08.15.2023

Market Insights – 8/15/2023

Wholesale Prices, Week Ending August 12th

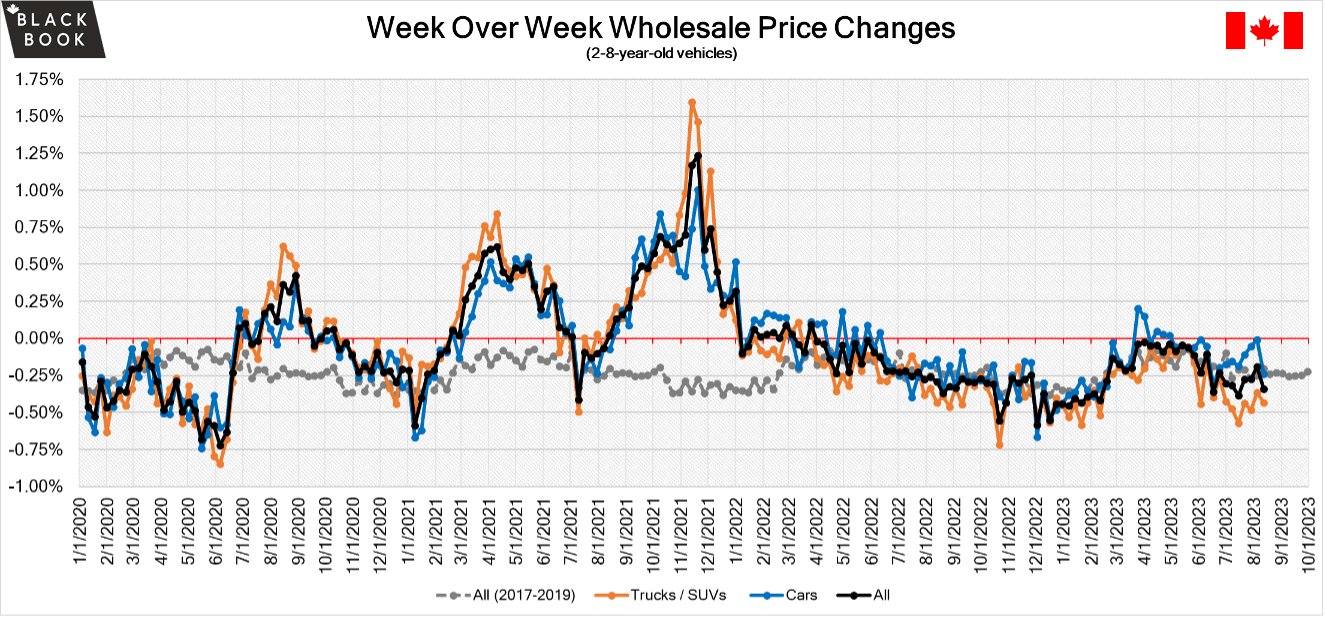

The Canadian used wholesale market saw a decline in prices for the week at -0.34%. The Car segment fell by -0.24% and the Truck/SUVs’ segment prices declined -0.43%. 1 out of 22 segments’ values have increased for the week. The Premium Sporty Car segment was up 0.05%. The segments with the largest declines were Minivan (-1.46%) followed by Compact Van (-1.28%).

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.24% | -0.01% | -0.14% |

| Truck & SUV segments | -0.43% | -0.36% | -0.27% |

| Market | -0.34% | -0.19% | -0.20% |

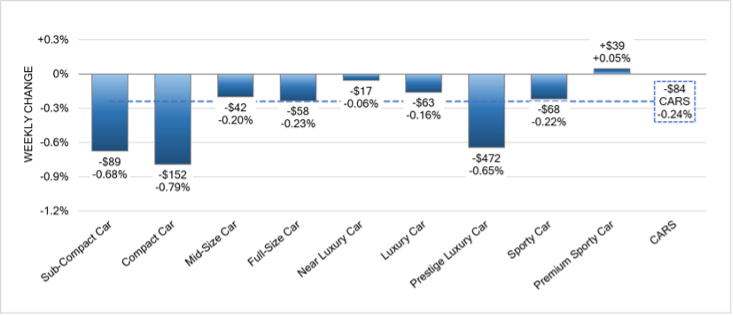

Car Segments

- There was an overall decrease of -0.24% within Car Segments last week.

- Eight of the nine segments showed a decrease in pricing. The segments with the largest decrease were Compact Car sitting at (-0.79%) and Sub-Compact Car following with (-0.68%). The segment with the least decrease was Near Luxury Car with (-0.05%).

- The only segment with an increase in pricing was Premium Sporty Car at (+0.05%).

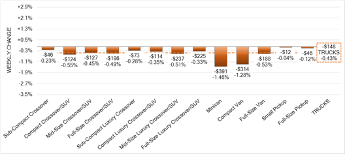

Truck Segments

- Last week there was an overall decrease of –0.43% in truck segments.

- All thirteen truck segments had decreases. Two of these had a downturn greater than one percent. Those were Minivan (-1.46%) and Compact Van (-1.28%).

- Other segments with a notable decline were Compact Crossover/SUV (-0.55%), Full-Size Van (-0.53%) and Mid-Size Luxury Crossover/SUV (-0.51%).

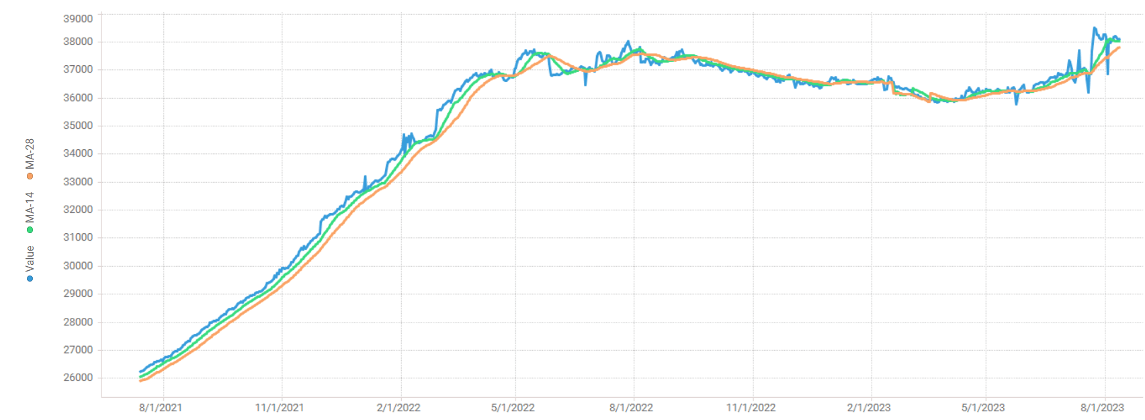

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,000. Analysis is based on approximately 186,500 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was larger than the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 18% but most were in the 20-40% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Canada posted a trade deficit of $3.73 billion in June of 2023, larger than market forecasts of $2.90 billion and a downwardly revised gap of $2.68 billion in the prior month.

- The median home sale price fell in Canada to $744,400 in Q2 2023, down 1.2% from the previous quarter and 8.1% lower than last year.

- Canadian 10-year bond yields dropped to 3.5% in last week.

- The Canadian dollar is around $0.744 this Monday morning down from $0.756 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -x.xx% last week; the prior week decreased by -1.10%.

Volume-weighted Car segments decreased -1.35%, compared to the prior week’s -1.36% decrease:

- The 0-to-2-year-old Car segments were down -0.97% and 8-to-16-year-old Cars declined -1.46%.

- All nine Car segments decreased last week, with five of the nine reporting declines exceeding 1%.

- Compact Car led the drops for the Car segments last week, down -2.35%. This was an increase from the prior week’s already large decline of -2.12%.

- In sharp contrast to the Compact Car segment, the Premium Sporty Cars declined -0.33%, a normal depreciation for this time of year.

Volume-weighted Truck segments decreased by -1.49%; the previous week decreased -0.98%:

- The 0-to-2-year-old models declined -1.25% last week, while the 8-to-16-year-olds declined -1.42% (compared to only -0.55% the previous week).

- All thirteen Truck segments declined last week, and seven of segments had declines greater than 1%.

- Full-Size Trucks dropped -2.66% last week, larger than any of the declines in the early days of the pandemic. In the retail market, the incentives are picking up, particularly on the Ram 1500’s and that is putting pressure on the used market.

Industry News

- New silicon carbide semiconductor chips are all the rage right now, with many large-scale automotive suppliers like Bosch investing heavily in their facilities to produce these chips for the many EV’s coming to market, as the expectation for the use of these chips is to increase by 30% annually. This will help support supply channels from falling too reliant on other industries to provide for vehicle manufacturing in the future.

- The Motor Vehicle Retailers of Ontario (MVRO) and Canadian Auto Dealers Association (CADA) have recently reported the lack of available automotive technicians in Ontario with more than 3,000 vacancies at the end of Q1 2023. The main concern is the aging of the workforce, as the report finds a lack of younger technicians aged 15-24 and 25-54 filtering in for older ones that are leaving.

- GM has introduced its next EV with the Cadillac Escalade IQ, a full-size luxury SUV that achieves 724km of range from its 200kWh Ultium powertrain making up to 750hp and 785lb.ft. of torque, accelerating to 100km/h in less than 5 seconds.

- Desrosiers Automotive Consultants hosted a survey for Used Car Dealers to identify how inventory was moving throughout the first half of 2023 – the results identify independent dealers selling the same number of vehicles as last year, but franchise dealers are selling slightly more. Annual forecasts show lower estimates for both, possibly due to increases in new car availability and rising incentives in some market segments.