08.19.2025

Market Insights – 8/19/25

Wholesale Prices, Week Ending August 16th, 2025

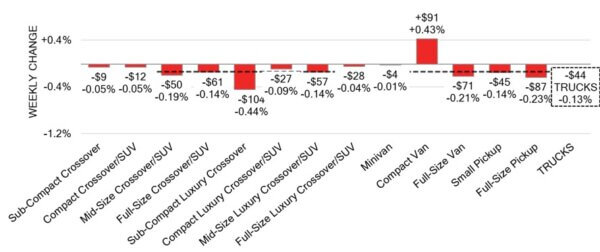

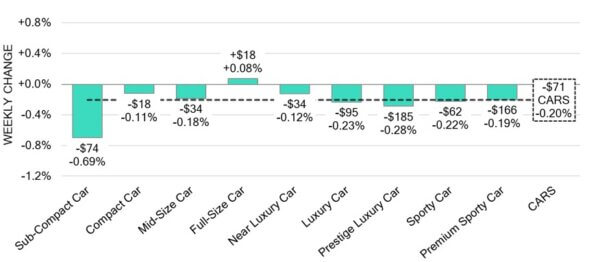

The Canadian used wholesale market saw a decline of -0.16% in pricing for the week. Car segments prices decreased by –0.20% while the Truck/SUV segments decreased by -0.13%. This Weeks top positive segments have been Compact Van at +0.43% followed by Full-Size Car at +0.08%. The largest declines in the Car segments were seen in Sub-Compact Car at -0.69% and Prestige Luxury Car with -0.28%. The largest declines in the Truck/SUV segments were Sub-Compact Luxury Crossover/SUV at -0.44% followed by Full-Size Pickup with -0.23%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.20% | -0.16% | -0.26% |

| Truck & SUV segments | -0.13% | -0.18% | -0.22% |

| Market | -0.16% | -0.17% | -0.24% |

Car Segments

- There was an overall depreciation of -0.20% seen in car segments last week. Eight of the nine categories echoed this movement.

- Segments with the most notable declines were Sub-Compact Car (-0.69%), followed by Prestige Luxury Car (-0.28%), Luxury Car (-0.23%) and Sporty Car (-0.22%).

- Those with the smallest declines were Near Luxury Car (-0.12%) and Compact Car (-0.11%).

Truck / SUV Segments

- Last week truck segments showed an overall softening of-0.13%. Twelve of the thirteen categories reflected this movement.

- Segments with the largest declines were Sub-Compact Luxury Crossover/SUV (-0.44%), Full Size Pickup (-0.23%), Full-Size Van (-0.21%) and Mid-Size Crossover/SUV (-0.19%).

- One segment displayed an opposite shift with small bump in value. That segment was Compact Van (+0.43%).

Wholesale

The Canadian market continues to see a decline in pricing; however, the pace of decrease has slowed slightly compared to the previous week’s drop. The market’s car segment values continue to trend downward, recording an additional 0.04% decrease this week and resulting in a total decline of –0.20%. The decline in truck segment prices was less pronounced than last week, with a 0.05% rise, the segments’ decline falls to -0.13%. Slightly less than 14% of market segments recorded an average value change exceeding ±$100. Meanwhile auction sale rates monitored during the period ranged from 39% to 45.5%, averaging 42.9%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including, economic uneasiness, political variants and sellers holding strong on floor prices. Even with supply remaining stable, upstream channels continue to gain early access to frontline ready vehicles. There remains a continued demand for inventory and high-quality vehicles at auctions on both sides of the border.

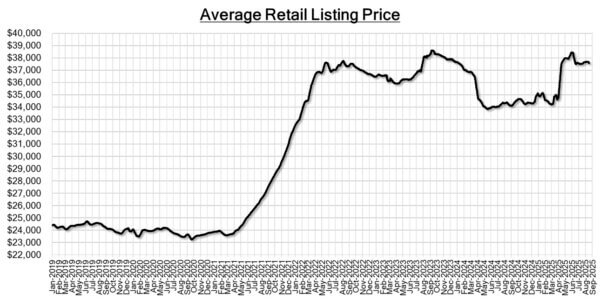

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,600. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Housing starts in Canada increased by 3.7% in July 2025 to 294,085 units, up

from 283,523 in June and significantly surpassing expectations of 265,000. In

urban areas with populations over 10,000, starts rose 4% year-over-year,

reaching 23,464 units. - The total value of building permits in Canada dropped by 9.0% month-over-month

to $12.0 billion in June, marking the sharpest decline since June 2024. - Canada’s manufacturing sales edged up 0.3% to $68.5 billion in June 2025,

following a revised 1.5% decline in May, and coming in slightly below the

preliminary estimate of a 0.4% gain. - The yield on the Canadian 10-year government bond increased to 3.46%.

- The Canadian dollar is around $0.724 this Monday morning, down slightly from

$0.725 a week prior.

U.S. Market

- Depreciation slowed last week while conversion rates improved, supported by strong bidding activity—particularly from larger independents. With Labor Day just a couple of weeks away, we’ll be watching the market closely to see if wholesale prices experience a post-holiday lift similar to last year, when modest week-over-week gains began in late August and carried through the first half of September.

Industry News

- For the first time in 3 decades, Canada imported more vehicles from Mexico than it did from the U.S. this June. $1.08 billion coming from Mexico and $950 million from the U.S.

- For some USMCA compliant suppliers, tariffs have not been as bad as initially expected. Martinrea and Linamar recognize that they are sheltered by the agreement, and impacts to their business are immaterial from a global scale.

- The Canadian Government will be spending $25 million on EV charging expansion projects, with most of that funding marked for EV share powerhouse, Quebec. Stations will be built around workplaces, public spaces, along highways and in Multi-Urban Residential Buildings.

- Another model bites the dust in Canada due to tariffs, as Hyundai stopped the sale of its Compact Pickup Truck, the Santa Cruz as significant increases to cost impact the model for this market.

- Digital used car retailer, Clutch, has now moved back into Western Canada as its operations had previously been wound back in 2023 as financial woes caused the organization to restructure.

- Honda and Acura recently released news on its Sporty hybrid coupe, the Honda Prelude and another historical nameplate, the Acura RSX, now envisioned as an electric crossover. The Japanese automaker changes course highlighting electrified vehicles over battery electrics to focus on more in-demand segments. This will be the first in-house developed EV for the company.

- Ford is redefining the way it assembles vehicles as it looks to find a “better way of making a car” in a process they’re calling “unboxed” manufacturing. Similar to the approach Tesla has taken.