08.01.2023

Market Insights- 8/1/2023

Wholesale Prices, Week ending July 29th

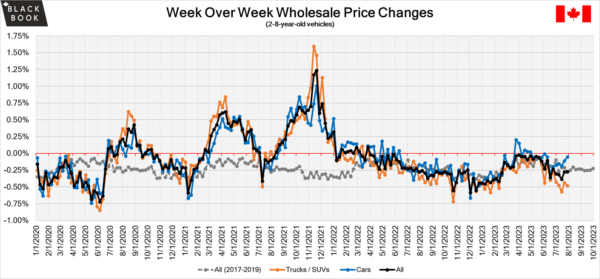

The Canadian used wholesale market saw a decline in prices for the week at -0.27%. The Car segment fell by -0.05% and the Truck/SUVs’ segment prices declined by -0.48%. 6 out of 22 segments’ values have increased for the week. The Mid-Size Car segment was up 0.20% followed by the Sporty Car segment at +0.08%. The segments with the largest declines were Compact Van (-1.25%) followed by Mid-Size Luxury Crossover/SUV (-0.73%).

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.05% | -0.11% | -0.33% |

| Truck & SUV segments | -0.48% | -0.44% | -0.23% |

| Market | -0.27% | -0.28% | -0.28% |

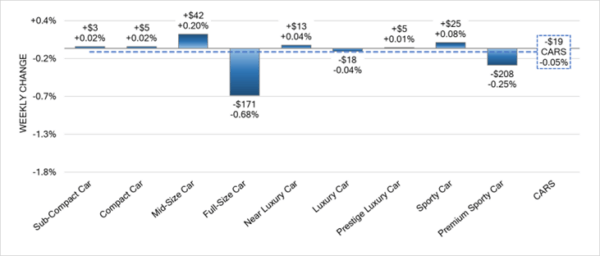

Car Segments

- Last week there was an overall decrease of -0.05% seen within Car Segments.

- Three of nine Segments showed a decrease in pricing. The segment with the largest decrease was Full-Size Car (-0.68%), followed by Premium Sporty Car at (-0.25%) and Luxury Car at (-0.04%).

- The two segments that showed the most increase in pricing are Mid-Size Car at (+0.20%) and Sporty Car at (+0.08%).

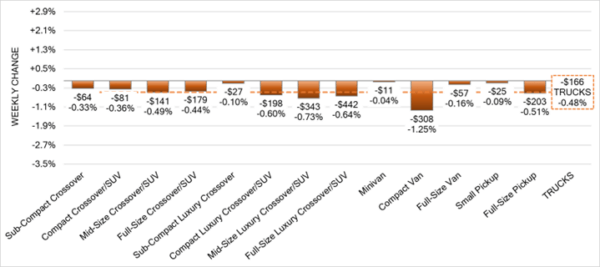

Truck Segments

- Overall truck segments decreased on average by -0.48% last week.

- Same as the prior week, all thirteen truck segments had decreases. Compact Van had the largest drop (-1.25%), followed by Mid-Size Luxury Crossover/SUV (-0.73%) and Full-Size Luxury Crossover/SUV (-0.64%).

- Other segments with a notable depreciation were Compact Luxury Crossover/SUV (-0.60%) and Full-Size Pickup (-0.51%).

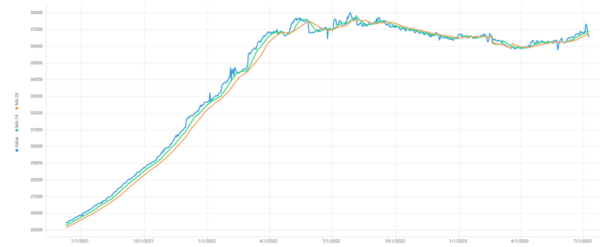

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $37,000. Analysis is based on approximately 184,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of less than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 23% and as high as 66% but most were in the 20-40% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Canada’s economy is forecasted to have contracted by 0.2 percent in June 2023 mostly due to the decreases seen in wholesale and manufacturing sectors.

- Canadian federal budget surplus contracted to 1.5 billion in the first two months of the 2023-2024 fiscal year.

- Canadian 5-year bond yields climbed to 4.01% last Thursday.

- The Canadian dollar is around $0.756 this Monday morning down from $0.758 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.37% last week; the prior week decreased by -0.53%. Volume-weighted Car segments decreased -0.27%, compared to the prior week’s -0.59% decrease:

- The 0-to-2-year-old Car segments were down -0.23% and 8-to-16-year-old Cars declined -0.40%.

- All nine Car segments decreased last week.

- Full-Size (-0.001%), Sporty (-0.02%), and Mid-Size (-0.06%) Car segments all reported stability last week. In sharp contrast, the Compact Car segment had the largest decline at -0.66%. Despite being the largest Car segment decline, it was still less than the prior week’s decline of -0.94%.

- The luxury segments also reported smaller declines than in recent weeks. For example, Premium Sporty was down -0.02%, compared with -0.24% the week prior and Near Luxury Car was down -0.26%, compared with -0.58% the previous week.

Volume-weighted Truck segments decreased by -0.41%; the previous week decreased by -0.50%:

- The 0-to-2-year-old Truck segments reported a smaller decline last week (-0.36%), but the 8-to-16-year-olds declined more, depreciating -0.46%.

- All thirteen Truck segments reported a decrease last week.

- Compact Luxury Crossovers reported the largest decrease last week with a decline of -0.85%. This marks the ninth consecutive week of declines for the segment for an average weekly change of -0.74%.

- Full-Size Pickups have been declining for eight consecutive weeks, but last week the segment had the largest single-week decline (-0.64%) since December 2022. Over the past eight weeks, the segment has averaged a weekly decline of -0.36%.

Industry News

- As new vehicle inventory improves, dealers have been quoted saying that manufacturers are not supporting sold orders they have, but pushing models they can produce that fetch a higher profit margin; impacting inventory sales rates due to having the wrong inventory right now. Plus contending with rail car shortages and strike action from the ports that recently affected as many as 2,000 new vehicles.

- By way of price action, Tesla looks to keep supply and demand in balance – an exercise more familiar to legacy brands than startups, as the car company looks to achieve its significant 50% increase in new car sales this year. Tesla executives have stated, these tactics will not stop anytime soon.

- Seven major automakers have joined together to build a new EV charging network that should help overcome some significant EV buying obstacles that focus on the charging infrastructure access and reliability, a multibillion-dollar investment that will bring over 30,000 charging points to the U.S. and Canada by 2030, many of which will be higher-powered. The first stations will be released in the U.S. in 2024.

- All signs point to sustained growth in the Luxury car market as dealers, manufacturers, and Desrosiers Automotive Consultants point to signs of market growth amidst high interest rates and inflation due to demographics of older, higher earning car buyers as well as increased lineups in the luxury space supporting overall market growth – now standing at 12.9% in only the first half of 2023, up from 11.9% in CY2019.