06.03.2025

Market Insights – 6/3/25

Wholesale Prices, Week Ending May 31st, 2025

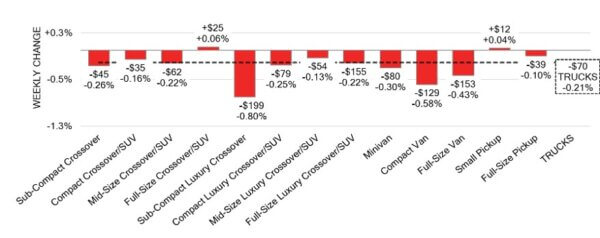

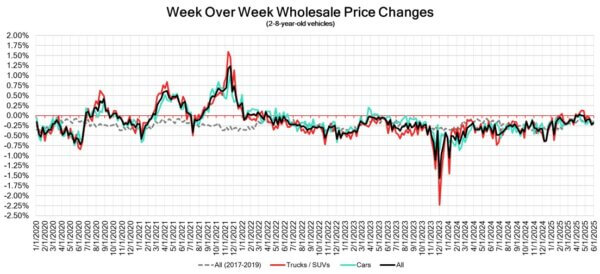

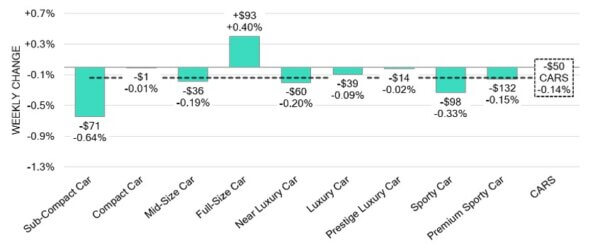

The Canadian used wholesale market saw a decline of -0.18% in pricing for the week. Car segments prices decreased by –0.14% while the Truck/SUV segments decreased by -0.21%. The largest increases were seen in Full Size Car at +0.40% and Full-Size Crossover/SUV +0.06%. The largest declines in the Car segments were seen in Sub Compact Car at -0.64% and Sporty Car with -0.33%. The largest declines in the Truck/SUV segments were Sub-Compact Luxury Crossover/SUV at -0.80% followed by Compact Van with -0.58%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.14% | -0.23% | -0.14% |

| Truck & SUV segments | -0.21% | -0.22% | -0.17% |

| Market | -0.18% | -0.23% | -0.16% |

Car Segments

- Last week there was an overall decline of –0.14% seen in car segments. This decrease was reflected in eight of the nine segments.

- Segments with the largest depreciations were Sub-Compact Car (-0.64%), Sporty Car (-0.33%), Near Luxury Car (-0.20%) and Mid-Size Car (-0.19%).

- One segment had an increase. That segment was Full-Size Car (+0.40%).

Truck / SUV Segments

- There was an overall depreciation of –0.21%seen in truck segments last week. This change was reflected in eleven of the thirteen segments.

- Segments with the largest declines were Sub-Compact Luxury Crossover (-0.80%), Compact Van (-0.58%), Full-Size Van (-0.43%) and Minivan (-0.30%).

- Two segments showed an increase, Full-Size Crossover/SUV (+0.06%) and Small Pickup (+0.04%).

Wholesale

The Canadian market experienced a slight increase in pricing, with a decline less pronounced than in its prior week. The decline in car segment values decreased by 0.09% resting at -0.14%, while the decline in truck segment prices also decreased overall by 0.01% bringing its change to -0.21%. Just under 23% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 23.5% to 69.3% averaging at 37.4%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing political variances and the gradual change in floor prices. Supply has remained high in comparison to prior weeks; however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $38,300. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s economy probably grew by 0.1% in April 2025, matching the growth

seen in March. Early estimates suggest that gains in mining, quarrying, oil and

gas extraction, as well as finance and insurance, helped boost the economy, but

these were partly balanced out by declines in manufacturing. - Canada’s government reported a budget deficit of $23.9 billion in March 2025,

which is an improvement from the $33.6 billion deficit recorded in March 2024.

This positive change was mainly due to a $5.9 billion (15.2%) increase in

revenues, largely driven by higher corporate income tax collections. - Canada’s current account deficit decreased to $2.1 billion in the first quarter of

2025, down from a revised $3.6 billion in the previous quarter and lower than the

market forecast of a $3.25 billion deficit. - The yield on the Canadian 10-year government bond increased to 3.226%.

- The Canadian dollar is around $0.730 this Monday morning, representing a slight

increase from $0.724 a week prior.

U.S. Market

- Although last week wasn’t the first time the overall market reported a decline, it marked a significant milestone as depreciation returned to a level typical for this time of year. The overall market dropped by -0.25% last week, closely aligning with the pre-pandemic seasonal average of -0.22%.

Industry News

- After a 1-day long Court of Appeals ruling that the Trump Administration issued reciprocal tariffs and levies illegally, those tariffs and levies were reinstated with a 10% baseline and up to 25% reciprocal tariff. This caused further confusion for global trade and the auto sector.

- Antonio Filosa was announced as the succeeding CEO to Carlos Tavares at Stellantis after Tavares had announced his departure from the organization back in December. Filosa will begin in his new position on June 23rd, announcing a new leadership team at that time.

- Vinfast will be closing 50% of its stores to maintain focus on future growth as North American EV outlooks shift.

- To bring more affordable vehicles to the marketplace, Honda Canada will introduce an extension to its used vehicle certification program that will back models up to 10 model years old and does not qualify a kilometer limit. Currently, their CPO program supports models no older than 5 model years, with less than 150,000km. Older vehicles added to this program will still be supported by a 6-mth/12,000km powertrain warranty.

- Jeep has revealed initial images of its redesigned next generation Cherokee crossover that will be arriving late this year. The model brings back traditional boxy styling to the nameplate as well as the brands first hybrid powertrain.

- Toyota will be bringing 7 new electric models to the North American market with at least 2 of those being built in the U.S. By the 2nd half of 2027, all 7 will reach the market and Toyota says plans are in place to export any surplus of units to other markets should sales pace continue to slow.