07.15.2025

Market Insights – 7/15/25

Wholesale Prices, Week Ending July 12th, 2025

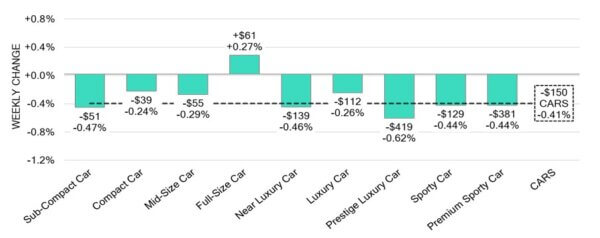

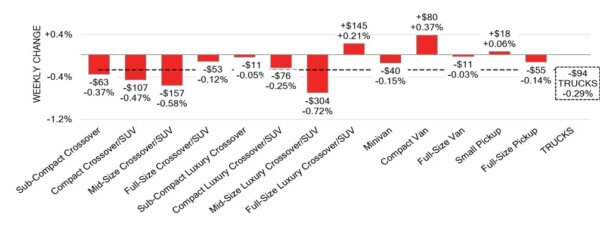

The Canadian used wholesale market saw a decline of -0.35% in pricing for the week. Car segments prices decreased by –0.41% while the Truck/SUV segments decreased by -0.29%. This Weeks positive segments have been Compact Van at +0.37% and Full-Size Car at +0.27%. The largest declines in the Car segments were seen in Prestige Luxury Car at -0.62% and Near Luxury Car with -0.46%. The largest declines in the Truck/SUV segments were Mid-Size Luxury Crossover/SUV at -0.72% followed by Mid-Size Crossover/SUV with -0.58%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.41% | -0.04% | -0.23% |

| Truck & SUV segments | -0.29% | -0.20% | -0.19% |

| Market | -0.35% | -0.13% | -0.21% |

Car Segments

- Car segments revealed an overall depreciation of -0.41% last week. Eight of the nine tracked categories echoed this movement.

- Segments with the steepest declines were Prestige Luxury Car (-0.62%), followed by Sub-Compact Car (-0.47%) and Near Luxury Car (-0.46%).

- One segment showed an increase. That segment was Full-Size Car (+0.27%).

Truck / SUV Segments

- Truck segments returned an overall weakening of-0.29% last week. Ten of the thirteen categories reflected this movement.

- Segments that dropped the greatest were Mid-Size Luxury Crossover/SUV (-0.72%) followed by Mid-Size Crossover/SUV (-0.58%) and Compact Crossover/SUV (-0.47%).

- Three segments bucked the trend with an uptick in values. Compact Van (+0.37%), Full-Size Luxury Crossover/SUV (+0.21) and Small Pickup (+0.06%).

Wholesale

The Canadian market’s decline in pricing continues with a decline more pronounced than in its previous week. The decline in car segment values increased by 0.37% resting at -0.41%. The decline in truck segment prices also increased, this time by 0.09% bringing its change to -0.29%. Just over 40% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 17% to 77.9% averaging at 33.3%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing political variances and the gradual change in floor prices. Supply has remained high in comparison to prior weeks; however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,500. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s unemployment rate dropped to 6.9% in June 2025, down from 7% the

month before, which had been the highest in nearly four years. This decrease

was unexpected, as many had predicted the rate would rise to 7.1%. - Canada’s Ivey Purchasing Managers Index increased to 53.3 in June 2025, up

from 48.9 in May and surpassing market expectations of 49.1. This signals

economic growth for the first time in three months. - In May 2025, the total value of building permits in Canada increased by 12.0%

over the previous month, reaching $13.1 billion. This follows a revised decline of

6.8% in April and significantly outperformed market forecasts, which had

expected a 0.8% decrease. - The yield on the Canadian 10-year government bond increased to 3.49%.

- The Canadian dollar is around $0.730 this Monday morning, down slightly from

$0.733 a week prior.

U.S. Market

- Depreciation picked up speed last week following the July 4th holiday, though activity at auctions remained strong. Nationwide conversion rates are holding steady in the high 50% range, as sellers set realistic floor prices, allowing engaged bidders to secure competitively priced inventory. Notably, newer used Full-Size Pickups warrant attention, as incentives on new models are impacting 0 to 2-year-old units in the market.

Industry News

- The Trump Administration has threatened another increase in tariffs on imported goods from Canada now as it decides on multiple trade policy changes globally. This new set of tariffs is planned to be a 35% duty to go into effect on August 1st, if Canada cannot provide a plan to further reduce the flow of Fentanyl across the U.S. border.

- After Quebecallowed Hybrids tocomply with its provincial ZEV mandate, Ontario mayors are lobbyingthe Canadian Government to do the sameasthe industry nears its first mandate checkpoint of 20% in 2026.

- After Dealerswere shortediZEV rebatereimbursements for eligible vehicles they soldas thefederal rebate was surprisingly ended back in January, the Government hasreleased plans onpaying thatmoney back to those Dealerswho were left on the hook, to the amount of roughly $11 million.

- Canadian Tesla registrations have fallen67% in the first half of 2025 compared tolast year as the EV brandhas beensouring its reputation in the industry over political views, public scrutiny and increased price volatility, burning both dealers and consumers alike in the buying and selling of new and used Tesla models.

- AutoCanada’s CEO, Paul Antony is stepping down from his leading position that he has held since 2018. The Dealer Group operates 64 new vehicle stores in Canada and 18 more in the U.S.

- EBlock is expanding its number of auctions by opening new facilities in Halifax, NS and Edmonton, AB. These will operate alongside its Montreal facility as the market in Canada for used vehicles continues to grow.