06.06.2023

Market Insights-6/6/23

Wholesale Prices, Week Ending June 3rd

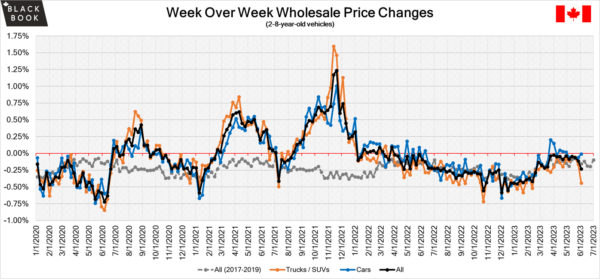

The Canadian used wholesale market saw a decline in prices for the week at -0.23%. The Car segment fell by -0.01% and the Truck/SUVs’ segment prices declined -0.44%. 6 out of 22 segments’ values have increased for the week. Compact Van leads with +1.54% and Full Size Car follows behind at +1.33%. The segments with the largest declines were Full Size Pick-up (-1.12%) and Full Size Van (-0.90%).

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.01% | -0.06% | -0.14% |

| Truck & SUV segments | -0.44% | -0.17% | -0.17% |

| Market | -0.23% | -0.12% | -0.16% |

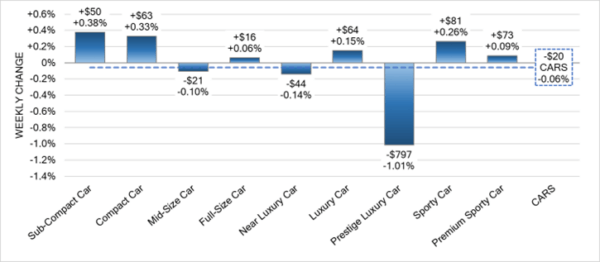

Car Segments

- There was a slight decrease of (-0.01%) in Car segment prices last week.

- Five of nine segments showed an increase in pricing. The largest increase being Full-Size Car at (+1.33%), followed by Mid-Size Cars (+0.11%) & Luxury Cars at (+0.05%).

- The segments with the largest declines in pricing were Prestige Luxury-Car at (-0.37%), followed by Compact-Car at (-0.13%) & Sub-Compact Car with (-0.04%).

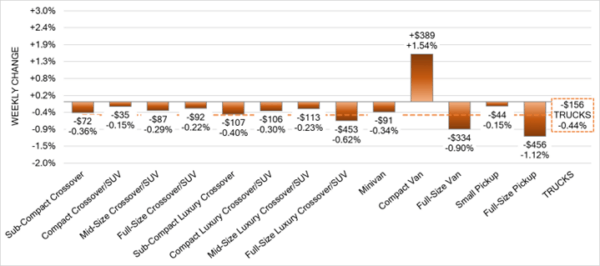

Truck Segments

- Last week, truck segments decreased on average overall by -0.44%.

- Twelve of the thirteen segments showed a decrease. Those with the largest declines were Full-Size Pickup (-1.12%), Full-Size Van (-0.90%) and Full-Size Crossover/SUV (-0.62%).

- Only one segment experienced an increase. That segment was Compact Van (+1.54%).

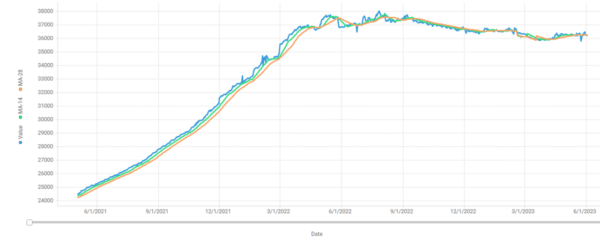

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $36,300. Analysis is based on approximately 165,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of less than $100 this week as the market continues to stabilize.

Conversion rates were quite varied. Some observed sell rates were as low as 20% but most were in the 30-40% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Canada’s current account deficit was 6.2 billion in the first quarter of 2023 which was less than market forecast of 8.85 billion and 8.1 billion in the previous quarter.

- Canadian GDP grew by 0.8% in the first quarter of 2023 which was higher than the market expectation of 0.4%.

- The Bank of Canada will announce its decision on the targe for the overnight rate on Wednesday June 7th. Markets are currently expecting a rate increase to occur.

- The Canadian dollar is around $0.744 this Monday morning up from $0.735 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.31% last week; the prior week decreased by -0.25%.

Volume-weighted Car segments decreased -0.26%, compared to the prior week’s -0.11% decrease:

- Only one of the nine Car segments declined last week.

- Sporty Car was the only segment to increase last week, up +0.38%. Last week the segment declined -0.19%.

- Sub-Compact Car had the largest decline last week, down -0.63%. This is the fifth consecutive week of declines for the segment for an average weekly decline of -0.39%.

Volume-weighted Truck segments decreased by -0.34%; the previous week decreased -0.32%:

- Only one of the thirteen Truck segments reported an increase last week.

- Full-Size Trucks increased +0.06%, after last week’s decline of -0.24%.

- Compact Luxury (-0.67%), Sub-Compact Luxury (-0.62%), and Mid-Size (-0.62%) Crossovers reported the largest declines last week.

Industry News

- As May comes to a close, we find the strongest sales month so far this year as the month fared 13% better than 1 year ago as total sales were an estimated 160,000 units – May is typically known for its particularly strong sales pace.

- Atlantic Canada’s largest dealer group, Steele Auto Group, is ending all used electric vehicle operations through its purchased used EV dealer, “All EV” which it bought less than 2 years ago – citing an overall “lack of demand”, which is something seen throughout national sales, though with strong used EV incentives for many Atlantic provinces, this comes as somewhat surprising.

- After much drama over the recent stoppage of construction in the Stellantis-LG Energy Solution battery cell plant in Windsor, the Ontario government looks to step in and keep the momentum rolling for the plant to stay, with a proposed 1/3 investment in total cost to build the plant.

- Toyota is recalling 14,000 Corolla Cross SUVs, as the company has discovered that the front passenger airbag may not deploy in the event of an accident, increasing the likelihood of an injury – the recall covers 2022-2023 models and is subject to gas-only models.

- New product arrives shortly to Canada in the form of new electric vehicles from Volkswagen with its ID.7 sedan and Polestar with its new 4, along with redesigns for the Subaru Impreza and Lincoln Nautilus.