05.29.2025

Market Insights – 5/27/25

Wholesale Prices, Week Ending May 24th, 2025

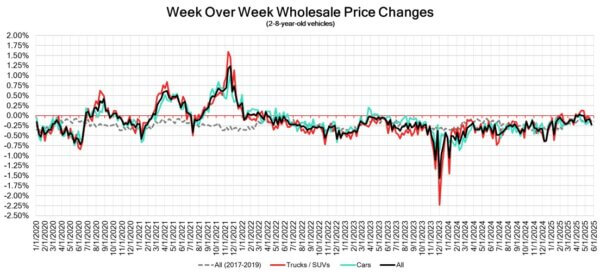

The Canadian used wholesale market saw a decline of -0.23% in pricing for the week. Car segments prices decreased by –0.23% while the Truck/SUV segments decreased by -0.22%. The largest increases were seen in Compact Van at +0.15% and Full-Size Pickup +0.16%. The largest declines in the Car segments were seen in Full-Size Car at -0.62% and Luxury Car with -0.44%. The largest declines in the Truck/SUV segments were Mid- Size Luxury Crossover/SUV at -0.66% followed by Mid-Size Crossover/SUV with -0.57%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.23% | -0.11% | -0.05% |

| Truck & SUV segments | -0.22% | -0.05% | -0.23% |

| Market | -0.23% | -0.08% | -0.14% |

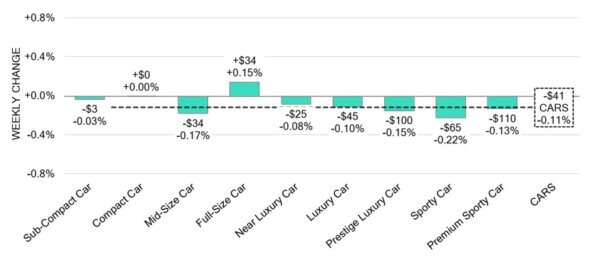

Car Segments

- Last week there was an overall decline of –0.11% seen in car segments. This softening was reflected in seven of the nine segments.

- Segments with the largest depreciations were Sporty Car (-0.22%), Mid-Size Car (-0.17%) and Prestige Luxury Car (-0.15%).

- One segment had an increase. That segment was Full-Size Car (+0.15%).

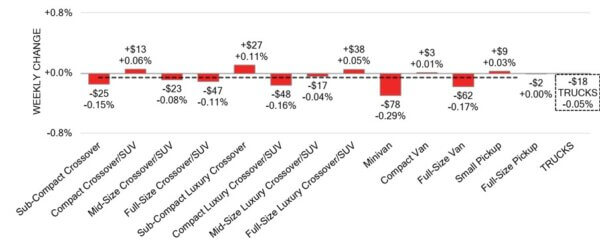

Truck / SUV Segments

- There was a slight overall depreciation of –0.05%seen in truck segments last week. This change was reflected in eight of the thirteen segments.

- Those with the largest declines were Minivan (-0.29%), Full-Size Van (-0.17%) and Compact Luxury Crossover/SUV (-0.16%).

- Five segments showed an increase in values. Sub-Compact Luxury Crossover (+0.11%) and Compact Crossover/SUV (+0.06%) had the most notable.

Wholesale

The Canadian market reflected a decrease in pricing, more pronounced than in its prior week. The decline in car segment values increased by 0.12% resting at -0.23%, while the decline in truck segment prices increased overall by 0.17% bringing its change to -0.22%. Just over 36% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 33.9% to 69% averaging at 41.7%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing political variances and the gradual change in floor prices. Supply has remained high in comparison to prior weeks; however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

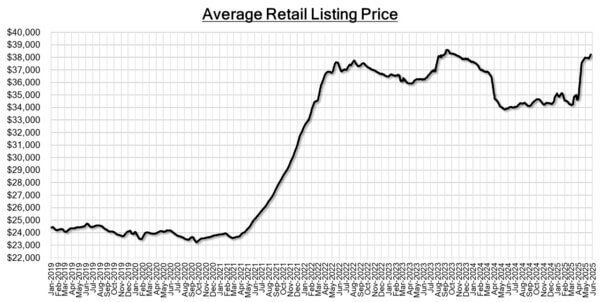

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $38,100. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In April 2025, the S&P Global Canada Services PMI experienced a minor

increase to 41.5, up from 41.2 in the prior month. This marks the fifth consecutive

month of contraction in Canada’s services sector, continuing at a historically rapid

rate. - In March 2025, Canada’s GDP saw a slight increase of 0.1% from the previous

month, as per the preliminary estimates. This growth was driven by

advancements in sectors such as mining, quarrying, oil and gas extraction, retail

trade, and transportation and warehousing. However, this was somewhat offset

by decreases in manufacturing and wholesale trade. - The S&P/TSX Composite Index dropped by approximately 0.4% to below the

24,910 level on Monday, slightly reducing the 1% gain from last week. - The yield on the Canadian 10-year government bond decreased to 3.178%.

- The Canadian dollar is around $0.724 this Monday morning, representing a slight

increase from $0.723 a week prior.

U.S. Market

- Last week’s activity aligned more closely with seasonal norms, as depreciation returned across most reporting segments. After eleven weeks of gains, the newer 0-to-2-year-old units declined for the first time, dropping by -0.07%, the same decline observed for 2-to-8-year-old units. However, 8-to-16-year-old units experienced a slightly higher depreciation rate, falling by -0.20% last week.

Industry News

- The North American automotive assembly line will produce 126,000 fewer vehicles this quarter due to tariffs: with estimates backed by scheduled production changes announced by automakers as of May 1.

- Dodge will no longer be making its Brampton, Ontario produced R/T trim of the electric Charger for 2026MY due to tariffs. It will only sell its top-of-the-line Scat Pack performance trim, keeping the entry price of the electric version at $75,185.

- Honda willheavily reduce its plans for EV investment and sales goals as trade policies and political regulations fluctuate. Planned R&D investment in electrification and software will be reduced by 30% throughout the rest of the decade, with sales volumes reducing from a projected 2 million by 2030 to 700,000 units.

- The latest U.S. EV Start-up, Slate Auto, has attracted 100,000 reservations for its Mini electric Pick-up, raising $700 million for the brand.

- Toyota is bringing some new EV’s to the North American market, with the new electric CH-R, replacing its outgoing gas version, as well as the bZ Woodland Crossover. The bZ Woodland would be a 2-row midsize SUV that is a sister model to the Subaru Trail seeker – both will be arrive as 2026MY vehicles.

- U.S. EV registrations increased 20% in March to 7.5%, as consumers react to incoming tariffs. This level of market share eclipsed Canada’s 6.5%, which includes plug-in hybrids.

- Infiniti refreshes its midsize luxury crossover, the QX60 for 2026MY with upgraded front and rear fascia’s as well as lighting design. It keeps its 2.0L turbo 4-cylinder powertrain, but hints at possible future electrification for the model.