05.22.2024

Market Insights – 5/22/2024

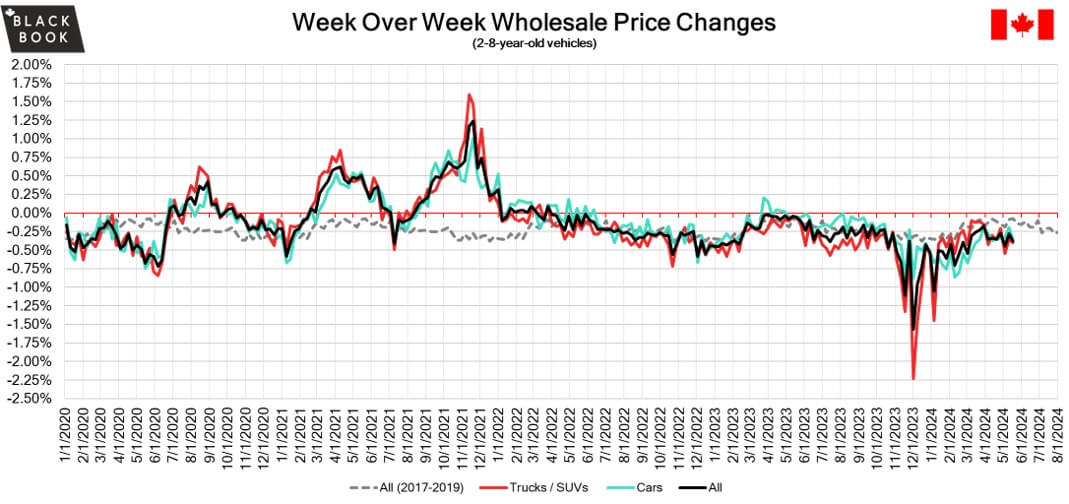

Wholesale Prices, Week Ending May 18th, 2024

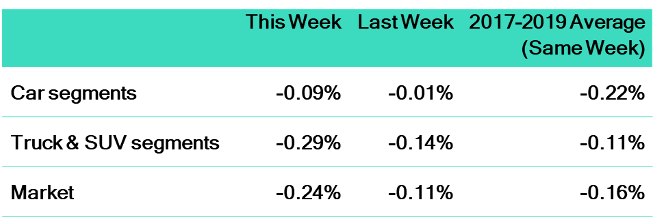

The Canadian used wholesale market saw a decline in prices for the week at –0.38%. The Car segment fell by –0.35% and the Truck/SUVs segment prices declined –0.40%. There was 1 segments with increased value for the week, Full- size Luxury Crossover/SUV at +0.15% The car segments with the largest declines were Sub-Compact Car at –1.19% followed by Compact Car at –0.90%. The largest declines for the Truck/SUV segments were, Compact Van at –1.26% followed by Full-Size Pickup at –0.75%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.35% | -0.20% | -0.07% |

| Truck & SUV segments | -0.40% | -0.35% | -0.08% |

| Market | -0.38% | -0.28% | -0.07% |

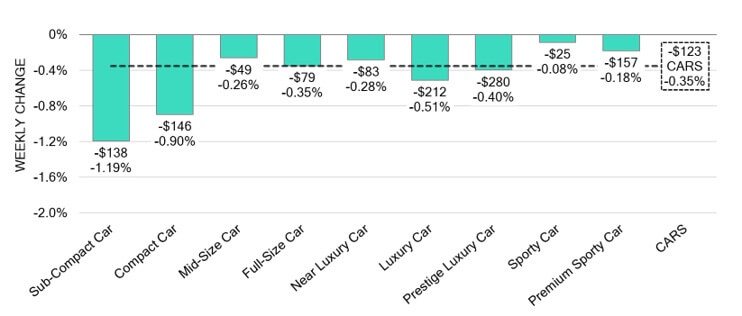

Car Segments

- There was an overall decrease of -0.35% within the Car segments last week. This decrease was noted across all nine segments.

- Sporty Car showed the least of declines with (-0.08%) followed by Premium Sporty Car at (-0.18%).

- The most significant decrease seen was from Sub-Compact Car at (-1.19%), followed by Compact Car at (-0.90%) and Mid-Size car at (-0.26%).

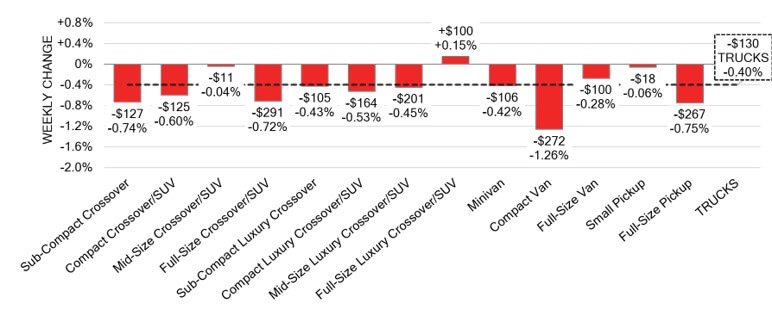

Truck / SUV Segments

- Last week truck segments showed an overall depreciation of -0.40%.

- Segments with the most notable declines were Compact Van (-1.26%), Full-Size Pickup (-0.75%), Sub-Compact Crossover (-0.74%) and Full-Size Crossover/SUV (-0.72%).

- One segment reflected an increase in wholesale values. That segment was Full-Size Luxury Crossover/SUV (+0.15%).

Wholesale

The Canadian market continued to decrease, with declines that was less than the prior week. Supply is building with stable demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $120 this week, as the Truck segments fell at more than the Car segments. Conversion rates were less than last week, but some observed sell rates were still as low as 12% while the high end was up to 68%; the average being between 20-40%. We also saw more sellers dropping floors last week, which has been contributing to more lanes with higher sell rates.

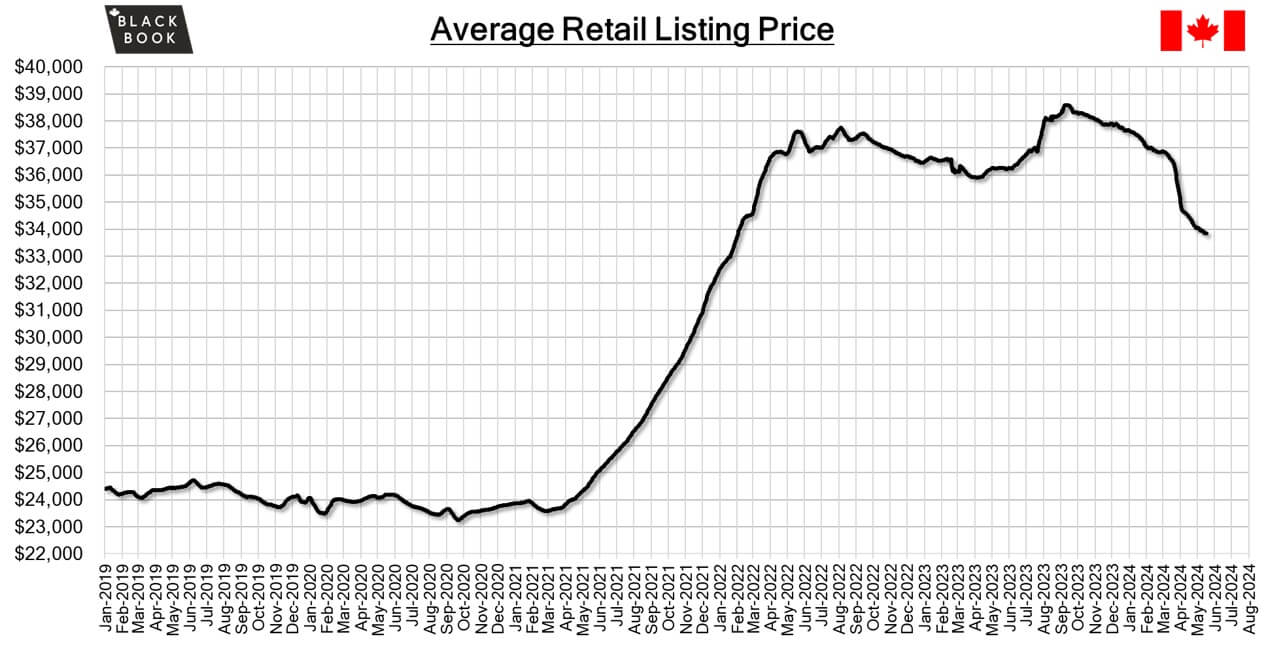

Used Retail Prices & Listing Volume

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $33,800. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The annual inflation rate in Canada eased to 2.7% in April of 2024 from 2.9% in the earlier month, in line with market expectations, to mark the softest rate of consumer price growth since March 2021.

- Housing starts in Canada fell slightly by 0.87% over a month earlier to 240,229 units in April 2024, still above market expectations of 238,000 units, according to the Canada Mortgage and Housing Corporation.

- Foreign investors increased their exposure to Canadian securities by a net $14.37 billion in March 2024, the most since June last year, above market expectations of $3.51 billion, and compared to a revised net divestment of $4.28 billion in February.

- The yield on the Canadian 10-year government bond fell to 3.60%.

- The Canadian dollar is around $0.734 this Monday morning, similar to $0.731 a week prior.

U.S. Market

- The overall market experienced an acceleration in the rate of decline last week, with all but two segments reporting a decrease in value. Although there was some reduction in auction inventory, the volumes being sold by the larger sellers, especially in the OEM lanes, are reminiscent of those seen pre-COVID.

Industry News

- In a move many industry players were hoping for, United States President Joe Biden will be significantly increasing tariffs on Chinese imports primarily aimed at EV’s, which enforces a 100% tariff on models made in China, as North America gears up to combat lower priced electric vehicles from the country. With Canada’s current inaction on the topic so far from Trudeau’s Liberal Government, Tesla has been pushing its Shanghai produced models into the nation at a much higher rate than last year.

- As Toyota and Subaru platform shared their inaugural EV to the North American market, they now have further collaborative plans to produce 3 new EV crossovers through 2026 as they ramp up electric models in their respective lineups.

- JLR named its new Canadian President last week, as it replaces Wolfgang Hoffman who had left the automaker around 6 months ago. Rory Beattie will lead the brand in Canada as its next President, as he’s last filled the role of Vice President of Customer Service for JLR in North America since 2016.

- Global EV sales are poised to continue to increase this year says Fatih Birol, Executive Director of the International Energy Agency (IEA) as they anticipate a 20% share of the overall market, representing 17 million units this year with China leading that trend, followed by Europe, then North America.

- Stellantis’ CEO for Dodge and Ram, Tim Kuniskis is retiring after 32 years. Possibly known best for his passion for horsepower with the Hellcat models, he will be succeeded by Matt McAlearwho will lead Dodge as well as Chrysler CEO Christine Feuell, who heads up Chrysler will fulfill those duties as well for Ram Trucks.