05.07.2024

Market Insights – 5/7/2024

Wholesale Prices, Week Ending May 4th, 2024

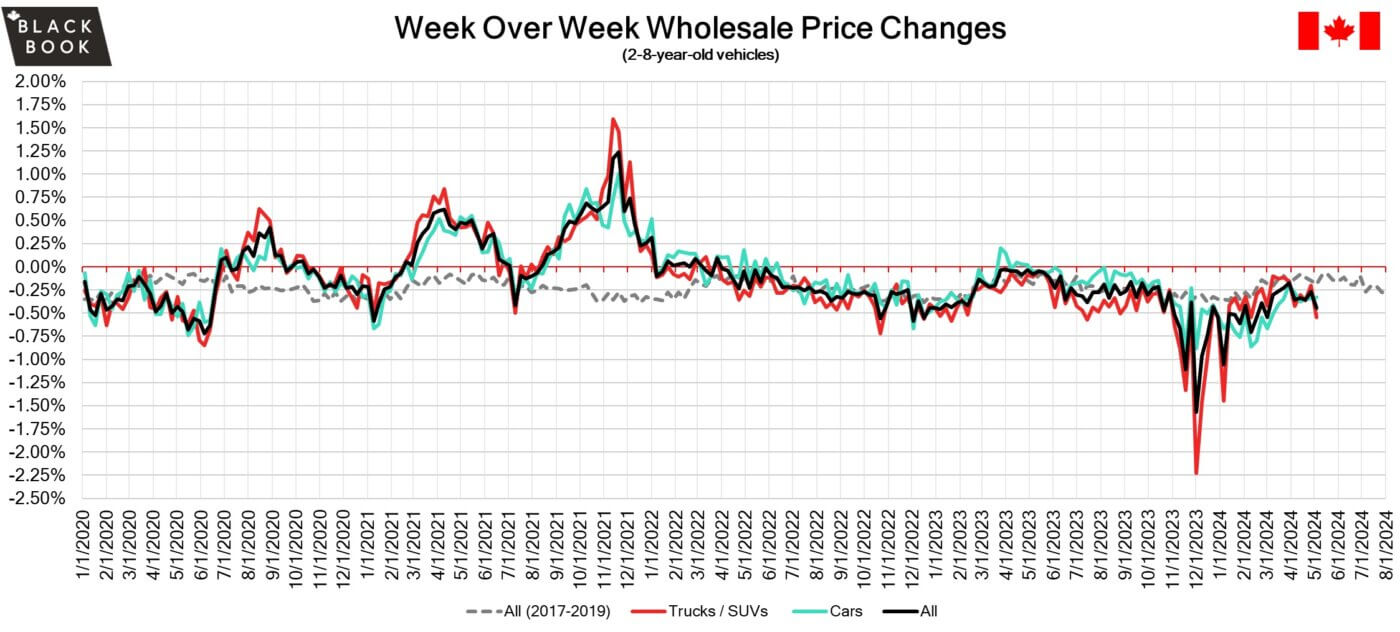

The Canadian used wholesale market saw a decline in prices for the week at –0.44%. The Car segment fell by –0.33% and the Truck/SUVs segment prices declined –0.54%. There were no segments with increased values for the week. The car segments with the largest declines were Compact Car at –1.01% followed by Full Size Car at –0.77%. The largest declines for the Truck/SUV segments were, Compact Van at –1.97% followed by Compact Crossover/SUV at –0.79.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.33% | -0.35% | -0.21% |

| Truck & SUV segments | -0.54% | -0.21% | -0.17% |

| Market | -0.44% | -0.27% | -0.19% |

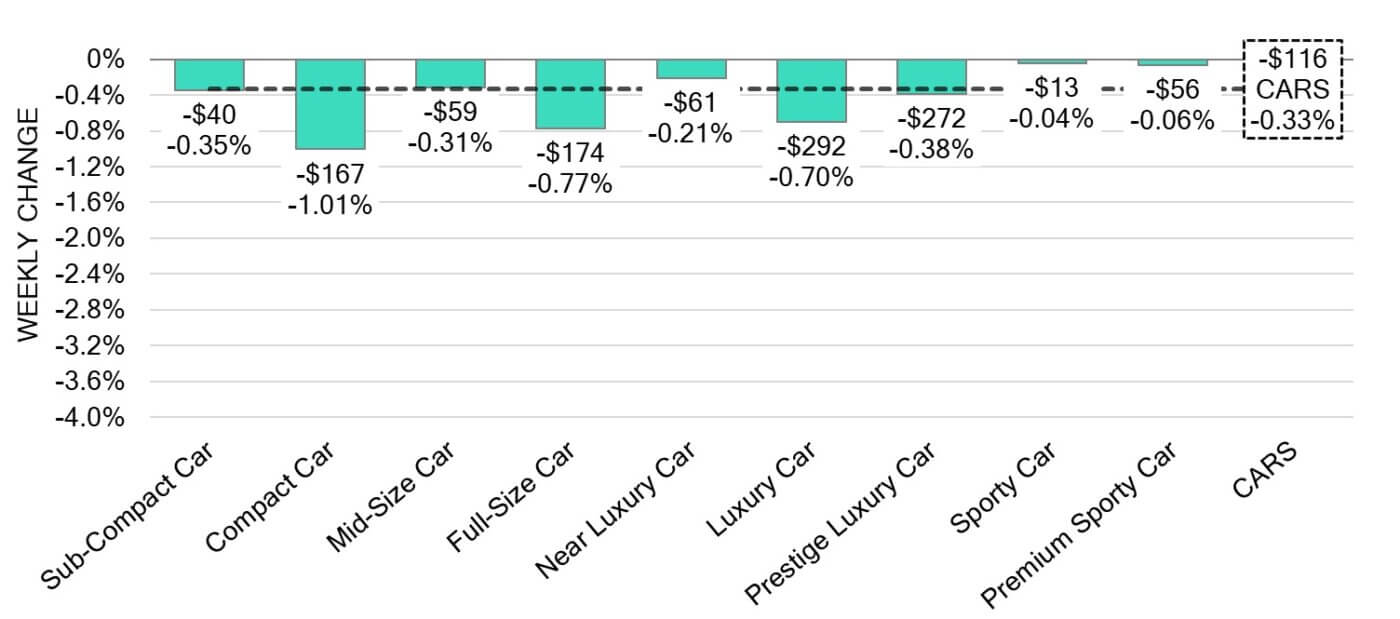

Car Segments

- There was an overall decrease of -0.33% within the Car segments last week. This decrease was noted across all nine segments.

- Sporty Car showed the least of declines with (-0.04%) followed closely by Premium Sporty Car at (-0.06%).

- The most significant decrease was seen in Compact Car at (-1.01%). Full-Size Car declined by (-0.77%) followed by Luxury Car at (-0.70%).

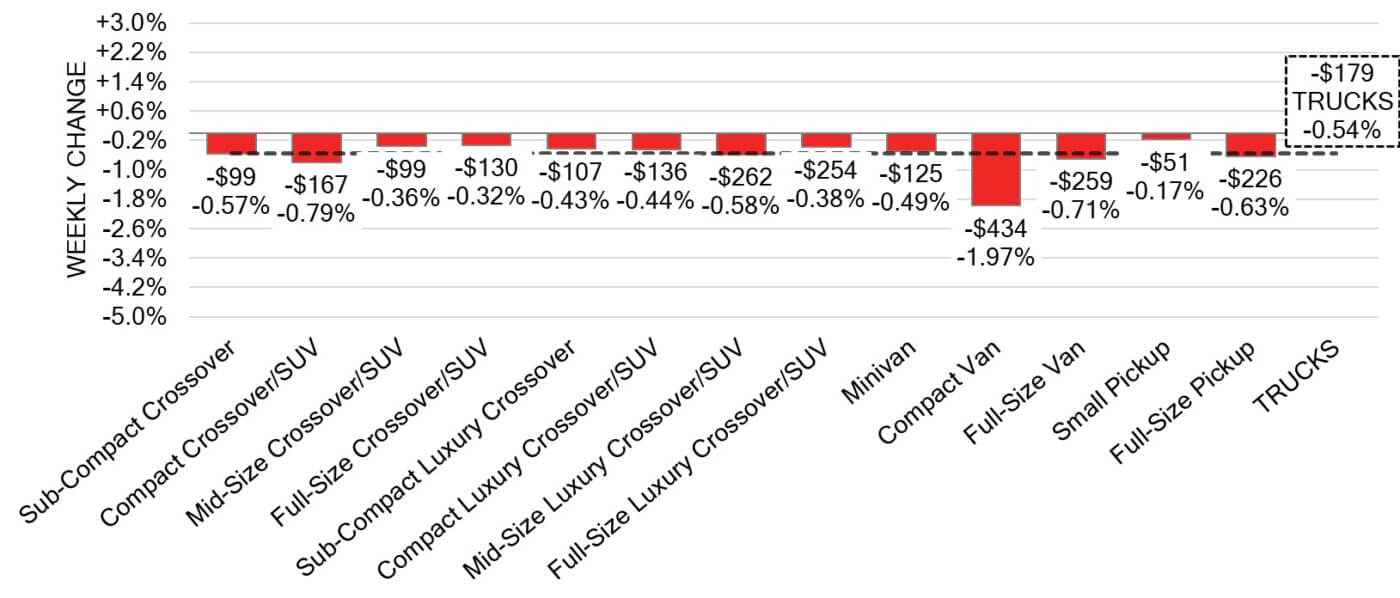

Truck / SUV Segments

- Last week truck segments showed an overall depreciation of -0.54%.

- All segments reflected a decline. Those with the most notable were Compact Van (-1.97%), Compact Crossover/SUV (-0.79%), Full-Size Van (-0.71%) and Full-Size Pickup (-0.63%).

- Others with a notable drop were Mid-Size Luxury Crossover/SUV (-0.58%) and Sub-Compact Crossover (-0.57%).

Wholesale

The Canadian market continued to decrease, with declines that were similar to the prior week. Supply is building with stable demand for vehicles at auction on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Most segments saw a change in average value of more than $120 this week, as the Truck segments fell at more than the Car segments. Conversion rates were slightly improved compared to last week, but some observed sell rates were still as low as 12% while the high end was up to 83%; the average being between 25-45%. We also saw more sellers dropping floors last week, which has been contributing to more lanes with higher sell rates.

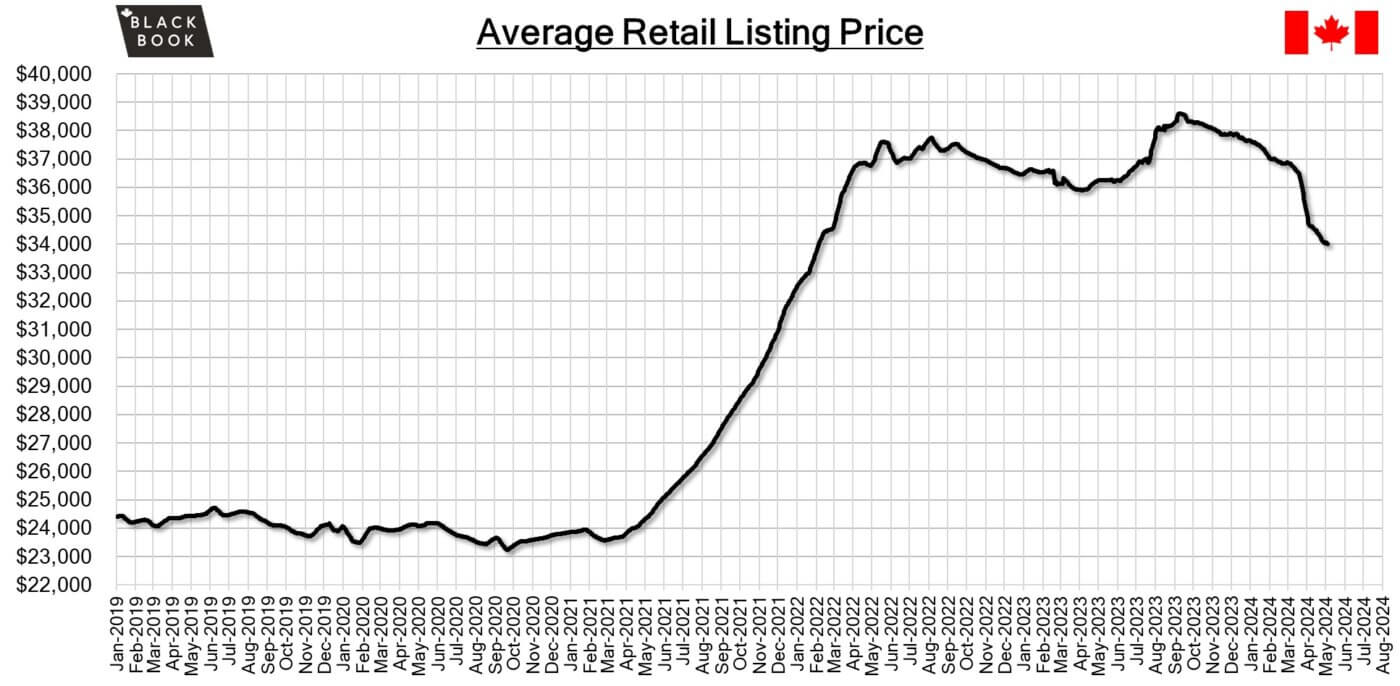

Used Retail Prices & Listing Volume

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $34,050. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s GDP is expected to have remained unchanged in March 2024, as increases in utilities, real estate and rental & leasing were offset by decreases in manufacturing and retail trade.

- The S&P Global Canada Manufacturing PMI decreased by 0.4 points from the previous month to 49.4 in April 2024, continuing a contractionary trend for the twelfth consecutive month in Canadian factory activity and significantly deviating from estimates of an expansion at 50.2.

- Canada reported a trade deficit of 2.3 billion dollars in March of 2024, contrasting with a surplus of 0.5 billion dollars in February and against market forecasts of a 1.5 billion dolllars surplus.

- The yield on the Canadian 10-year government bond fell slightly to 3.80%.

- The Canadian dollar is around $0.731 this Monday morning, similar to $0.732 a week prior.

U.S. Market

- Could the spring bump be concluding? Indications suggest it might be, as the overall market has reported its first drop in seven weeks, but it is too early to say for certain. Nevertheless, this decline aligns with seasonal trends observed before the pandemic.

Industry News

- The Ram 1500 DS generation, aka Ram Classic will no longer be produced for Canada after all 2023MY stock is sold, reported Stellantis at the end of last month. The Ram Classic will however still sell in the U.S. as well as Mexico, prolonging the model’s lifecycle since its launch in 2008.

- Jeep will be increasing its powertrain lineup for the Gladiator pick-up in 2025MY as it gains the 4xe nomenclature denoting a plug-in hybrid system allowing it to operate fully electrically for a limited distance.

- April sales came in at a sizeable 14% increase over last year, estimated at roughly 164,000, which is still significantly off pace from 2019’s 180,000+ vehicles sold, referencing the pre-pandemic benchmark. Of manufacturers reporting sales, Toyota saw the largest gains YoY with 34% more than in April 2023 – at 22,148, it’s the 2nd best April on record for the brand.

- Magna International Inc., Canada’s largest parts supplier to the global auto industry is projecting a $400 million loss on earnings after the electric vehicle production for the financially troubled EV start-up Fisker Inc. was forced to stop production of the brands Ocean electric SUV, on top of slowing sales of EV’s in general for other contracts the supplier has ongoing.

- Tesla’s eagerness to adopt giga-casting further into their manufacturing process is showing signs of uncertainty as the brand backs off from its effort to innovate the casting a full underbody sections in one piece rather than the three-piece it operates with today. This would reduce manufacturing cost, coming at a time when the brands sales and profit margins continue to fall and it cuts its staff around its Supercharger network.