05.31.2023

Market Insights – 5/31/2023

Wholesale Prices, Week Ending May 27th

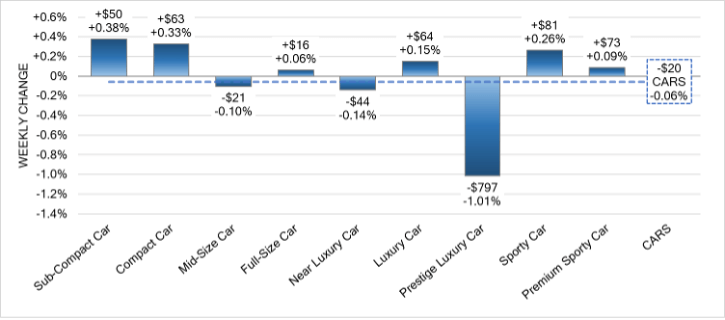

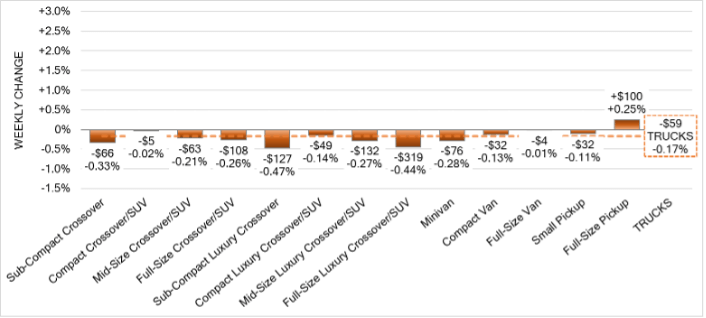

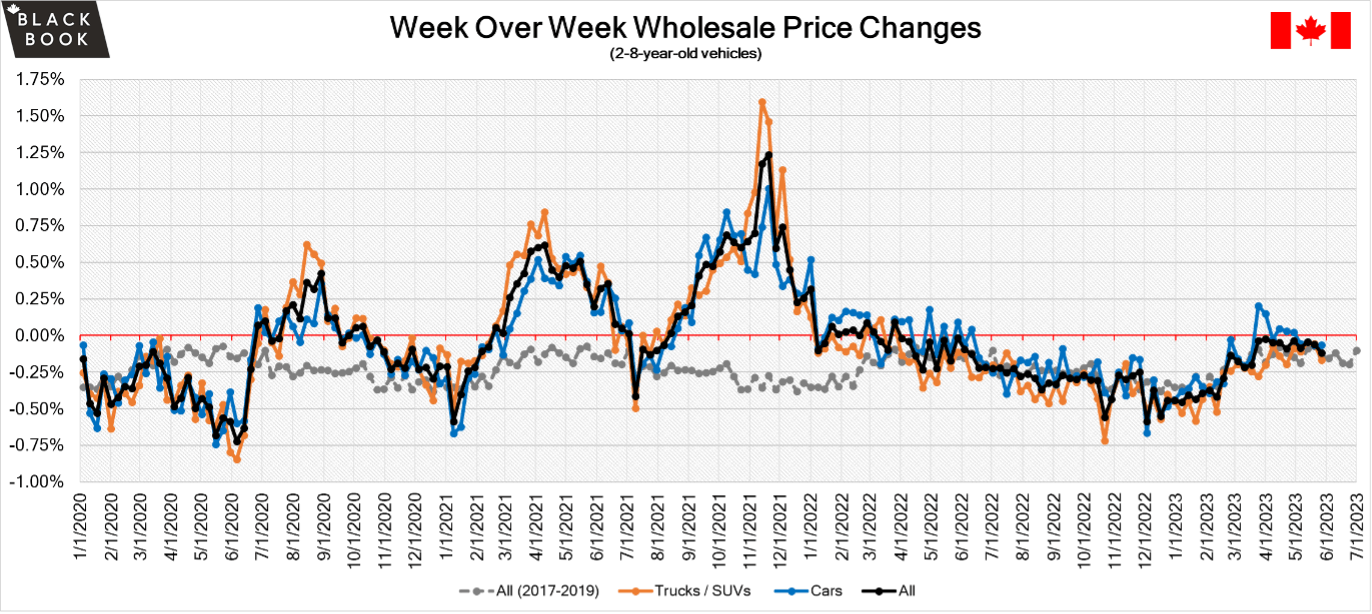

The Canadian used wholesale market saw a decline in prices for the week at -0.12%. The Car segment fell by -0.06% and the Truck/SUVs’ segment prices declined -0.17%. 7 out of 22 segments’ values have increased for the week. Sub Compact Car leads with +0.38% and Compact Car follows behind at +0.33%. The segments with the largest declines were Prestige Luxury Car (-1.01%) and Sub Compact Luxury Crossover (-0.47%).

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.06% | -0.06% | -0.05% |

| Truck & SUV segments | -0.17% | -0.06% | -0.23% |

| Market | -0.12% | -0.06% | -0.14% |

Car Segments

- Last week, Car segment prices saw a decrease overall by -0.06% once again.

- Of the nine segments, five showed an increase in pricing. The largest increase being Mid-Size Cars at (+0.27%), followed by Sporty Car (+0.20%) & Full-Size Car at (+0.13%).

- The segments with the largest decline in pricing were Prestige Luxury Cars at (-0.72%) followed by Near Luxury Car at (-0.02%) and both Compact-Car & Luxury-Car at (-0.01%).

Truck Segments

- Truck segments decreased on average last week overall by -0.17%.

- Segments with the largest declines were Sub-Compact Luxury Crossover (-0.47%), Full-Size Luxury Crossover/SUV (-0.44%) and Sub-Compact Crossover (-0.33%).

- One segment experienced an increase. That segment was Full–Size Pickup (+0.25%).

Used Retail Prices & Listing Volumes

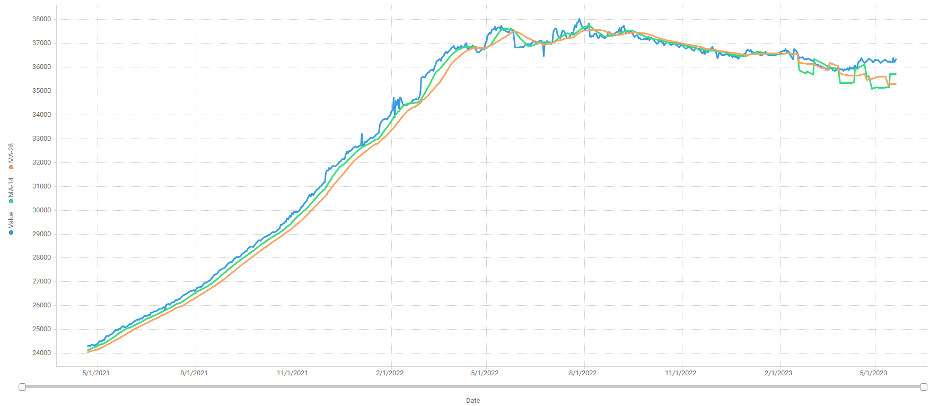

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $35,850. Analysis is based on approximately 175,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of less than $65 this week as the market continues to stabilize.

Conversion rates were quite varied. Some observed sell rates were as low as 15% but most were in the 35-50% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

• The Toronto Stock Exchange’s S&P/TSX composite index dropped 1% to trade below the 19,800 points mark on Thursday, the lowest level since March 28th, due to lower crude oil prices, uncertainties surrounding the US debt deal, and mixed bank earnings reports.

• Canada’s government budget deficit widened to CAD 44.4 billion in March 2023, from CAD 25.7 billion in the corresponding month of the previous year.

• Industrial producer prices in Canada unexpectedly edged down by 0.2% over a month in April of 2023, compared with market expectations of a 0.2% increase and following a revised 0.1% fall in the prior month.

• The Canadian dollar is around $0.735 this Monday morning down from $0.741 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.25% last week; the prior week decreased by -0.13%.

Volume-weighted Car segments decreased -0.11%, compared to the prior week’s -0.16% decrease:

- Three of the nine Car segments increased last week.

- After eighteen weeks of increases, for an average weekly gain of +0.58%, the Sporty Car segment declined -0.19% last week.

- Prestige Luxury Car reported the largest decline for cars last week, down -0.33%, consistent with the previous three weeks that have averaged -0.33% decline each week.

Volume-weighted Truck segments decreased by -0.32%; the previous week decreased -0.12%:

- Three of the thirteen Truck segments reported increases last week.

- A popular summer travel segment, Minivans (+0.27%) continue to report gains for fifteen consecutive weeks now with an average weekly increase of +0.60%.

- Full-Size Van had the largest decline last week, -1.00%. This is the largest decline for the segment since 2019.

Industry News

- Early next year, all current and future Ford electric vehicles will have access to roughly 12,000 Tesla Supercharger stations, as the EV brand will outfit its vehicles with Tesla standard charging ports removing the need for an adapter to utilize the largest charging network in North America.

- EV battery start-up, Lyten, has attracted the investment of Stellantis through its development of an all-new lithium-sulfur EV battery that should be production ready by the end of this decade; the new battery promises reduced weight, higher energy density and a simpler approach to acquiring materials.

- Due to interest rates increasing monthly payments, the industry is seeing inventory improvements as Desrosiers Automotive Consultants reported inventory across Canada reached 42.3% of normal (normal being pre-2019 levels) as opposed to 19.4% at this time last year; and this trend ranges between segments and brands.

- AM radio has been the subject of discussion as manufacturers play with the idea of removing it from vehicles radio frequencies, and as Ford has recently learned, AM radio is here to stay, as the company had recently removed AM frequencies from its electric vehicles but has since restored its service after speaking with policy leaders who asked that it be returned, due to its part in emergency alert communications.

- Toronto-based EnerSavings Inc. is helping accelerate EV adoption in Canada as there is a much greater push for EV chargers amongst multi-unit residential buildings (MURBs); the business began installing EV chargers in MURBs in the B.C. just 4 years ago and now offers a turnkey approach to EV charger install across Canada as a surge in demand for building owners and tenants is expected.