07.01.2025

Market Insights – 7/1/25

Wholesale Prices, Week Ending June 28th, 2025

The Canadian used wholesale market saw a decline of -0.32% in pricing for the week. Car segments prices decreased by –0.32% while the Truck/SUV segments decreased by -0.32%. The only positive segments have been Minivan at +0.26% and Sub Compact Luxury Crossover/SUV at +0.11%. The largest declines in the Car segments were seen in Sub-Compact Car at -0.69% and Sporty Car with -0.63%. The largest declines in the Truck/SUV segments were Full-Size Luxury Crossover/SUV at -1.20% followed by Full-Size Crossover/SUV with -0.69%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.32% | -0.06% | -0.12% |

| Truck & SUV segments | -0.32% | -0.29% | -0.08% |

| Market | -0.32% | -0.19% | -0.10% |

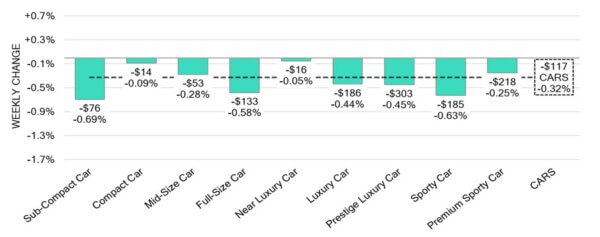

Car Segments

- Car segments returned an overall depreciation last week by an average of 0.32%. All nine tracked categories reflected this trend.

- Segments with the most notable declines were seen in Sub-Compact Car (-0.69%), Sporty Car (-0.63%) Full-Size Car (-0.58%).

- Those with the least amount of depreciation were Near Luxury Car (-0.05%) and Compact Car (-0.09%).

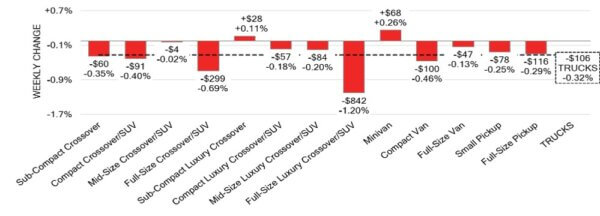

Truck / SUV Segments

- Truck segments experienced an average depreciation of-0.32% last week, with eleven out of thirteen categories echoing a decline.

- Truck categories with the most notable drop in values were Full-Size Luxury Crossover/SUV (-1.20%), Full-Size Crossover/SUV (-0.69%) and Compact Van (-0.46%).

- Two segments contradicted the trend showing an increase in values. Minivan (+0.26%) and Sub-Compact Luxury Crossover (+0.11).

Wholesale

The Canadian market’s decrease in pricing continues with a decline more pronounced than in its previous week. The decline in car segment values increased by 0.26% resting at -0.32%, while the decline in truck segment prices also increased overall by 0.03% bringing its change to -0.32%. Just under 41% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 18.7% to 72.4% averaging at 35.8%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing political variances and the gradual change in floor prices. Supply has remained high in comparison to prior weeks; however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,500. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The annual inflation rate in Canada stood at 1.7% in May 2025, the same as the

previous month, matching what markets had anticipated. - Canada’s manufacturing sales are projected to decrease by 1.3% in May 2025

compared to the previous month, after experiencing a 2.8% decline in April. - Canada has decided to drop its planned Digital Services Tax (DST), which would

have applied retroactively from 2022, in an effort to restart trade negotiations with

the United States. - Advance estimates show that Canada’s GDP slipped by 0.1% in May 2025

compared to the previous month. - The yield on the Canadian 10-year government bond decreased to 3.26%.

- The Canadian dollar is around $0.734 this Monday morning, up slightly from

$0.731 a week prior.

U.S. Market

- The market continues searching for a new “normal,” with Truck and SUV depreciation holding steady compared to the previous week. In contrast, Car depreciation has accelerated beyond typical seasonal patterns. Additionally, Tesla depreciation remains under close observation, as the manufacturer has experienced significant fluctuations in wholesale values over the past few months.

Industry News

- Online Used car retailer Clutch has just opened its first brick and mortar store at Markville Mall in Markham, ON. By adding this type of location, it offers a “physical touchpoint” to help close the gap between traditional in-person service and its fully online experience.

- President Trump has said he will be ending all trade discussions with Canada after a move to implement a digital services tax. The tax was considered “egregious” and Trump’s Administration is planning to impose a new tariff rate on Canada within the next week. Canada has since rescinded this tax in effort to continue trade talks with the U.S.

- The 2026 Cadillac Optiq will be GM’s first EV equipped with the NACS connector standard. Also available in 2026MY will be the addition of a rear-wheel-drive variant along with the V-Series performance trim.

- Nissan has introduced a Nismo version of the Armada full-size, body-on-frame SUV that the brand recently launched. The Nismo trim provides a sporty look and feel as well as added performance from its twin-turbo V6 engine which will add 35hp for a total of 460hp.

- Kia has released its EV4 electric sedan as a Tesla Model 3 fighter, with 400-volt architecture and as much as 330 miles of range from an available 81.4kWh battery pack. It’s expected to go on sale early in 2026.

- Ford will be adding the Tremor treatment to its Mid-size Explorer Crossover in 2026MY. It adds offroad features like higher ground clearance and aggressive tires with both 2.3 litre 4-cylinder and 3.0 V6 engines.