.718 this Monday morning, representing a slight

decrease from $0.724 a week prior.

U.S. Market

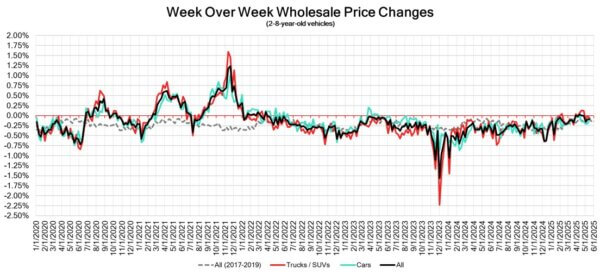

- After ten consecutive weeks of rising wholesale prices in the overall market, the trend shifted last week, recording a modest decline of -0.03%. This figure remains below the pre-pandemic seasonal average decline of -0.16%. Meanwhile, newer used inventory, aged 0 to 2 years, continues to show positive growth, with the overall market increasing by +0.03%.

Industry News

- The United States and United Kingdom have agreed to reduce tariffs on most U.K. vehicle imports with the country now receiving only 10% tariffs on vehicles and an array of parts, initially subject to 25%. Though the improved tariff margin only applies to the first 100,000 units imported into the U.S. (102,000 were imported in all of 2024).

- Scotiabank’s Senior VP, Auto Finance, John Hiscock announced his retirement earlier this year. The 59-year-old industry veteran will be succeeded by John Kontos as of June 2nd. Kontos has been serving as VP, Manufacturer Partnerships and Dealer Programs.

- Toyota may be among one of the largest impacted Auto Manufacturers in the Trump administration’s trade war, with large scale operations within U.S. borders, the brand still requires global parts supply to those facilities causing roughly 1.2 million vehicles to be impacted per year. Toyota has disclosed a nearly $1.2 billion profit drop in only the last 2 months.

- The United States and China have agreed to temporarily lower tariffs. The 145% tariffs on Chinese goods imported to the U.S. will be reduced to 30%, while the 125% on U.S. goods to China will decrease to 10%, all for the next 90-days.

- Nissan Motor Company plans to cut almost 20,000 jobs globally as part of restructuring the business under new CEO, Ivan Espinosa. On top of the already 9,000 planned cuts, this new plan looks add another 10,000 to the total.

- Canadian auto parts manufacturer, Linamar could be one of the only benefactors of the U.S. tariffs, as the company’s parts comply with USMCA rules. Resulting in an acquisition of roughly $200 million in parts contracts in the last quarter.