07.23.2025

Market Insights – 7/22/25

Wholesale Prices, Week Ending July 19th, 2025

The Canadian used wholesale market saw a decline of -0.32% in pricing for the week. Car segments prices decreased by –0.21% while the Truck/SUV segments decreased by -0.42%. This Weeks positive segments have been Compact Van at +0.16% and Full-Size Crossover/ SUV at +0.02%. The largest declines in the Car segments were seen in Full-Size Car at -0.46% and Prestige Luxury Car with -0.31%. The largest declines in the Truck/SUV segments were Minivan at -1.06% followed by Mid-Size Crossover/SUV with -0.75%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.21% | -0.41% | -0.21% |

| Truck & SUV segments | -0.42% | -0.29% | -0.21% |

| Market | -0.32% | -0.35% | -0.21% |

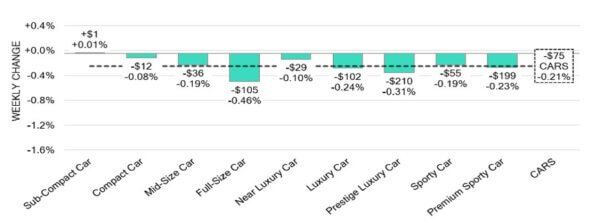

Car Segments

- Car segments revealed an overall depreciation of -0.21% last week. Eight of the nine reporting categories reflected a downward direction.

- Those with the most notable declines were Full-Size Car (-0.46%), followed by Prestige Luxury Car (-0.31%), Luxury Car (-0.24%) and Premium Sporty Car (-0.23%).

- One segment experienced a slight increase. That segment was Sub-Compact Car (+0.01%).

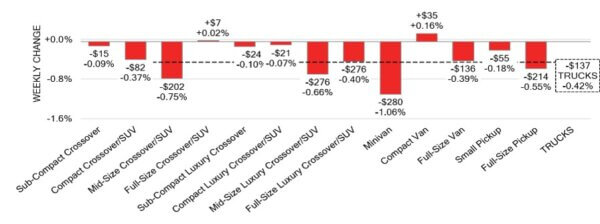

Truck / SUV Segments

- Truck segments returned an overall softening of-0.42% last week. Eleven of the thirteen categories showed this movement.

- The largest depreciations were seen in Minivan (-1.06%), followed by Mid-Size Crossover/SUV (-0.75%), Mid-Size Luxury Crossover/SUV (-0.66%) and Full-Size Pickup (-0.55%).

- Two segments bucked the trend with a slight increase in values. Compact Van (+0.16%) and Full-Size Crossover/SUV (+0.02).

Wholesale

The Canadian market’s decline in pricing continues with a decline less pronounced than in its previous week. The decline in car segment values decreased by 0.20% resting at -0.21%. The decline in truck segment prices increased, this time by 0.13% bringing its change to -0.42%. Just over 31% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 22% to 49% averaging at 35.5%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing political variances and the gradual change in floor prices. Supply has remained high in comparison to prior weeks; however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,600. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s annual inflation rate increased to 1.9% in June 2025, up from 1.7% the

month before, which was in line with what markets had anticipated. - Canada’s manufacturing sales fell by 0.9% to $68.7 billion in May 2025, marking

their lowest point since January 2022. However, the decline was less than the

expected decrease of 1.3%. - Canada has announced new steps to help its steel industry in response to 50%

tariffs imposed by the U.S. These measures include setting limits on steel imports

from countries other than the U.S. and Mexico. If those limits are exceeded,

heavy duties will be applied. - The yield on the Canadian 10-year government bond decreased to 3.48%.

- The Canadian dollar is around $0.731 this Monday morning, up slightly from

$0.730 a week prior.

U.S. Market

- Depreciation continues to outpace typical seasonal trends; however, the market remains significantly stronger than it was in 2024. At this time last year, cumulative 12-month depreciation stood at 23.6%, compared to just 9.6% this year.

Industry News

- Tariffs have showed signs of impact in U.S. vehicle production for Canada, with market share in Q2 declining against Q1 results. At 41% share in Q1, U.S. built vehicle decreased to 39% in Q2 with expectations that this trend continues further into 2025.

- ZEV sales results from May show gentle recovery in Plug-in and EV sales. Though down roughly 32% YoY, May ZEV sales contributed 7.9% to total sales, which has grown from 6.5% in March after iZEV rebates were cancelled in early January.

- Signal Technologies, a Canadian tech company that supports the export process for dealers has reported that about 350,000 used vehicles are still being exported into the U.S. Currently it is lighter than previous years, but nets dealers roughly $2,000 more per vehicle in doing so.

- Stats Canada has reported June’s inflation numbers up to 1.9% from 1.7% in May, citing that passenger vehicles prices are a contributing factor to the uptick in consumer spending. Used cars were part of the increase for the first time in 18 months.

- Subaru has released its next EV, a subcompact crossover named Uncharted. The model is another shared platform project with Toyota, joining the brands upcoming next generation C-HR EV. Toyota and Subaru have jointly created their first EV as well as a low-cost sports car in recent years.

- A Ford Bronco Sport-looking model from the brand has been launched in China, called the Bronco New Energy that markets both an EV and long-range Plug-in Hybrid. The Plug-in, with a 44kWh battery, can drive up to 218kms on electric power alone on the European WLTP range metric.