06.17.2025

Market Insights – 6/17/25

Wholesale Prices, Week Ending June 14th, 2025

The Canadian used wholesale market saw a decline of -0.21% in pricing for the week. Car segments prices decreased by –0.10% while the Truck/SUV segments decreased by -0.30%. The largest increases were seen in Minivan at +0.09% and Sub-Compact Car +0.04%. The largest declines in the Car segments were seen in Full-size Car at -0.87% and Compact Car with -0.28%. The largest declines in the Truck/SUV segments were Full-Size Pickup at -0.55% followed by Mid-Size Luxury Crossover/SUV with -0.47%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.10% | -0.21% | -0.10% |

| Truck & SUV segments | -0.30% | -0.47% | -0.28% |

| Market | -0.21% | -0.35% | -0.19% |

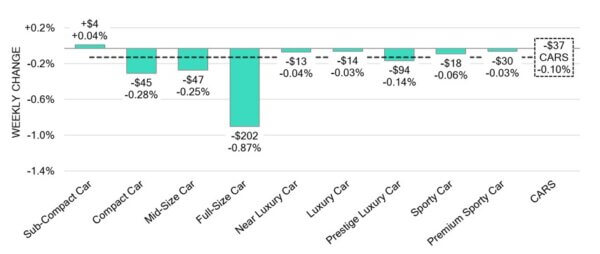

Car Segments

- Last week, car segments saw a modest overall decline, with values dipping by an average of 0.10%. Out of the nine tracked categories, eight experienced depreciations.

- The steepest drops were recorded in Full-Size Car (-0.87%), Compact Car (-0.28%), Mid-Size Car (-0.25%), and Prestige Luxury Car (-0.14%).

- Amid the downturn, there was one exception—Sub-Compact Cars posted a slight gain of +0.04%, standing out as the only segment to post an increase.

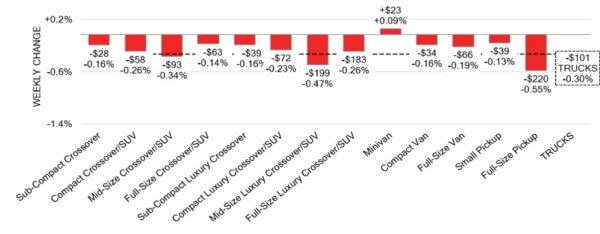

Truck / SUV Segments

- Truck segments faced an average depreciation of-0.30% last week, with twelve out of thirteen categories posting declines.

- The largest drops occurred in Full-Size Pickup (-0.55%), Mid-Size Luxury Crossover/SUV (-0.47%), Mid-Size Crossover/SUV (-0.34%), Compact Crossover/SUV and Full-Size Luxury Crossover/SUV (-0.26%).

- One segment saw a modest uptick. That segment was Minivan (+0.05%).

Wholesale

The Canadian market’s decrease in pricing continues with a decline less pronounced than in its previous week. The decline in car segment values decreased by 0.11% resting at -0.10%, while the decline in truck segment prices also decreased overall by 0.17% bringing its change to -0.30%. Just over 18% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 17% to 75.2% averaging at 44%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing political variances and the gradual change in floor prices. Supply has remained high in comparison to prior weeks; however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,600. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The Bank of Canada kept its key interest rate steady at 2.75% in June 2025,

matching the expectations of half the market. This marks the second time the

central bank has left rates unchanged after previously cutting them by a total of

2.25 percentage points over seven straight meetings. - Labour productivity among Canadian businesses increased by 0.2% in the first

quarter of 2025, down from a revised 1.2% rise in the fourth quarter of 2024.

Despite the slowdown, this is the second quarter in a row showing growth—the

first time this has happened since the COVID-19 pandemic. - Canada’s merchandise trade deficit grew to a record $7.1 billion in April 2025, up

from $2.3 billion in March. This was much higher than the expected gap of $1.5

billion. - The yield on the Canadian 10-year government bond increased to 3.346%.

- The Canadian dollar is around $0.731 this Monday morning, representing a slight

increase from $0.730 a week prior.

U.S. Market

- The market experienced continued large depreciation last week, recording a decline of -0.47% following the previous week’s significant drop of -0.54%. Bidding activity also slowed slightly, leading to a decrease in the conversion rate, which fell below 60%.

Industry News

- Zero-emission vehicle sales were down year-over-year in April, as the market adjusts to a landscape with an absent Federal iZEV rebate. But at 7.5% in April, market share did improve against March, which came in at 6.5%.

- There is a new concept “Lexus Studio” that has just opened in Burnaby, B.C. by Regency Lexus that will help customers learn about the brands electrified lineup by creating an environment focused on education rather than selling in a more untraditional setting inspired by Apple Stores.

- Tesla has refreshed its Model X and S vehicles in the U.S. and in turn increased pricing on each by $5,000. No changes have been made to these models in Canada so far, but this can be expected to follow.

- Renault Group, a France-based auto manufacturing conglomerate has expressed interest in bringing its sports-inspired car brand, Alpine to Canada as its first entry into North America. The brand is attracted to this market largely “due to its French-speaking population and its ability to reach most of the buying population through four key cities”, said Alpine CEO Philippe Krief. He also noted tariffs as a contributing factor.

- The unemployment rate in Canada for May reached 7% according to StatsCan, reporting this as the highest rate of unemployment since 2016 outside of pandemic years. 8,800 jobs were added last month as manufacturing jobs continue to lose amidst the impact from tariffs.

- Ford Canada CEO, Bev Goodman urged that the nation’s ZEV mandate by repealed as consumer demand for electric vehicles has declined so drastically, pending the removal of rebates among other reasons. She discussed this issue at the Canada Automotive Summit hosted in Vaughan, ON last week by the APMA.