07.09.2024

Market Insights – 7/09/2024

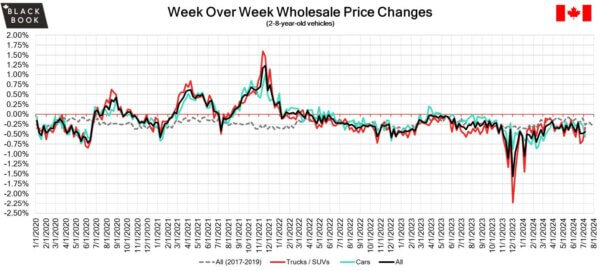

Wholesale Prices, Week Ending July 6th, 2024

The Canadian used wholesale market saw a decline in prices for the week at –0.47%. The Car segment fell by –0.57% and the Truck/SUVs segment prices declined –0.33%. Compact Crossover/SUV was the only segment to appreciate at +0.07. The car segments with the largest declines were Prestige Luxury car at –1.47% followed by Sub-Compact Car at –1.18%. The largest declines for the Truck/SUV segments were, Full-Size Van at –0.88% followed by Full-Size Luxury Crossover/SUV at –0.56%.

| This Week | Last Week | 2017-2019 Average

(Same Week) |

|

| Car segments | -0.57% | -0.28% | -0.25% |

| Truck & SUV segments | -0.33% | -0.66% | -0.29% |

| Market | -0.44% | -0.48% | -0.27% |

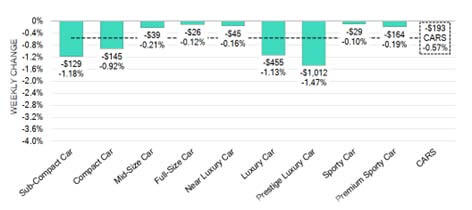

Car Segments

- Last week there was an overall decrease of -0.57% across Car segments. This decrease was noted all nine segments.

- Segments that decreased the least were Sporty Car at (-0.10%), followed by Full-Size Car at (-0.12%) and Near Luxury Car at (-0.16%).

- The largest decreases were seen from Prestige Luxury Car (-47%), Sub-Compact Car at (-1.18%) and Luxury Car at (-1.13%).

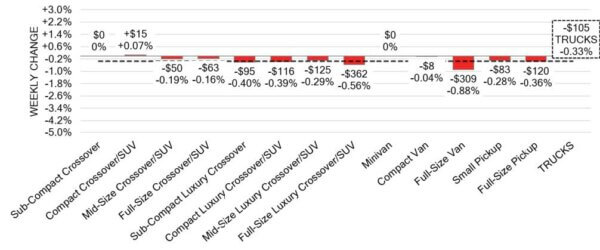

Truck / SUV Segments

- There was an overall depreciation of –0.33% seen in truck pricing last week. Ten of the thirteen segments reflected this change.

- Segments with the largest declines were Full-Size Van (-0.88%), Full-Size Luxury Crossover/SUV (-0.56%), Sub-Compact Luxury Crossover (-0.40%) and Compact Luxury Crossover/SUV (-0.39%).

- Compact Crossover/SUV was the only segment to show an increase with (+0.07%).

Wholesale

A decline was noted in the Canadian market last week. Less than 55% of market segments observed an average value change exceeding ±$100 this week. Among these segments, Car segments saw a decrease 24% larger than that observed in Truck segments. Monitored auction sale rates ranged from 11% to 69%. The variation in sale rates across different lanes could be attributed to the decrease in floor prices. As more supply appears in the wholesale market, upstream channels have been tapping in early to gain first access. This has led to an increase in inventory, driven by high demand on both sides of the border for vehicles at auctions.

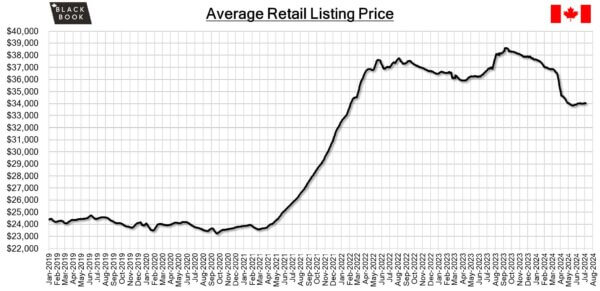

Used Retail Prices & Listing Volume

The average listing price for used vehicles is stable, as the 14-day moving average was at $34,000. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The annual inflation rate in Canada increased to 2.9% in May 2024 from the three-year low of 7% the previous month, contrary to market expectations of a slowdown to 2.6%. While this rise aligns with the Bank of Canada’s forecasts of inflation remaining close to the 3% mark in the first half of the year, it has defied earlier predictions of the central bank continuing to ease monetary policy in response to the disinflation trend.

- According to the latest forecast, Canada’s GDP is projected to experience a modest 0.1% growth in May This increase is attributed to gains in sectors such as manufacturing, real estate, rental & leasing, and finance & insurance. However, this positive outlook is somewhat dampened by a decline in both retail trade and wholesale trade.

- The yield on the Canadian 10-year government bond fell slightly to 3.64%.

- The Canadian dollar is around $0.733 this Monday morning, similar to $0.731 a week prior.

U.S. Market

- June’s depreciation trend continued into July, with the overall market declining by -0.47%, consistent with the previous week’s decline of -0.51%. Last week, the auctions at the end of the week were slower than normal due the July 4th holiday, but the overall average conversion rate continues to be in the high 50-percent range.

Industry News

- June sales figures for Canada are in and estimates from Desrosiers Automotive Consultants show 169,000 units were sold, which is roughly what they were last year. As June has been subject to the CDK Global outage severely affecting U.S. dealers but also some in Canada has led the numbers to likely be more. With total sales of 924,000 for the first half of 2024, Canadian sales are still up 10.4% vs. 2023.

- iZEV rebates topped 20,000 for the first time in 2024 for the month of May as monthly rebate claims near the record set last Fall. Quebec leads all provinces with 56% of claims while Ontario and B.C. accounted for 20% and 17%, respectively. Newcomers from Fiat and Honda received their first-ever rebates for the 500e and Prologue models while Tesla continues its dominance with Model 3 & Y sales.

- Nissan and Honda could be the next automaker partnership on vehicle software development and EV charging infrastructure as the two Japanese carmakers are working together in each region they operate, to improve economies of scale and reduce costs associated with vehicle development.

- Black Book Co-Founder and former President, Eugene McDonald, died on July 1st at 96 years old. “Gene was an exceptional leader whose groundbreaking work in co-founding National Auto Research, which became Black Book, transformed the automotive industry,” said Hearst President and CEO Steven R. Swartz.

- Canada’s Used Car Week was held last week at the Westin Harbour Castle in Toronto to record registrations as the conference highlights topics surrounding today’s Dealership challenges and opportunities.