06.10.2025

Market Insights – 6/10/25

Wholesale Prices, Week Ending June 7th, 2025

The Canadian used wholesale market saw a decline of -0.35% in pricing for the week. Car segments prices decreased by –0.21% while the Truck/SUV segments decreased by -0.47%. The largest increases were seen in Full Size Car at +0.22% and Compact Crossover/SUV +0.05%. The largest declines in the Car segments were seen in Mid-Size Car at -0.38% and Prestige Luxury Car with -0.32%. The largest declines in the Truck/SUV segments were Full-Size Crossover/SUV at -1.24% followed by Mid-Size Luxury Crossover/SUV with -0.89%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.21% | -0.14% | -0.12% |

| Truck & SUV segments | -0.47% | -0.21% | -0.11% |

| Market | -0.35% | -0.18% | -0.12% |

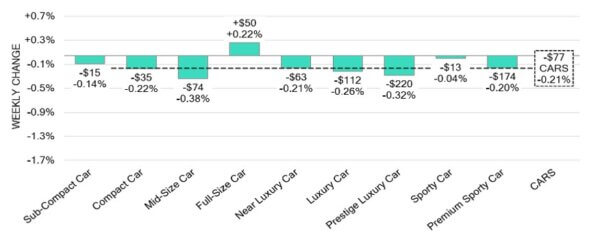

Car Segments

- Last week, car segments experienced an overall depreciation of –0.21%, with declines observed in eight out of nine categories.

- The most significant decreases were seen in Mid-Size Cars (-0.38%), Prestige Luxury Cars (-0.32%), Luxury Cars (-0.26%), and Compact Cars (-0.22%).

- However, one segment bucked the trend—Full-Size Cars recorded a slight increase of +0.22%.

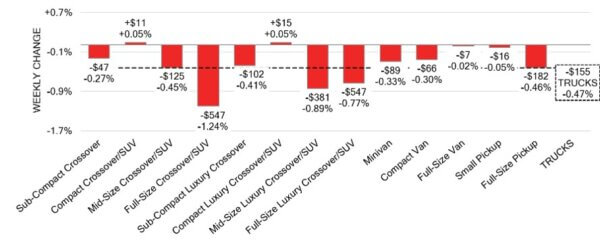

Truck / SUV Segments

- Truck segments experienced an overall depreciation of –0.47% last week, with declines observed in eleven out of thirteen categories.

- The most significant drops occurred in Full-Size Crossover/SUV (-1.24%), Mid-Size Luxury Crossover/SUV (-0.89%), Full-Size Luxury Crossover/SUV (-0.77%), and Full-Size Pickup (-0.46%).

- However, two segments saw modest gains—Compact Crossover/SUV and Compact Luxury Crossover/SUV each rose by +0.05%.

Wholesale

The Canadian market experienced a decrease in pricing, with a decline less far more pronounced than in its previous week. The decline in car segment values increased by 0.07% resting at -0.21%, while the decline in truck segment prices also increased overall by 0.26% bringing its change to -0.47%. Just under 41% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 16.5% to 50.8% averaging at 31.9%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing political variances and the gradual change in floor prices. Supply has remained high in comparison to prior weeks; however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $38,200. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The Bank of Canada kept its key interest rate steady at 2.75% in June 2025,

matching the expectations of half the market. This marks the second time the

central bank has left rates unchanged after previously cutting them by a total of

2.25 percentage points over seven straight meetings. - Labour productivity among Canadian businesses increased by 0.2% in the first

quarter of 2025, down from a revised 1.2% rise in the fourth quarter of 2024.

Despite the slowdown, this is the second quarter in a row showing growth—the

first time this has happened since the COVID-19 pandemic. - Canada’s merchandise trade deficit grew to a record $7.1 billion in April 2025, up

from $2.3 billion in March. This was much higher than the expected gap of $1.5

billion. - The yield on the Canadian 10-year government bond increased to 3.346%.

- The Canadian dollar is around $0.731 this Monday morning, representing a slight

increase from $0.730 a week prior.

U.S. Market

- Sales rates bounced back to 60% last week. However, this rebound was accompanied by an accelerated depreciation, with the overall market declining by -0.54%. This drop surpasses the typical seasonal decline of -0.28% for this time of year.

Industry News

- President Donald Trump has increased tariffs on Canadian steel and aluminum imported into the U.S. from 25% to 50%. This will further impact vehicle assembly and production, raising prices on new vehicles sold in Canada.

- As pre-tariff new vehicle inventory sells at an increased pace this year, it is now expected that prices will start getting impacted in showrooms this month. Though the impact on price isn’t likely to be as significant as forecasted, it will rise roughly $2,000 on average, according to J.D. Power.

- May new car sales were up over last year, as strong sales for 2025 continued last month. With one extra selling day, May 2025 saw 187,000 units sold, a 7.9% increase over 2024. We now forecast sales for 2025 to finish at 1.83M units.

- According to StatsCan, Canada reported its greatest trade deficit in April of $7.1B as exports fell due to U.S. tariffs. Autos and auto parts were the hardest hit export, falling 17.4%. With May unemployment hitting 7% as manufacturing continues to lose jobs at an alarming rate.

- The Government of Ontario has set aside $500M from the provincial budget to invest in critical mineral processing projects as Vic Fedeli, Ontario’s Minister of Economic Development, looks to create jobs and increase trade opportunities, supporting the auto sector.

- The Ram brand will be bringing back V8 power to its Ram 1500 lineup as an optional engine choice for 2025. With a new logo denoting the engine as well as a $1,200 upcharge, the V8 will now sell alongside the current Hurricane inline 6-cylinder that Ram loyalists have frowned upon.