07.08.2025

Market Insights – 7/8/25

Wholesale Prices, Week Ending July 5th, 2025

The Canadian used wholesale market saw a decline of -0.13% in pricing for the week. Car segments prices decreased by –0.04% while the Truck/SUV segments decreased by -0.20%. This Weeks positive segments have been Compact Van at +0.25% and Mid-Size Car at +0.04%. The largest declines in the Car segments were seen in Luxury Car at -0.07% and Prestige Luxury Car with -0.07%. The largest declines in the Truck/SUV segments were Full-Size Crossover/SUV at -0.97% followed by Full-Size Luxury Crossover/SUV with -0.50%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.04% | -0.32% | -0.25% |

| Truck & SUV segments | -0.20% | -0.32% | -0.29% |

| Market | -0.13% | -0.32% | -0.27% |

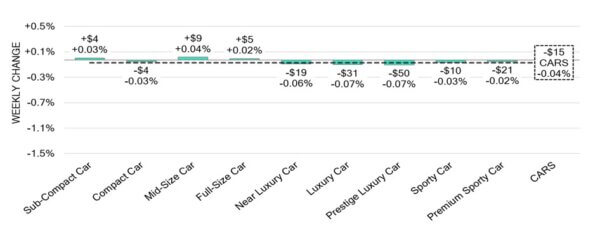

Car Segments

- Car segments revealed a slight overall softening-0.04% last week. Six of the nine tracked categories reflected this trend.

- Segments with the most notable declines were seen in Luxury Car and Prestige Luxury Car (-0.07%), followed by Near Luxury Car (-0.06%).

- Three segments produced a slight increase in prices. Mid-Size Car (+0.04%), Sub-Compact Car (+0.03%) and Full-Size Car (+0.02%).

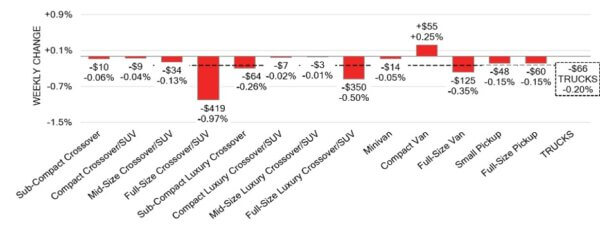

Truck / SUV Segments

- Truck segments experienced an overall depreciation of-0.20% last week, with twelve out of thirteen categories showing this movement.

- Categories with the most notable drop in values were Full-Size Crossover/SUV (-0.97%), Full-Size Luxury Crossover/SUV (-0.50%) and Full-Size Van (-0.35%).

- One segment contradicted the trend showing an increase in values. That segment was Compact Van (+0.25%).

Wholesale

The Canadian market’s decrease in pricing continues with a decline less pronounced than in its previous week. The decline in car segment values decreased by 0.28% resting at -0.04%, while the decline in truck segment prices decreased overall by 0.12% bringing its change to -0.20%. Just under 14% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 7.6% to 57.1% averaging at 32.2%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including ongoing political variances and the gradual change in floor prices. Supply has remained high in comparison to prior weeks; however upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for an increase in inventory and vehicles at auctions.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,500. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The annual inflation rate in Canada stood at 1.7% in May 2025, the same as the

previous month, matching what markets had anticipated. - Canada’s manufacturing sales are projected to decrease by 1.3% in May 2025

compared to the previous month, after experiencing a 2.8% decline in April. - Canada has decided to drop its planned Digital Services Tax (DST), which would

have applied retroactively from 2022, in an effort to restart trade negotiations with

the United States. - Advance estimates show that Canada’s GDP slipped by 0.1% in May 2025

compared to the previous month. - The yield on the Canadian 10-year government bond decreased to 3.26%.

- The Canadian dollar is around $0.734 this Monday morning, up slightly from

$0.731 a week prior.

U.S. Market

- The market experienced a decline last week, which was smaller than the usual seasonal depreciation rate. Given last week’s holiday and the slowdown in auction activity, this outcome is not entirely unexpected. However, the team will closely monitor this week’s performance to determine if the declines, which have been averaging around half a percent per week throughout June, have stabilized for July.

Industry News

- Quebec will change its EV mandate legislation to allow for hybrid vehicles to be included for compliance requirements. This change brings in a much larger set of eligible models that will register for the mandate that is currently set at 32.5% by next year and then 85% in 2030, on its way to 100% by 2035 like the rest of Canada.

- Amidst tariff turmoil, Nissan has been affected with its 3 models produced out of the U.S. for the Canadian market. The Pathfinder, all-new Murano, and the Frontier small pick-up truck will suspend production while it awaits a decision on U.S.-Canadian trade talks. These models fortunately only account for roughly 13% of sales volume in the country.

- To account for lost volume of the U.S.-built Mazda CX-50, the Japanese carmaker will be supporting volume efforts through increasing its production dependency on models built in Mexico and Japan. The impact to that model was calculated at roughly$10,000per unit, by way of a tariff coming in from its Alabama assembly plant.

- In more Nissan news, the brand has communicated to suppliers that it will delay the production schedule fortwo new electric crossovers that were scheduled to be produced in the carmakers Canton, Miss. Facility by almost one full year. This comes just three days after President Donald Trump’s budget bill was signed, scheduling the end of the U.S. Federal EV Tax Credit.

- The Trump Administration is imposing a 25% tariff on imports from Japan and Korea effective August 1st in a new set of levies he has scheduled to release to almost 15 countries.