07.02.2024

Market Insights – 7/02/2024

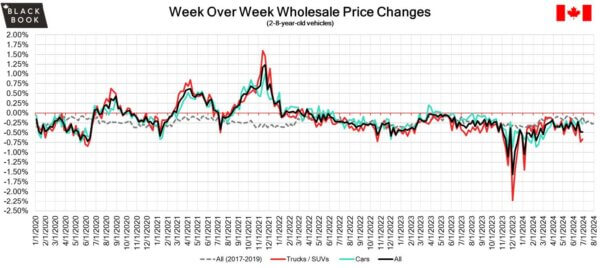

Wholesale Prices, Week Ending June 28th, 2024

The Canadian used wholesale market saw a decline in prices for the week at –0.51%. The Car segment fell by –0.28% and the Truck/SUVs segment prices declined –0.66%. The car segments with the largest declines were Sub-Compact car at –0.56% followed by Compact Car at –0.53%. The largest declines for the Truck/SUV segments were, Full-Size Van at –0.96% followed by Mid-Size Crossover/SUV at –0.95%.

| This Week | Last Week | 2017-2019 Average

(Same Week) |

|

| Car segments

|

-0.28% | -0.21% | -0.12% |

| Truck & SUV segments

|

-0.66% | -0.73% | -0.08% |

| Market | -0.48% | -0.48% | -0.10% |

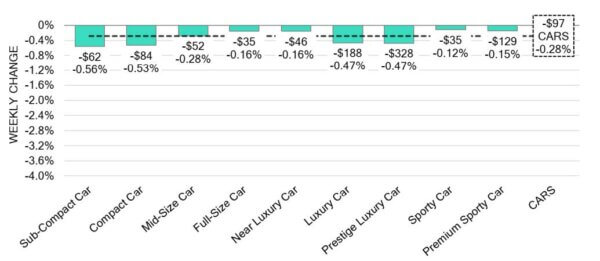

Car Segments

- Last week there was an overall decrease of -0.28% across Car segments. This decrease was noted all nine segments.

- Segments that decreased the least were Sporty Car at (-0.12%), followed by Premium Sporty Car at (-0.15%) and Full-Size Car at (-0.16%).

- The largest decreases were seen from Sub-Compact Car (-56%), Compact Car at (-0.53%) and Prestige Luxury Car at (-0.47%).

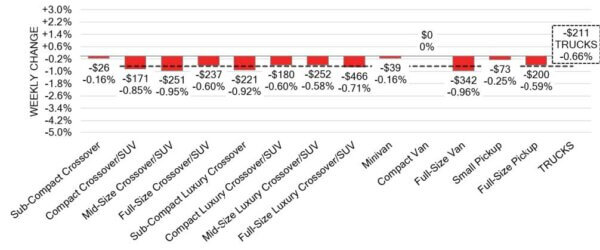

Truck / SUV Segments

- An overall depreciation of –0.66% was seen in trucks last Twelve of the thirteen segments reflected this change.

- Segments with the largest declines were Full-Size Van (-0.96%), Mid-Size Crossover/SUV (-0.95%), Sub-Compact Luxury Crossover (-0.92%) and Compact Crossover/SUV (-0.85%).

- Full-Size Crossover/SUV and Compact Luxury Crossover/SUV had the same percentage drop (-0.60%).

Wholesale

The Canadian market is continuing its decline from the previous week. Before supply appears in the wholesale market, upstream channels have been tapping in early to access them first. This has led to an increase in inventory, driven by high demand on both sides of the border for vehicles at auctions . Nearly 55% of segments saw an average value change exceeding ±$100 this week, with Truck segments experiencing a decrease 38% larger than that of the Car segments. Auction sale rates ranged from 6% to 68%. The variation in sale rates across different lanes could be attributed to the decrease in floor prices.

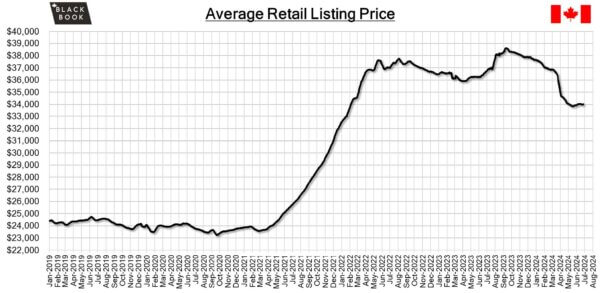

Used Retail Prices & Listing Volume

The average listing price for used vehicles was slightly down week-over-week, as the 14-day moving average was at $34,000. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The annual inflation rate in Canada increased to 2.9% in May 2024 from the three-year low of 7% the previous month, contrary to market expectations of a slowdown to 2.6%. While this rise aligns with the Bank of Canada’s forecasts of inflation remaining close to the 3% mark in the first half of the year, it has defied earlier predictions of the central bank continuing to ease monetary policy in response to the disinflation trend.

- According to the latest forecast, Canada’s GDP is projected to experience a modest 0.1% growth in May This increase is attributed to gains in sectors such as manufacturing, real estate, rental & leasing, and finance & insurance. However, this positive outlook is somewhat dampened by a decline in both retail trade and wholesale trade.

- The yield on the Canadian 10-year government bond increased slightly to 65%.

- The Canadian dollar is around $0.731 this Monday morning, similar to $0.732 a week prior.

U.S. Market

- The market depreciation rate continues to surpass pre-pandemic seasonal trends, which averaged less than a quarter percent per Currently, the rate of depreciation has consistently hovered around half a percent per week throughout most of June.

Industry News

- Porsche Cars Canada has announced a leadership change, as John Cappella will succeed Joe Lawrence as the Executive VP, COO Porsche Cars North America as he leaves the organization on his own accord.

- Production of the Honda Civic Hybrid has begun in Alliston, ON as the automaker looks to bring its least expensive electrified vehicle to market, starting at $35,305 including freight and PDI.

- A research study commissioned by Toyota Canada has found results showing over half of the roughly 1,500 Canadians surveyed see new vehicle ownership as “less financially achievable”. Regarding EV’s, 54% view $45,000 as the highest price for consideration of a battery-electric vehicle.

- VW Group and Rivian have announced that they will form a joint venture for EV software in which VW has committed to an investment of $5 Billion into Rivian by 2026 as the automaker looks to provide software-defined vehicles as quickly as possible. This news comes as VW has already been actively developing its own EV brand, Scout, that could be viewed as a direct competitor to Rivian’s current vehicle lineup.

- CDK’s recent cyberattack has the potential to impact vehicle sales for the month of June, with expected impacts estimated to be as much as 100,000 vehicles sales in the S. and possibly impacting Canadian sales as well, although no forecast has been shared.