07.22.2024

Market Insights – 7/24/2024

Wholesale Prices, Week Ending July 23nd, 2024

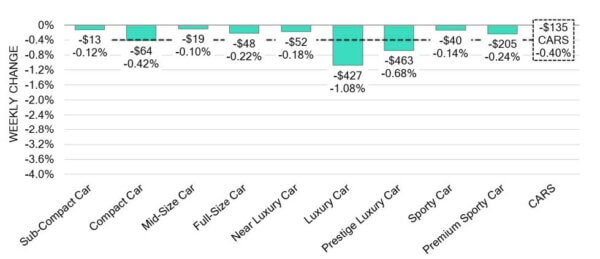

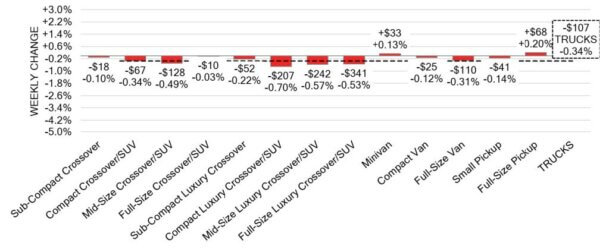

The Canadian used wholesale market saw a decline in prices for the week at –0.37%. The Car segment fell by –0.40% and the Truck/SUVs segment prices declined –0.34%. The Segments with positive changes this week were Full Size Pickup with +0.20 and Minivan with +0.13. Car segments with the largest declines were Luxury Car at –1.08% followed by Prestige Luxury Car at –0.69%.The largest declines for the Truck/SUV segments were, Compact Luxury Crossover/SUV at –0.70% followed by Mid-Size Luxury Crossover/SUV at –0.57%.

| This Week | Last Week | 2017-2019 Average

(Same Week) |

|

| Car segments

|

-0.40% | -0.31% | -0.21% |

| Truck & SUV segments

|

-0.34% | -0.49% | -0.21% |

| Market | -0.37% | -0.41% | -0.21% |

Car Segments

- Last week there was an overall decrease of -0.31% across Car segments. This decrease was noted across eight out of nine segments.

- The Premium Sporty Car segment showed no change, with Prestige Luxury car (-0.05%) and Sub-Compact Car (-0.17%) showing the smallest

- The largest decreases were seen from Near Luxury Car (-0.77%%), Sporty Car at (-0.63%) and Compact Car at (-0.46%).

Truck / SUV Segments

- There was an overall decline of –0.34% in wholesale truck pricing last week. Eleven of the thirteen segments showed a decrease.

- Those with the largest depreciations were Compact Luxury Crossover/SUV (-0.70%), Mid-Size Luxury Crossover/SUV (-0.57%) and Full-Size Luxury Crossover/SUV (-0.53%).

- Two segments had slight Those were Full-Size Pickup (+0.20%) and Minivan (+0.13%).

Wholesale

The Canadian market is experiencing a decline very similar to that of the previous week. Just over 30% of market segments saw an average value change greater than ±$100, showing a slight decrease compared to the previous week. Among these segments, Car segments saw a decrease 6% larger than that observed in the Truck segments. Monitored auction sale rates ranged from 28% to 68%. The variation in sale rates across different lanes could be attributed to the decrease in floor prices. As more supply appears in the wholesale market, upstream channels continue to gain early access. This has led to an increase in inventory, driven by high demand on both sides of the border for vehicles at auctions.

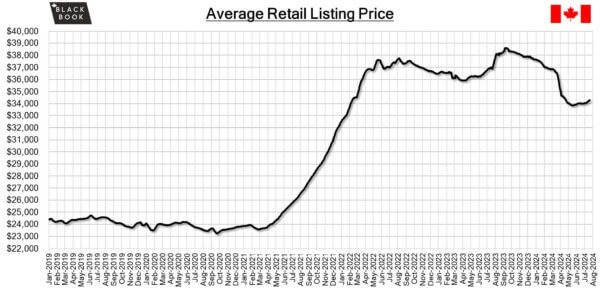

Used Retail Prices & Listing Volume

The average listing price for used vehicles is stable, as the 14-day moving average was at $34,200. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In June of 2024, the annual inflation rate in Canada decreased to 7% from 2.9% in the previous month, defying market predictions of it staying at 2.9% and matching the three-year low from April, signaling a continuation of the disinflation trend in Canadian consumer prices.

- Foreign investors raised their stake in Canadian securities by a net $20.89 billion in May 2024, marking the third consecutive month of investment This was in contrast to a revised net investment of $41.05 billion in April.

- The yield on the Canadian 10-year government bond fell to 3.35%.

- The Canadian dollar is around $0.726 this Monday morning, declining from $0.732 a week prior.

U.S. Market

- The overall depreciation rate continues to accelerate, with the market dropping by -0.74% last week, significantly higher than the pre-pandemic average of -0.25%. Notably, six out of the twenty-two segments tracked by Black Book reported declines exceeding 1% last week.

Industry News

- Ford has shifted plans for its Oakville assembly plant, that was recently pegged for EV production. The plant will now support Super Duty truck supply as the U.S. plants are at capacity with demand still not met. This change will also necessitate 1,800 union jobs to be filled more quickly, than the 3,200 that were needed years down the line as the plant was retooling for EV production.

- Auto theft has reported a significant decrease in the first half of 2024, as a 17% decrease has registered across Canada. This progress is cited by the actions taken by the industry as well as government to reduce this criminal activity.

- The 2025 Cadillac Escalade has broken cover with a minor refresh for the new model year that takes cues from its EV counterpart. With some styling changes outside, the focus looks to be on the interior with a tech showcase through the all-new 55″ curved infotainment touchscreen that spans pillar to pillar across the dashboard. Standard for the first time this year is GM’s semi-autonomous Super Cruise system.

- Mercedes-Benz Canada bids adieu to its current VP of Sales, Bart Herring, as he will make the move to Mercedes-Benz USA to lead Sales and Product as of August 1st. No replacement has been named yet.

- Porsche has released 2 new trims that will arrive with its first EV crossover that joins its lineup for 2025. A Base single-motor trim with RWD starts at $94,900 and is the lightest iteration in the lineup. Joining it will be the 4S trim, slotting below the Turbo and driving all 4 wheels with a dual-motor and 509hp achieving 606km of range.