07.18.2023

Market Insights- 7/18/2023

Wholesale Prices, Week Ending July 15th

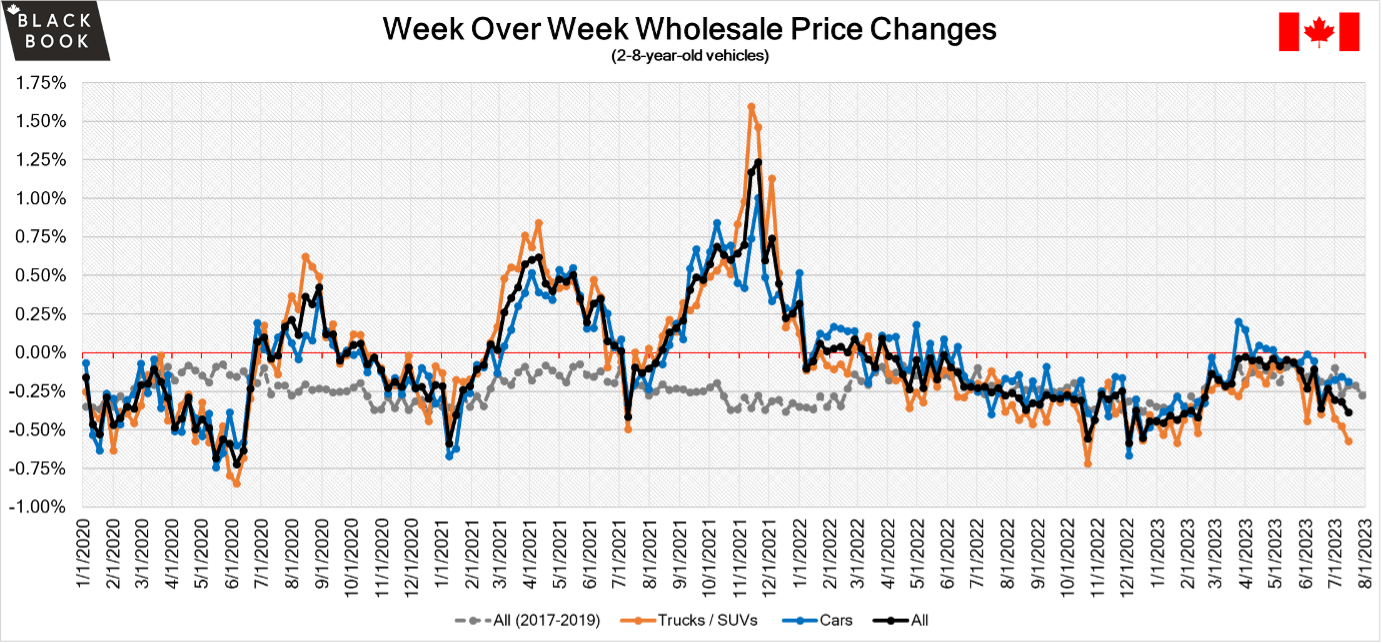

The Canadian used wholesale market saw a decline in prices for the week at -0.38%. The Car segment fell by -0.19% and the Truck/SUVs’ segment prices declined -0.57%. 2 out of 22 segments’ values have increased for the week. The Small Pickup segment was up 0.15% followed by the Mid-Size Car segment at +0.11%. The segments with the largest declines were Full-Size Luxury Crossover/SUV (-1.51%) followed by Compact Van (-1.10%).

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.19% | -0.15% | -0.23% |

| Truck & SUV segments | -0.57% | -0.47% | -0.19% |

| Market | -0.38% | -0.32% | -0.21% |

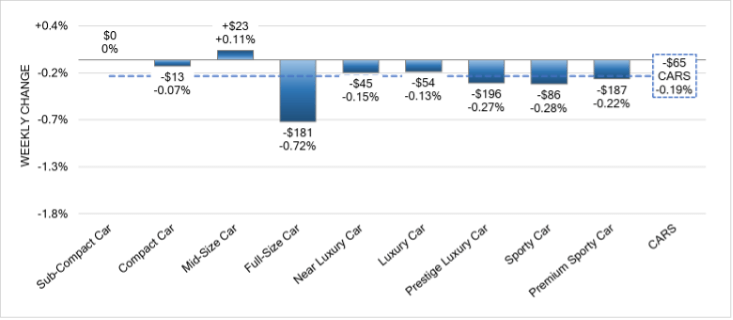

Car Segments

- There was an overall decrease of -0.19% seen in the Car segments last week.

- Seven of the nine segments showed a decrease in pricing. The segments with the largest decrease were Full-Size Car at (-0.72%), followed by Sporty Car at (-0.28%) and Prestige Luxury Car with (-0.27%).

- There was only one segment that showed an increase in pricing; Mid-Size Car at (+0.11%) and Sub-Compact Car (0%) rests at no change for the week.

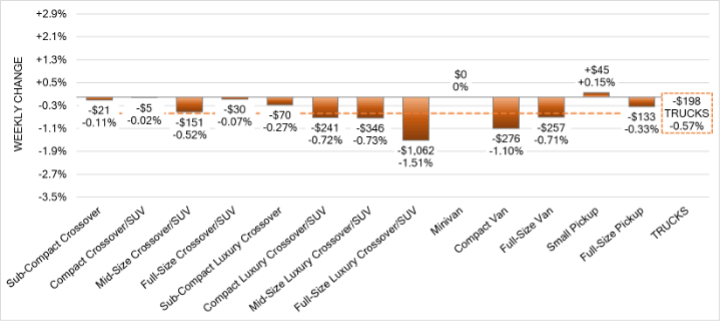

Truck Segments

- Last week overall truck segments decreased on average by -0.57%.

- Twelve of the thirteen truck segments had decreases. Full-Size Luxury Crossover/SUV had the most significant decline (-1.51%), followed by Compact Van (-1.10%).

- Mid-Size Luxury Crossover/SUV (-0.73%), Compact Luxury Crossover/SUV (-0.72%) and Full-Size Van (-0.71%) also had sizable depreciations.

- Small Pickup (+0.15%) was the only segment with a slight increase.

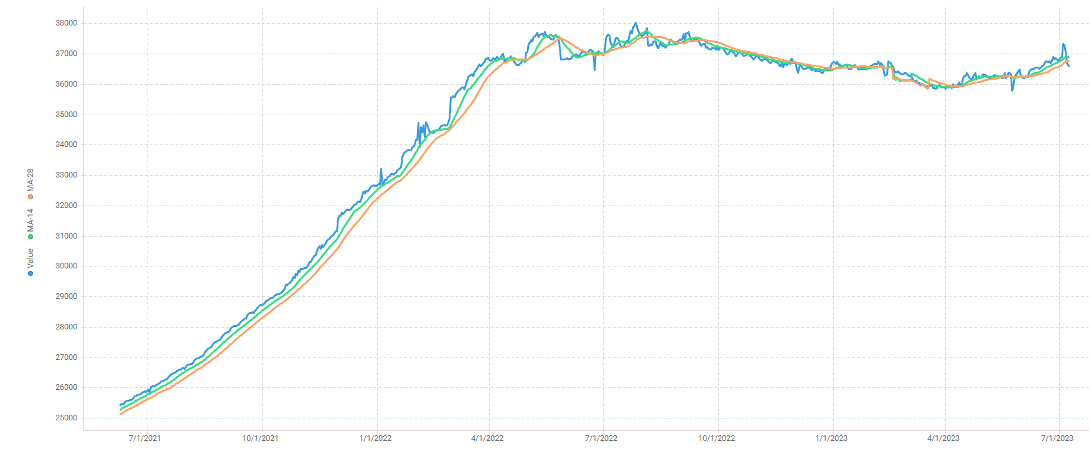

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $37,000. Analysis is based on approximately 184,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was larger than the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 9% but most were in the 35-55% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

• The Bank of Canada raised the target for its overnight rate by 25bps to 5% in July 2023, as expected by markets, backing the surprise 25bps rate hike from the previous meeting and extending its tightening cycle after the brief pause in March and April.

• The yield on the Canadian 10-year government bond dipped below the 3.5% threshold once again as interest rates in Canada increase.

• The total monthly value of building permits in Canada increased 10.5% in May to $10.5 billion.

• The Canadian dollar is around $0.756 this Monday morning up from $0.753 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.73% last week; the prior week decreased by -0.47%.

Volume-weighted Car segments decreased -0.73%, compared to the prior week’s -0.52% decrease:

- The 0-to-2-year-old Car segments were also down, but only by -0.53%; 8-to-16-year-old Cars declined -0.63%.

- All nine Car segments decreased last week.

- The Luxury Car (-1.10%) segment was the only segment with a decline greater than 1%. This was the largest single week drop for the segment since the last week of 2022.

- Sporty Car reported the smallest level of decline last week, down -0.40%, but it was still the largest depreciation for the segment since the week of New Years.

Volume-weighted Truck segments decreased by -0.70%; the previous week decreased -0.45%:

- The 0-to-2-year-old Truck segments reported a smaller decline last week (-0.49%), as did the 8-to-16-year-olds that declined -0.52%.

- All thirteen Truck segments reported a decrease last week.

- Mid-Size and Compact Luxury Crossovers reported the largest Truck segment declines last week, down -1.12% and -1.34%, respectively.

- Small Pickups increased the rate of depreciation substantially last week, down -0.99%, compared with -0.45% the week prior.

Industry News

- After almost 2 weeks the port workers in B.C. are back to work as the strike which affected 30 ports in the province including the largest, Port of Vancouver is over – as of July 12th there were 63,000 shipping containers stuck on vessels by the ports of B.C. waiting to be unloaded.

- Leasing vehicles in Canada has taken a large step back, as the factors involved with vehicle affordability have fundamentally changed as well as the impact of the pandemic on vehicle ownership where now cash transactions have taken over much of lease’s market penetration, which now stands around 20% today.

- The Ontario Digital Dealership Registration (DDR) system previously only allowed new cars to be registered online, but now they have expanded the service to used vehicles for the first time. This had been a longstanding issue with the Motor Vehicle Retailers of Ontario (MVRO) as it kept dealers from entering the digital age.

- S & P Global Mobility says the semiconductor chip crisis that plagued 2021 and 2022 seems to be fading, as now production setbacks related to the issue only amounted to 524,000 vehicles in the first half of 2023; much lower volume than the 9.5 million in 2021 and 3 million in 2022.

- The F-150 Lightning electric Pickup from Ford will see its price slashed by as much as $15,000; taking advantage of increased plant capacity, continued work on scaling production and cost, and improving battery raw material costs. All this comes at a time when Tesla is starting up production of the long anticipated Cybertruck.