08.12.2025

Market Insights – 8/12/25

Wholesale Prices, Week Ending August 9th, 2025

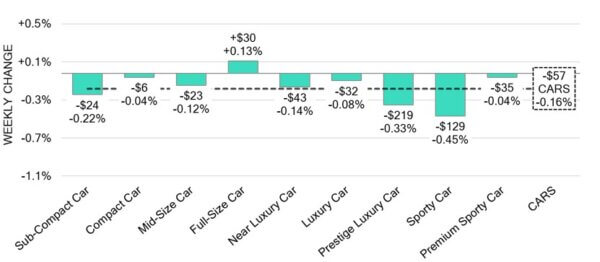

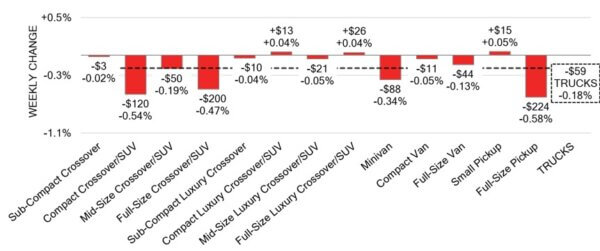

The Canadian used wholesale market saw a decline of -0.17% in pricing for the week. Car segments prices decreased by –0.16% while the Truck/SUV segments decreased by -0.18%. This Weeks top positive segments have been Full-Size Car at +0.13% followed by Small Pickup at +0.05%. The largest declines in the Car segments were seen in Sporty Car at -0.45% and Prestige Luxury Car with -0.33%. The largest declines in the Truck/SUV segments were Full-Size Pickup at -0.58% followed by Compact Crossover/SUV with -0.54%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.16% | -0.31% | -0.14% |

| Truck & SUV segments | -0.18% | -0.47% | -0.27% |

| Market | -0.17% | -0.40% | -0.20% |

Car Segments

- There was an overall depreciation of -0.16% seen in car segmentslast week. All ninecategories echoed this movement.

- Segments withthe most notable declines were Sporty Car(-0.45%), followed by Prestige Luxury Car(-0.33%), Sub-Compact Car (-0.22%) and Near LuxuryCar (-0.14%).

- Those with the smallest declines were Luxury Car (-0.08%) and Compact Car (-0.04%).

Truck / SUV Segments

- Last week truck segments showed an overall softening of-0.18%. Ten of the thirteen categories reflected this movement.

- Segments with the largest declines were Full Size Pickup (-0.58%), Compact Crossover/SUV (-0.54%), Full-Size Crossover/SUV (-0.47%) and Minivan (-0.34%).

- Three segments displayed an opposite shift with small bumps in values. Those segments are Compact and Full-Size Luxury Crossover/SUV Segments both with (+0.04%) and Small Pickup with (+0.05%).

Wholesale

The Canadian market’s decline in pricing continues, however the decrease has receded noticeably compared to its previous week’s decline. The markets car segment values remain trending down despite the 0.15 % increase from last week, the change sits at –0.16%. Similarly, the decline in truck segment prices also increased. A 0.19% increase bringing the change to -0.47%. Just under 23% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 26.9% to 59.6% averaging at 38.9%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including, economic uneasiness, political variants and sellers holding strong on floor prices. Even with supply remaining stable; upstream channels continue to gain early access to frontline ready vehicles. There remains a continued demand for inventory and high-quality vehicles at auctions on both sides of the border.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,700. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s total imports increased by 1.4% in June 2025, marking the first rise in

four months. This growth was driven by higher imports in 5 out of 11 product

categories. - Canada’s exports increased by 0.9% in June 2025 to $61.74 billion, following an

upwardly revised 2.0% gain in May. This marks the second straight month of

export growth after a significant 11.3% decline in April. - Canada’s unemployment rate held steady at 6.9% in July 2025, unchanged from

the previous month. While slightly below market expectations of 7%, it remains

near the nearly four-year high reached two months earlier. - The yield on the Canadian 10-year government bond increased to 3.37%.

- The Canadian dollar is around $0.725 this Monday morning, down slightly from

$0.726 a week prior.

U.S. Market

- Depreciation accelerated last week across nearly every vehicle segment. However, due to the strength of this year’s spring market, current pricing remains above levels seen at the start of the year.

Industry News

- July New car sales rose 6.9% in Canada, according to Desrosiers Automotive Consultants. Although a year ago, July sales were noticeably weak, it still shows the resiliency of the car market amidst tariff impacts and volatility in zero-emission vehicles.

- Unemployment rate remains unchanged in July even with the economy losing 41,000 jobs in the month. The Auto parts industry helped the rate remain constant with its second consecutive job increase with 5,300 jobs coming in July, though still down year-over-year.

- VW Group’s PowerCo battery facility in St. Thomas, ON is hiring for hundreds of job seven with the ongoing threat of tariffs. Hiring for a wide range of roles in chemistry, engineering, data, sustainability, and IT departments, the $7 billion facility shows signs of significant progress.

- Ford has shifted its EV plans significantly as of late, not in delaying all plans, but shifting what electric models to bring to market first. After communicating delays for its next EV Pickup and Vanto 2028,it is shifting focus on a low-cost EV platform that will bring a small electric Pickup to market as early as 2027. These models aim at providing affordable urban duty EVs also well suited for commercial use.

- Jeep released early images of its refreshed Grand Wagoneer that will arrive later this year with ‘Jeep’ script across the front. The brand will drop the lower-priced Wagoneer variant and introduce hybrid powertrains. Other introductions before years end will be a next-gen Cherokee, refreshed Grand Cherokee, and the all-new electric Recon.

- JLR has tapped parent company Tata Motors for its next CEO. PB Balaji will replace Adrian Mardell, effective in November. Balaji has been Tata’s CFO since 2017.