07.11.2023

Market Insights- 7/11/2023

Wholesale Prices, Week Ending July 8th

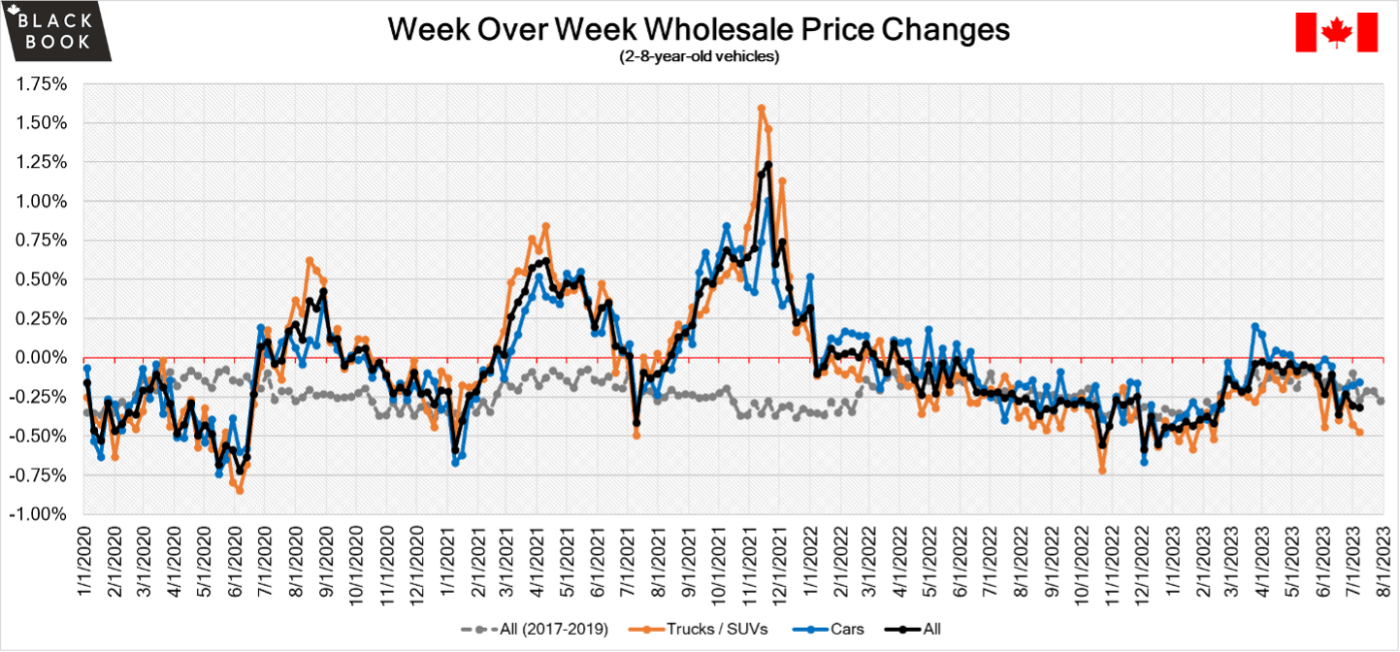

The Canadian used wholesale market saw a decline in prices for the week at -0.32%. The Car segment fell by -0.15% and the Truck/SUVs’ segment prices declined -0.47%. 1 out of 22 segments’ values have increased for the week. The Full-Size car segment was up 0.27%. The segments with the largest declines were Full-Size Luxury Crossover/SUV (-1.27%) followed by Compact Van (-0.98%).

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.15% | -0.18% | -0.25% |

| Truck & SUV segments | -0.47% | -0.43% | -0.29% |

| Market | -0.32% | -0.31% | -0.27% |

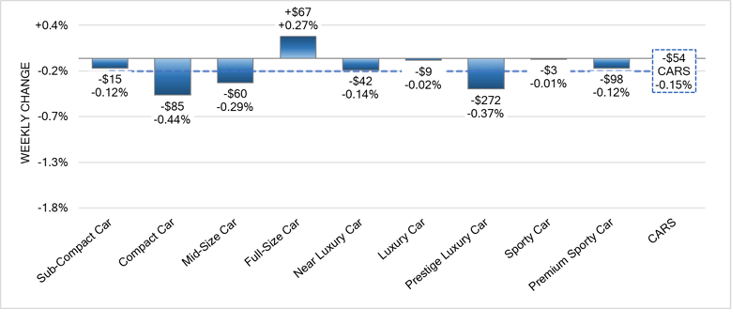

Car Segments

- Last week there was an overall decrease of -0.15% seen in Car segments.

- There was only one segment that showed an increase in pricing; Full-Size Car (+0.27%).

- The segments with the largest decrease in pricing were Compact Car at a (-0.44%) decrease, followed by Prestige Luxury at (-0.37%) and Mid-Size Car (-0.29%).

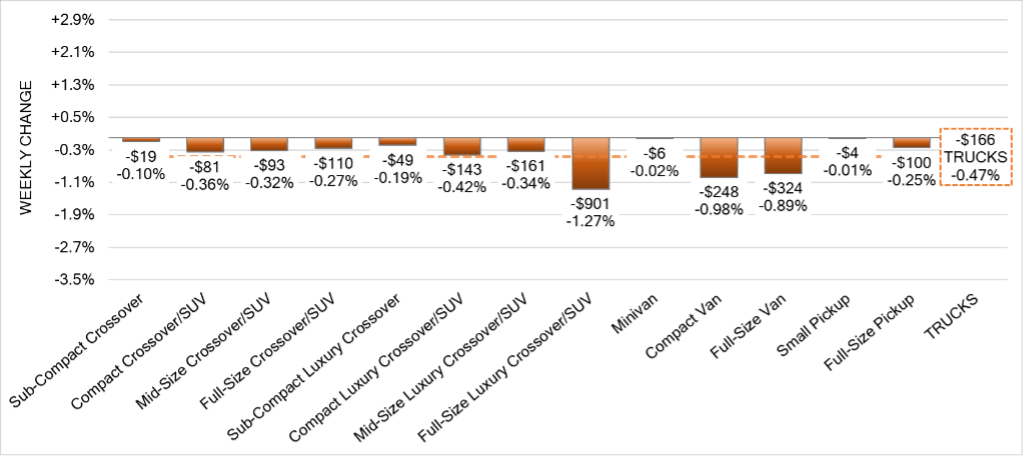

Truck Segments

- Last week overall truck segments decreased on average by -0.47%.

- All thirteen truck segments had decreases. Full-Size Luxury Crossover/SUV had the most significant decline (-1.27%), followed by Compact Van (-0.98%) and Full-Size Van (-0.89%).

- Other segments with notable declines were Compact Luxury Crossover/SUV (-0.42%), Compact Crossover/SUV (-0.36%) and Mid-Size Luxury Crossover/SUV (-0.34%).

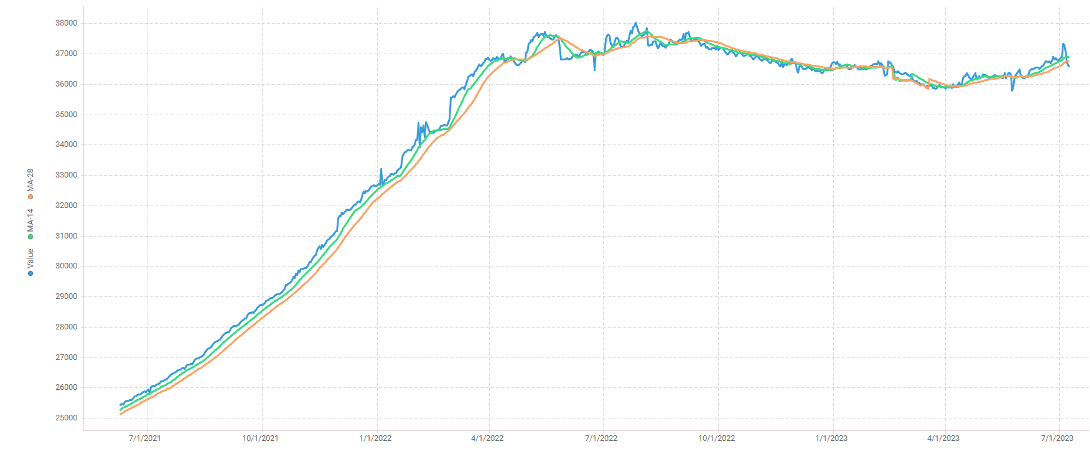

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $36,900. Analysis is based on approximately 184,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 10% but most were in the 35-55% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The unemployment rate in Canada rose to 5.4% in June of 2023 from 5.2% in the previous month, the highest since February of 2022 and slightly above market estimates of 5.3%.

- The S&P Global Canada Manufacturing PMI fell to 48.8 in June of 2023 from 49 in the previous month, marking the third month of contraction since the start of the year and as high borrowing costs continue to hamper economic activity.

- Canada posted a trade deficit of 3.44 billion in May of 2023, while the previous month had a 09 billion surplus.

- The Canadian dollar is around $0.755 this Monday morning down from $0.760 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.47% last week; the prior week decreased by -0.44%.

Volume-weighted Car segments decreased -0.52%, compared to the prior week’s -0.42% decrease:

- The other age units we track had smaller depreciation last week, with the 0-to-2-year-old down -0.35% and 8-to-16-year-old Cars declining -0.48%.

- All nine Car segments decreased last week.

- Sub-Compact Car had the largest decline last week, down -1.11%. This marks the tenth consecutive week of declines for the segment, with an average weekly depreciation of -0.58%.

- Sporty Car had a second consecutive week of declines, down -0.18% after the prior week’s drop of -0.16%.

- Near Luxury Car declined -0.74%, the largest single week decline for the segment since the middle of January.

Volume-weighted Truck segments decreased by -0.45%; the previous week decreased -0.45%:

- The 0-to-2-year-old Truck segments reported a smaller decline last week (-0.35%), as did the 8-to-16-year-olds that declined -0.35%.

- All thirteen Truck segments reported a decrease last week.

- The Sub-Compact Luxury Crossovers had the largest Truck segment decline last week, down -0.95%. This is the largest single week drop for the segment since the last week of January.

- Minivan declined -0.87%, the largest depreciation since late December 2022 when the segment declined -1.12%.

- Full-Size Vans continue to decline, but the rate of decline is lessening, it was only -0.10% last week.

Industry News

- Canadian Black Book has named Yolanda Biswah its new President – Biswah previously held the position of Senior Vice President and General Manager of Canadian Black Book and has been with the company since 2015.

- Ending the first half of 2023, Canadian new vehicle sales are up 7.6% vs. last year as June concluded 12.6% up compared to a year ago, marking strong gains over 2022 but heavily lagging against pre-pandemic numbers as the new inventory environment improves.

- After a lengthy stand-off between the Canadian government and Stellantis, construction has resumed at the site of the battery cell factory with all parties moving forward with additional financial support from the Ontario government to provide roughly 1/3 of the entire financial package that’s being coined as a “historic” intergovernmental deal to counter the U.S. Inflation Reduction Act.

- Mercedes-Benz announced an all-new 2-door model, the CLE-Class to pare down on the C and E-Class Coupe and Convertibles into one sleek and sporty nameplate that will go on sale in 2024.

- As the B.C. port workers’ strike reaches its 10th day, the disruption to supply chains for many industries has been affected and the overall cost so far on affected cargo is estimated to be $7 billion, including countless deliverable vehicles being held in limbo waiting for this issue to resolve.