07.30.2024

Market Insights – 7/30/2024

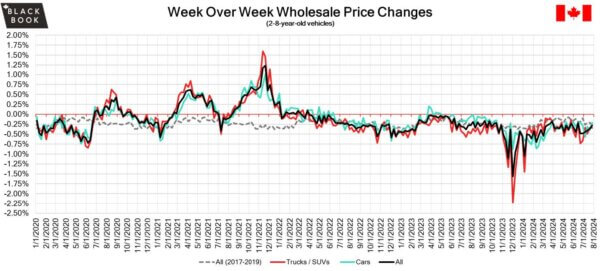

Wholesale Prices, Week Ending July 27th, 2024

The Canadian used wholesale market saw a decline in prices for the week at –0.28%. The Car segment fell by –0.21% and the Truck/SUVs segment prices declined –0.34%. The Segment with positive changes this week was Full Size Crossover/SUV with +0.03. Car segments with the largest declines were Sporty Car at –.47% followed by Near Luxury Car at – 0.34%.The largest declines for the Truck/SUV segments were, Compact Luxury Crossover/SUV at –0.84% followed by Mid-Size Luxury Crossover/SUV at –0.62%.

| This Week | Last Week | 2017-2019 Average

(Same Week) |

|

| Car segments | -0.21% | -0.40% | -0.33% |

| Truck & SUV segments | -0.34% | -0.34% | -0.23% |

| Market | -0.28% | -0.37% | -0.28% |

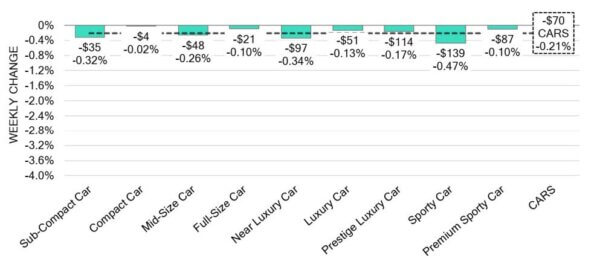

Car Segments

- Last week there was an overall decrease of -0.21% across Car segments. This decrease was noted across all nine segments.

- The Compact Car (-0.02%) segment showed the smallest change, with Full-Size Car (-0.10%) and Premium Sporty Car (-0.10%) showing the next smallest declines.

- The largest decreases were seen from Sporty Car (-0.47%), Near Luxury Car at (-0.34%) and Sub-Compact Car at (-0.32%).

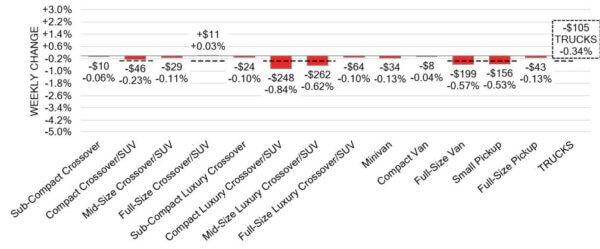

Truck / SUV Segments

- There was an overall weakening of –0.34% in wholesale truck pricing last week. Twelve of the thirteen segments showed a decrease.

- Those with the largest depreciations were Compact Luxury Crossover/SUV (-0.84%), Mid-Size Luxury Crossover/SUV (-0.62%), Full- Size Van (-0.57%) and Small Pickup (-0.53%).

- One segment had slight That segment was Full-Size Crossover/SUV (+0.03%).

Wholesale

The Canadian market continues to show a gradual decline. More than 27% of market segments saw an average value change greater than ±$100, showing a slight decrease compared to the previous week. Among these segments, Car segments saw a decrease 13% larger than that observed in the Truck segments. Monitored auction sale rates ranged from 25% to 77%. A continued drop in floor prices highlights the variations in sale rates across different lanes. With more supply entering the wholesale market and upstream channels securing early access, there continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

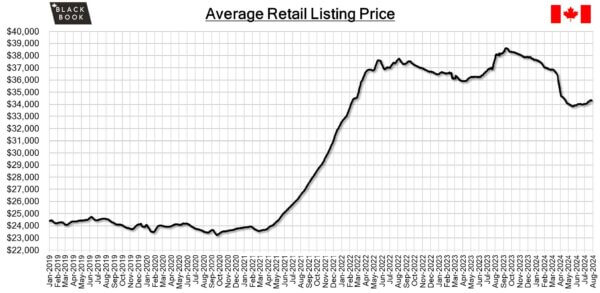

Used Retail Prices & Listing Volume

The average listing price for used vehicles is stable, as the 14-day moving average was at $34,300. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- As anticipated, the key interest rate was reduced by 25 basis points to 4.5% in July 2024 in line with a consensus view reflected in market This followed the prior 25-point reduction from the June meeting and after remaining unchanged for a full 10 months from the end of the previous hiking cycle with a terminal rate of 5%.

- New home prices in Canada were down 0.2% month-over-month in June 2024, the first fall in 5 month, following a 2% increase in May and compared to market forecasts of a 0.1% increase.

- The yield on the Canadian 10-year government bond fell further to 3.30%.

- The Canadian dollar is around $0.722 this Monday morning, declining from $0.726 a week prior.

U.S. Market

- As July comes to a close, the depreciation rate is After experiencing significant declines over the past couple of weeks, last week’s depreciation rate slowed, aligning more closely with the typical rates for this time of year.

Industry News

- The next-level in top trim Chevrolet Corvettes was released last week for the C8 generation. The ZR1 welcomes a turbocharger to the 5.5 liter V8 found in the Z06, which brings output to an eye-watering 1,064hp that helps the ZR1 reach a top speed in excess of 215-mph.

- Volvo, one of the first brands that announced an early transition to a full EV lineup is stepping its EV strategy back as the market shows high interest for plug-ins and hybrids. Previously stating that only full battery- electric vehicles will be sold passed 2030, this will no longer be the case after 2030 where it expects to sell partially electric vehicles that will utilize an internal combustion engine.

- Porsche is another brand taking backing off its word on EV transition which previously stated aims for 80% of its sales to be fully electric by 2030. With consumers detracting from adopting a full EV on the driveway, the luxury performance brand says it can deliver 80% electric sales by 2030, but only if customers seek it.

- Lucid has signed a battery materials deal with Canadian-based mining company Graphite One to provide 5,000 tons of graphite per year for the next 5 years as the EV brand looks to bring material acquisition closer to

- Problems for multi-brand automaker, Stellantis continue as it reports poor results for the first half of 2024 that pushes actions forward on reducing output and cutting prices. This news comes as both Detroit rivals, GM and Ford results are relatively positive.

- Federal iZEV rebates for electrified vehicles reached 95.775 for the first half of 2024, doubling numbers from the same period last year where 45,669 rebates were claimed in 2023.