05.06.2025

Market Insights – 5/6/25

Wholesale Prices, Week Ending May 3rd, 2025

The Canadian used wholesale market saw a decline of -0.15% in pricing for the week. Car segments prices decreased by –0.21% while the Truck/SUV segments decreased by -0.09%. The largest increases were seen in Mid-Size Crossover/SUV at +0.31% and Small Pickup +0.14%. The largest declines in the Car segments were seen in Compact Car at -0.31% and Near Luxury Car with -0.22%. The largest declines in the Truck/SUV segments were Full Size Van at -0.56% followed by Sub-Compact Luxury Crossover/SUV with -0.19%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.21% | -0.15% | -0.21% |

| Truck & SUV segments | -0.09% | +0.12% | -0.17% |

| Market | -0.15% | +0.00% | -0.19% |

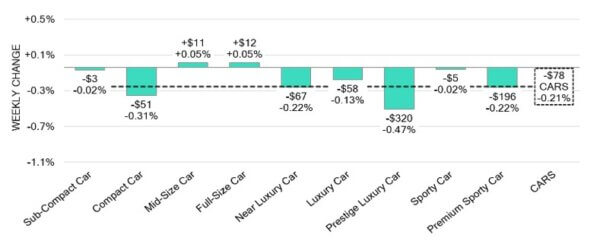

Car Segments

- There was an overall depreciation of –0.21% seen in car segments last week. This decline was reflected in seven of the nine segments.

- Segments with the largest declines were Prestige Luxury Car (-0.47%), followed by Compact Car (-0.31%), Near Luxury Car and Premium Sporty Car (-0.22%).

- Two segments had a slight gain in values. Those were Mid-Size Car and Full-Size Car with the same increase (+0.05%).

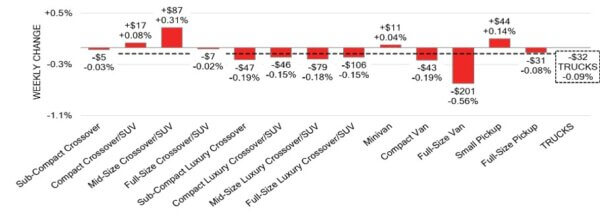

Truck / SUV Segments

- Truck segments showed an overall price drop of -0.09% last week. This change was reflected in nine of the thirteen segments.

- Segments with the largest depreciations were Full-Size Van (-0.56%) followed by Sub-Compact Luxury Crossover and Compact Van (-0.19%).

- Four segments showed an increase in values. Mid-Size Crossover/SUV (+0.31%) and Small Pickup (+0.14%) were the most notable.

Wholesale

The Canadian market indicated a decrease in pricing, experiencing a decline more pronounced than in its prior week. The decline in car segment values increased to – 0.21%, while trucks decreased overall by 0.21 bringing its change to -0.09%. Just over 18% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 14.9% to 60.6% averaging at 41.2%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing political variances and the gradual change in floor prices. Supply has remained high in comparison to prior weeks; however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

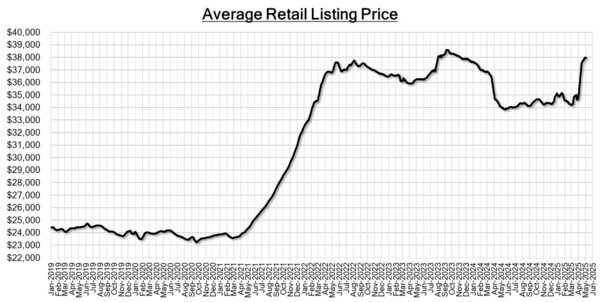

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,950. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In April 2025, the S&P Global Canada Services PMI experienced a minor

increase to 41.5, up from 41.2 in the prior month. This marks the fifth consecutive

month of contraction in Canada’s services sector, continuing at a historically rapid

rate. - In March 2025, Canada’s GDP saw a slight increase of 0.1% from the previous

month, as per the preliminary estimates. This growth was driven by

advancements in sectors such as mining, quarrying, oil and gas extraction, retail

trade, and transportation and warehousing. However, this was somewhat offset

by decreases in manufacturing and wholesale trade. - The S&P/TSX Composite Index dropped by approximately 0.4% to below the

24,910 level on Monday, slightly reducing the 1% gain from last week. - The yield on the Canadian 10-year government bond decreased to 3.178%.

- The Canadian dollar is around $0.724 this Monday morning, representing a slight

increase from $0.723 a week prior.

U.S. Market

- The market continued to see week-over-week increases in wholesale values, although the pace of these gains slowed last week. Despite the moderation compared to the prior two weeks, the scale of these gains remains atypical, as seasonal trends would generally reflect week-over-week declines during this period.

Industry News

- The CADA proposed ideas to help ease tariff impacted vehicle pricing, with alternatives like eliminating the Luxury Tax on $100,000+ vehicles and removing the2035 100% ZEV mandate. Another opportunity to open up safety standards to allow homologated vehicles from the European Union, South Korea and Japan to be sold in Canada, avoiding hefty standardizing costs necessary for the U.S. consumption.

- Desrosiers has reported that April sales are up 10% to an estimated 186,000 units sold as consumers run scared to dealerships to purchase before tariff-imposed prices make it into showrooms.

- Tesla raises prices in Canada, encouraging consumers to buy while quantities last of pre-tariff inventory. Price impacts have been seen online with Model 3 Long Range AWD increasing from $69,000 to $79,990.

- President Donald Trump’s Administration has released new information for tariffs on Canadian-made auto parts, which will not face a tariff if a part is compliant with the USMCA, which originally stated that there would be a 25% tariff imposed on all Canadian-made parts as of May 3rd.

- General Motors Oshawa Assembly plant will be reducing its requirement of 3 shifts down to 2 shifts as it decreases its pickup truck output from the plant down by 48,000 vehicles annually. The plant built 144,000 vehicles in 2024.

- British Columbia has suspended its EV purchase incentive indefinitely as it considers next steps. The program has been active for 15 years, supporting consumers with $650 million for their EV purchase.

- An electric vehicle start-up called Slate Auto, backed by Amazon Founder Jeff Bezos broke cover last week as a bare-bones modular electric pick-up truck and SUV aimed at affordability, with a starting price under $30,000 USD.