06.18.2024

Market Insights – 6/18/2024

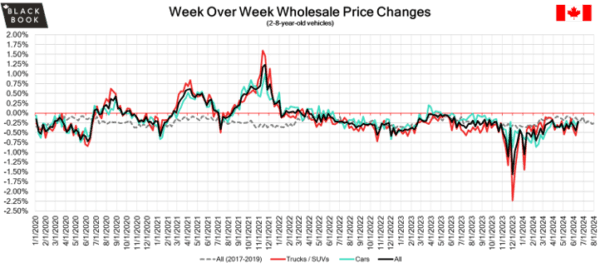

Wholesale Prices, Week Ending June 15th, 2024

The Canadian used wholesale market saw a decline in prices for the week at –0.22%. The Car segment fell by –0.21% and the Truck/SUVs segment prices declined –0.22%. The segment with the biggest increased value for the week was Mini Van with +0.34%, The car segments with the largest declines were Sub-compact Car at –0.78% followed by Compact Car at –0.50%. The largest declines for the Truck/SUV segments were, Full-Size Pickup at –0.83% followed by Sub-Compact Crossover/SUV at –0.43%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.21% | -0.31% | -0.10% |

| Truck & SUV segments | -0.22% | -0.57% | -0.28% |

| Market | -0.22% | -0.45% | -0.19% |

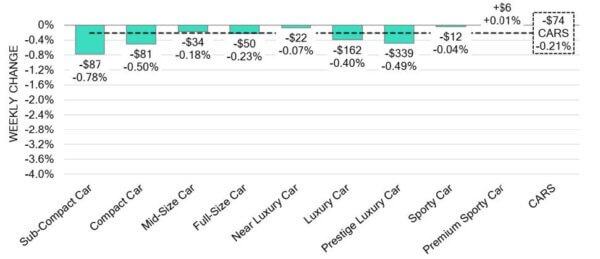

Car Segments

- Last week there was an overall decrease of -0.21% seen in Car segments. This decrease was noted across eight of the nine segments.

- The segment showing an increase in price was Premium Sporty Car at (+0.01%), with by Sporty Car at (-0.04%) and Near Luxury Car at (-0.07%) having the smallest decrease.

- The greatest decrease was seen from Sub-Compact Car (-0.78%), followed by Compact Car at (-0.50%) and Prestige Luxury Car at (-0.49%).

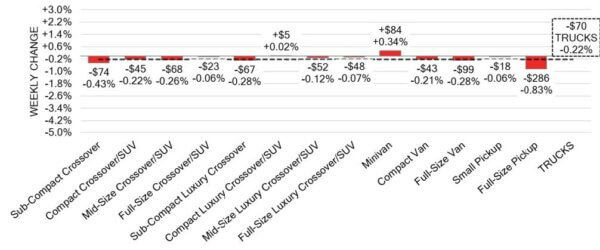

Truck / SUV Segments

- There was an overall decline in truck values of –0.22% last week. Eleven of the thirteen segments reflected this.

- Those with the largest depreciations were Full-Size Pickup (-0.83%) and Sub-Compact Crossover (-0.43%).

- Two segments had increases. These segments were Minivan (+0.34%) and Compact Luxury Crossover/SUV (+0.02%).

Wholesale

The Canadian market continues its decline, almost mirroring the decreases seen in the previous week. Supply continues to be accessed through upstream channels before becoming available in the wholesale market, leading to an increase in inventory as demand for vehicles at auction rises on both sides of the border. Only 14% of segments experienced an average value change exceeding $100 this week, with the Truck segment showing a decrease 1% larger than that of the Car segments. Auction sale rates ranged from 16% to 73%, reflecting a slight decline in average conversion rates for the week. The variation in sale rates across different lanes could be attributed to the drop in floor prices.

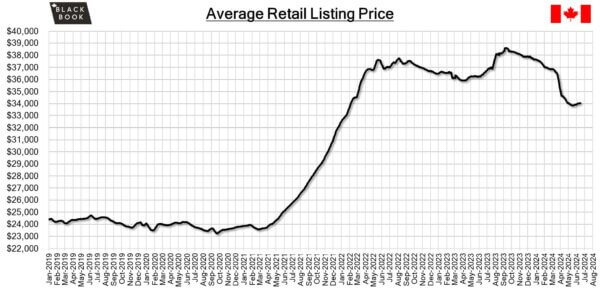

Used Retail Prices & Listing Volume

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $33,900. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In April 2024, the total value of building permits surged by 20.5% compared to the previous month, marking the most substantial increase since May 2020, reaching $12.8 billion. This growth follows a 12.3% decline in March and exceeded market expectations, which had anticipated only a 2.2% rise.

- In April 2024, foreign investors significantly increased their exposure to Canadian securities by a net $41.16 billion, the highest increment in over two years. This surpasses market expectations of $12.3 billion and is a notable contrast to the revised net investment of $14.38 billion in March.

- The yield on the Canadian 10-year government bond fell to 3.30%.

- The Canadian dollar is around $0.728 this Monday morning, similar to $0.725 a week prior.

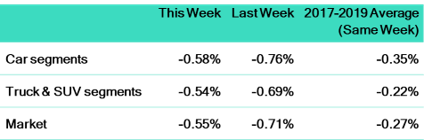

U.S. Market

The market continued to decline last week, but the rate of depreciation slowed, registering a drop of -0.55% compared to the previous week’s -0.71%. Despite the reduced depreciation, the current rate of decline exceeds pre-pandemic norms for this time of year of -0.27%.

Industry News

- The Canadian Border Services Agency and the federal government reached a tentative deal to avoid a border strike last week that could have significantly impacted vehicle supply through parts and vehicle component transportation across the border.

- On top of the tariffs imposed recently by the U.S. on chinese–made electric vehicles, the EU has now announced their own tariffs on these vehicles by as much as 38% starting next month as its configured through a by-manufacturer basis; with BYD receiving 17.4%, 20% to Geely, and the largest 38.1% to SAIC.

- Retailers for JLR in Canada are suing the automaker as the brand looks to reduce its number of retailers in its transition to an electric vehicle lineup with online retailing and a far reduced number of annual sales, as its dealers cite inadequate compensation from the automaker.

- As its all-new Macan EV and refreshed Taycan electric vehicles reach the market, Porsche has announced a partnership with EV charging network, Chargepoint, which will improve access to charging for its customers with an additional 20,000 stations as of Q4 of this year.

- Canadian ZEV market share in Q1 was 11.3% of all registered vehicles, up versus this time last year but down against the previous quarter’s 12% in Q4 2023. A growing share of PHEV’s make up this total, amounting to 27%, compared to 24.7% at the end of last year and 22.1% at the start of 2023.

- Many automakers are citing affordability as the cause of reduced interest in new cars from younger buyers, with a study conducted by J.D. Power resulting in 21% of buyers in Canada aged 35 years or younger, compared with 25% per-COVID.