08.22.2023

Market Insights – 8/22/2023

Wholesale Prices, Week Ending August 19th

The Canadian used wholesale market saw a decline in prices for the week at -0.20%. The Car segment fell by -0.05% and the Truck/SUVs’ segment prices declined -0.34%. 5 out of 22 segments’ values have increased for the week. The Small Pickup segment was up 0.45% followed by the Premium Sporty Car segment at +0.12%. The segments with the largest declines were Compact Van (-0.64%) followed by Full-Size Pickup (-0.48%).

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.05% | -0.24% | -0.26% |

| Truck & SUV segments | -0.34% | -0.43% | -0.22% |

| Market | -0.20% | -0.34% | -0.24% |

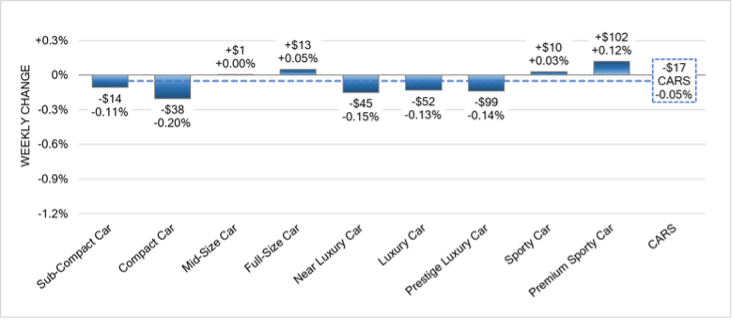

Car Segments

- There was an overall decrease of -0.05% within Car Segments last week.

- Four of the nine segments showed an increase in pricing. The segments with the largest increase were Premium Sporty Car at (+0.12%) and Full-Size Car with (+0.05%).

- The segments to decrease the most were Compact Car at (-0.20%), followed by Near Luxury Car with (-0.15%) and Prestige Luxury Cars at (-0.14%).

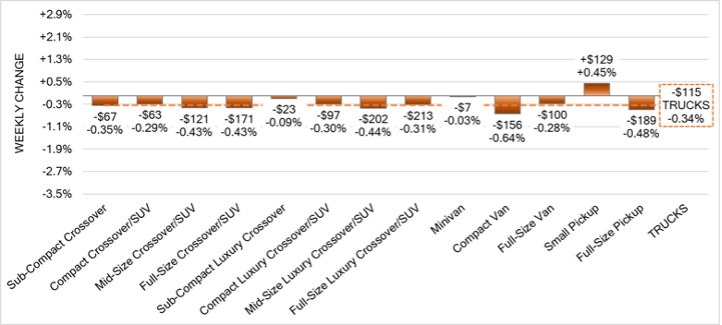

Truck Segments

- Last week there was an overall decrease of -0.34% in truck segments.

- All but one of the thirteen truck segments had decreases. The greatest decrease goes to Compact Van (-0.64%) and Full-Size Pickup at (-0.48%), followed by both Mid-Size & Full-Size Crossover/SUVs at (-0.43%)

- The only segment to have an increase in pricing was Small Pickups with (+0.45%).

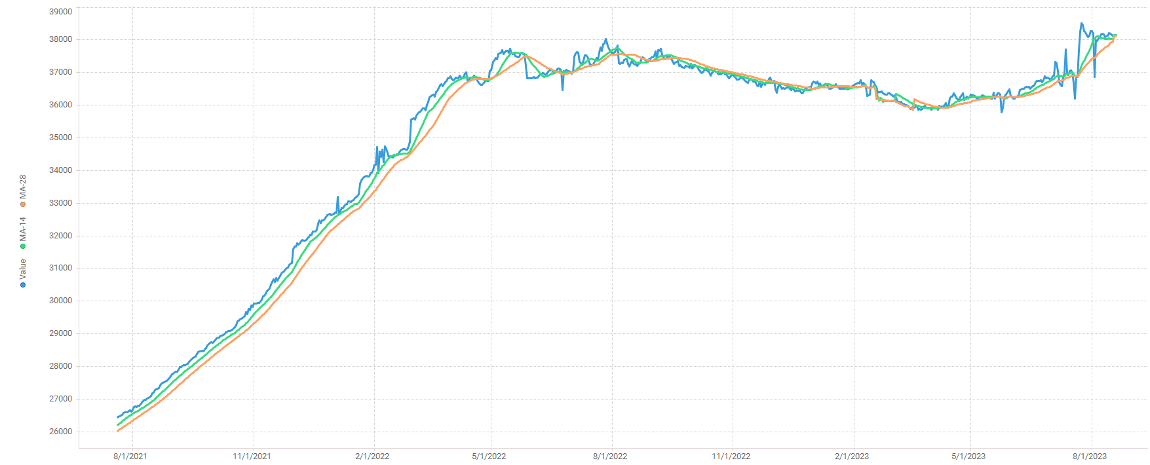

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,000. Analysis is based on approximately 186,500 vehicles listed for sale on Canadian dealer lots.

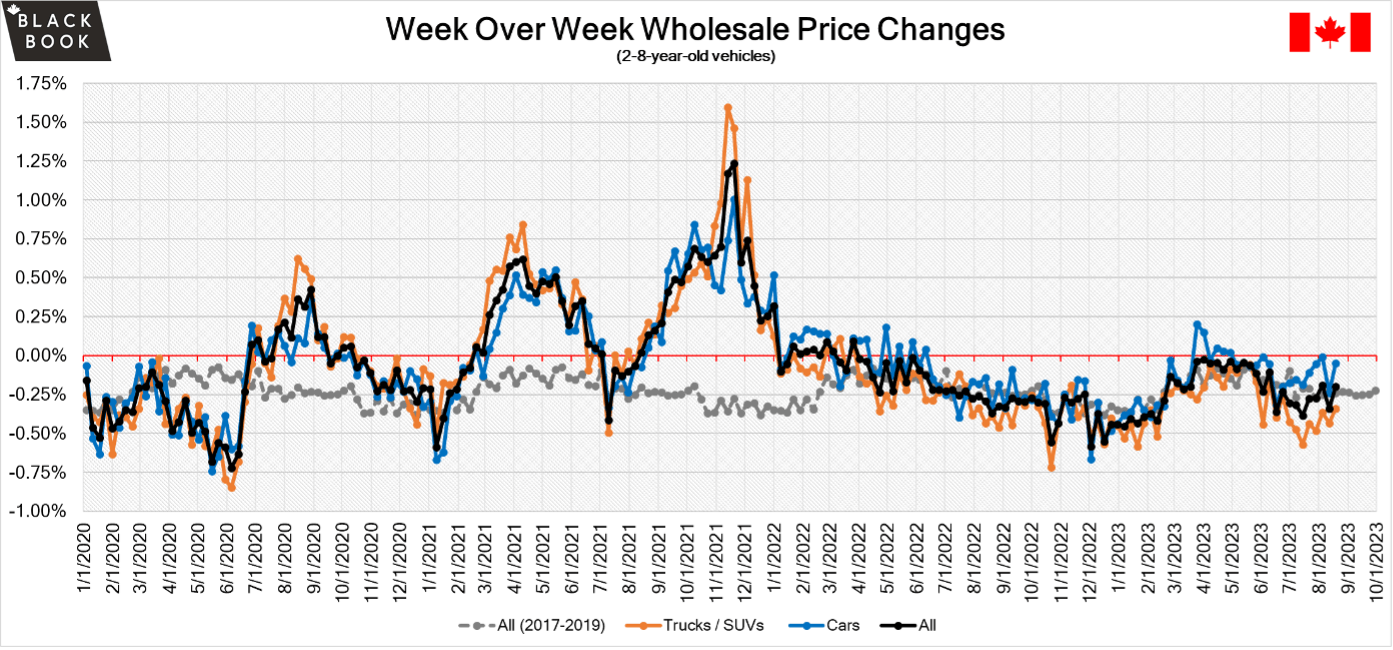

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of less than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 4% and as high as 68% but most were in the 25-40% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The Canadian inflation rate rose to 3.3% in July from 2.8% in the previous month and higher than market expectations of 3.0%.

- Housing starts fell by 10% in July to 254,966 according to the Canada Mortgage and Housing Corporation.

- Canadian 10-year bond yields increased to 3.811% in last week.

- The Canadian dollar is around $0.738 this Monday morning down from $0.744 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -1.52% last week; the prior week decreased by -1.45%.

Volume-weighted Car segments decreased -1.73%, compared to the prior week’s -1.35% decrease:

- The 0-to-2-year-old Car segments were down -1.20% and 8-to-16-year-old Cars declined -1.90%.

- All nine Car segments decreased last week, with seven of the nine reporting declines exceeding 1%.

- Compact (-2.51%), Mid-Size (-2.16%), and Full-Size (-2.15%) Cars reported declines exceeding 2%. This marks the third straight week of single week depreciation exceeding 2% for the Compact Car segment.

- Premium Sporty and Prestige Luxury Car segments continue to experience typical seasonal depreciation.

Volume-weighted Truck segments decreased by -1.43%; the previous week decreased -1.49%:

- The 0-to-2-year-old models declined -1.20% last week, while the 8-to

- -16-year-olds declined -1.10%.

- All thirteen Truck segments declined last week, and eleven of the segments had declines greater than 1%.

- Minivan (-2.15%) was the only Truck segment to drop by more than 2%. Despite being a large decline, this is still less than some of the declines last year and at the onset of the pandemic that were as large as -2.50%.

- The Small Pickup (-0.74%) segment had smaller depreciation than the larger Full-Size Pickup segment (-1.34%).

Industry News

- As the key obstacles to EV adoption circle around charging your car, access to EV charging is improving in key EV markets like Quebec and British Columbia, but overall, it is not improving quickly enough. As of August 15th, Natural Resources Canada lists roughly 23,000 charging ports in 9,100 locations across Canada, but over 1/5 can be found in Montreal or Vancouver.

- Ford along with EcoPro BM Co. and SK On Co. are planning a $1.2-billion EV battery materials plant in Quebec, as its first investment will provide cathode active material for EV battery production.

- VinFast saw its public debut this week as the EV automaker sold shares of the company, rising to value it as much as $85-billion, more than tripling from its starting point. With only a small number of shares (1.3 million to date), VinFast is recognized as a “low-float” company, meaning that it can have large fluctuations in value over short periods of time.

- Awareness has been growing around another supply issue for electric vehicles, which deals with the negative side or anode of a battery’s composition. This could bring the next obstacle for EV’s as Graphite, which counters Lithium within a battery’s chemistry could be just as problematic to attain supply; making up 30% of materials to build just one EV battery.