07.29.2025

Market Insights – 7/29/25

Wholesale Prices, Week Ending July 26th, 2025

The Canadian used wholesale market saw a decline of -0.18% in pricing for the week. Car segments prices decreased by –0.20% while the Truck/SUV segments decreased by -0.18%. This Weeks positive segments have been Compact Luxury Crossover/SUV at +0.07% and Full-Size Luxury Crossover/SUV at +0.11%. The largest declines in the Car segments were seen in Sub-Compact Car at -0.76% and Compact Car with -0.34%. The largest declines in the Truck/SUV segments were Sub-Compact Luxury Crossover/SUV at -1.13% followed by Compact Van with -1.01%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.20% | -0.21% | -0.33% |

| Truck & SUV segments | -0.18% | -0.42% | -0.23% |

| Market | -0.18% | -0.32% | -0.28% |

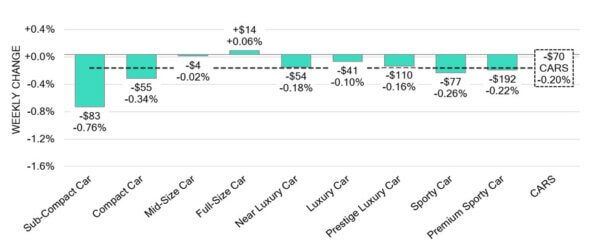

Car Segments

- Car segments reflected an overall depreciation of -0.20% last week. Eight of the nine categories followed this direction.

- Segments with the most notable declines were Sub-Compact Car (-0.76%), followed by Compact Car (-0.34%), Sporty Car (-0.26%) and Premium Sporty Car (-0.22%).

- One segment experienced a slight increase. That segment was Full-Size Car (+0.06%).

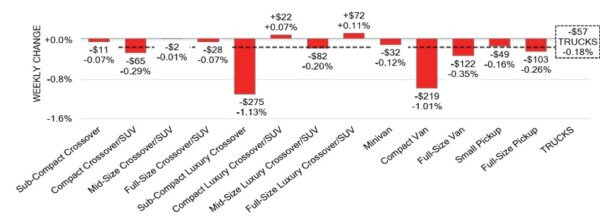

Truck / SUV Segments

- Truck segments showed an overall softening of-0.18% last week. Eleven of the thirteen categories mimicked this movement.

- Segments with the largest declines were seen in Sub-Compact Luxury Crossover (-1.13%), Compact Van (-1.01%) and Full-Size Van (-0.35%).

- Two segments had the opposite change. Full-Size Luxury Crossover/SUV (+0.11%) and Compact Luxury Crossover/SUV (+0.07).

Wholesale

The Canadian market’s decline in pricing continues with another overall softening in used vehicle values. The decline in car segment values was 2% less than the previous week, resting at -0.18%. The truck segment prices saw a change of 0.00%, bringing its change to -0.18%. Twenty seven percent of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 20% to 27% averaging at 23.5%. There has been continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including, economic uneasiness, political variants and sellers holding strong on floor prices. Even with supply remaining stable, upstream channels continue to gain early access to frontline ready vehicles. There remains a continued demand for inventory and high-quality vehicles at auctions on both sides of the border.

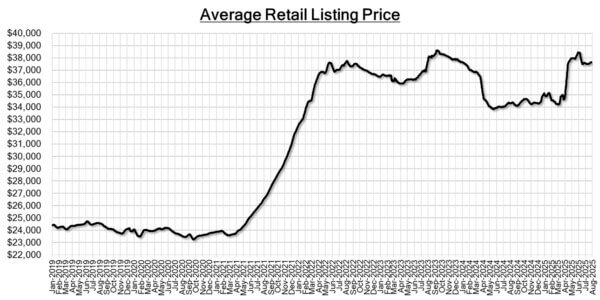

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,600. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canadian Prime Minister Mark Carney announced that financial assistance

programs are being planned to support industries most affected by significant

U.S. tariffs. These programs could be introduced as early as next month,

depending on the results of the current trade negotiations. - Canada’s industrial producer prices increased by 1.7% in June 2025 compared to

the previous year, marking the ninth straight month of annual growth. - New home prices in Canada dropped by 0.2% in June 2025, making it the third

month in a row that prices have fallen. This decline was unexpected, as experts

had predicted prices would stay the same. - The yield on the Canadian 10-year government bond increased to 3.50%.

- The Canadian dollar is around $0.729 this Monday morning, down slightly from

$0.731 a week prior.

U.S. Market

- Although the overall market depreciation rate is exceeding pre-pandemic seasonal norms, there are encouraging signs of strength, with sales rates remaining robust nationwide. Throughout most of July, the weekly depreciation rate has hovered around 0.50%, roughly double the typical 0.25% seen during this period in a typical July market.

Industry News

- The Port of Vancouver is undergone an expansion project at its Annacis Auto Terminal that increases its capacity by a third which will support a more seamless process and supply chain in receiving imported vehicles from Japan, South Korea and other Asian countries.

- An effort to remove start-stop technology from vehicles has been lodged by the Trump Administration that looks to eliminate this feature that typically helps attain EPA emissions targets but has been a point of contention for consumers since its introduction. Removing this feature would deem another unique aspect to the North American car market.

- The U.S. car market will be winding down its EV credit that gives $7,500USD towards the purchase of an EV as part of the Trump Administrations ‘Big Beautiful Bill ‘Act that was approved earlier. The impacts of this are anticipated to impact Canada’s EV market as well, by way of less access to electric vehicles no longer produced for the North American market.

- Rivian makes another step in its expansion into Canada as it has broken ground on a new service center in Quebec that will help support Rivian customers and prepare for the company’s next platform when the R2 debuts in 2026.

- Weins Auto Group has broken ground on a new Genesis dealership in Aurora, ON. This will be the brands 36th retail location in Canada as Weins had purchased Hyundai of Aurora last year and will convert that dealership into a joint dealership with Genesis.