08.26.2025

Market Insights – 8/26/25

Wholesale Prices, Week Ending August 23rd, 2025

The Canadian used wholesale market saw a decline of -0.34% in pricing for the week. Car segments prices decreased by –0.30% while the Truck/SUV segments decreased by -0.37%. This Week’s top positive segments have been Compact Van at +0.24% followed by Full-Size Car at +0.16%. The largest declines in the Car segments were seen in Mid-Size Car at -0.44% and Prestige Luxury Car with -0.43%. The largest declines in the Truck/SUV segments were Full-Size Pickup at -0.63% followed by Full-Size Van with -0.52%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.30% | -0.20% | -0.22% |

| Truck & SUV segments | -0.37% | -0.13% | -0.25% |

| Market | -0.34% | -0.16% | -0.23% |

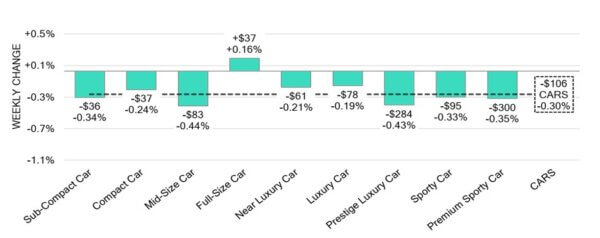

Car Segments

- An overall depreciation of -0.30% was seen in car segments last week. Eight of the nine categories echoed this movement.

- Segments with the most notable declines were Mid-Size Car (-0.44%), followed by Prestige Luxury Car (-0.43%), Premium Sporty Car (-0.35%) and Sub-Compact Car (-0.34%).

- Those with the smallest declines were Luxury Car (-0.19%) and Near Luxury Car (-0.21%).

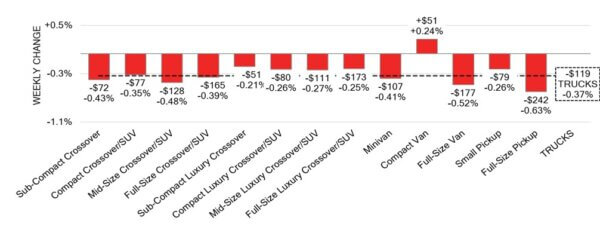

Truck / SUV Segments

- Last week truck segments showed an overall softening of-0.37%. Twelve of the thirteen categories reflected this movement.

- Segments with the largest declines were Full-Size Pickup (-0.63%), Full Size Van (-0.52%) and Mid-Size Crossover/SUV (-0.48%).

- One segment displayed an opposite shift with small bump in value. That segment was Compact Van (+0.24%).

Wholesale

The Canadian market remains on a downward trend; however, this week the downturn is more pronounced. Car segment values in the market continue to decline, slipping a further 0.10%, bringing the total decline to –0.30%. Truck segment prices saw a sharper decline than last week, falling 0.24% and bringing the total decline to –0.37%. Slightly more than 40% of market segments recorded an average value change exceeding ±$100. Meanwhile auction sale rates monitored during the period ranged from 20.5% to 66%, averaging 40%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including, economic uneasiness, political variants and sellers holding strong on floor prices. Even with supply remaining stable, upstream channels continue to gain early access to frontline ready vehicles. There remains a continued demand for inventory and high-quality vehicles at auctions on both sides of the border.

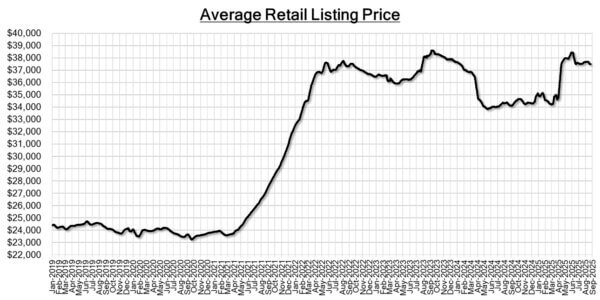

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,500. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada announced Friday it will remove its 25% tariff on roughly half of the U.S.

goods targeted since March, aiming to reset trade relations with Washington. - Canada’s annual inflation rate slowed to 1.7% in July 2025, down from 1.9% in

June and slightly below market expectations of 1.8%. It remained below the Bank

of Canada’s 2% target midpoint for the fourth straight month. - New home prices in Canada dipped 0.1% month-over-month in July 2025,

marking the fourth straight monthly decline and falling short of market

expectations for a 0.1% increase. - Retail sales in Canada are projected to have declined by 0.8% in July 2025 from

the previous month, based on a preliminary estimate. - The yield on the Canadian 10-year government bond decreased to 3.44%.

- The Canadian dollar is around $0.723 this Monday morning, down slightly from

$0.724 a week prior.

U.S. Market

- Last year, the market stabilized and saw four consecutive weeks of rising wholesale values around Labor Day. This year, while we haven’t seen overall market appreciation yet, depreciation is slowing, and some segments are even reporting value increases. Nationwide, conversion rates remain exceptionally strong, consistently exceeding 60%.

Industry News

- Nissan is planning multiple new products to enter the market with 20 new or updated models to North America by early 2027. With new generations of the Rogue, Sentra, Q50, as well as the return of historical nameplates like the Xterra SUV and even a body-on-frame Pathfinder.

- The 2026 Jeep Cherokee is coming back to the market. It will return as hybrid-only, similar to Toyota’s Rav4, providing 210hp and 230lb.ft. of torque. The Jeep brand has lacked affordable, efficient models in its lineup, and the return of this model as planned provides exactly that. Arriving early in 2026, the Cherokee will compete in the heart of the compact crossover segment.

- The 2026 Nissan Leaf returns to the market with an affordable price point in the U.S., of under $30,000. But in Canada, we get some essential extras like heated front seats and mirrors, as well as a heat pump and battery heater as standard. While these are necessary features for the Canadian market, that brings the starting price to a less budget-friendly $44,998, but nonetheless still very competitive.

- As tariffs work their way into new car pricing, the U.S. remains less isolated than Canada. An example of this is with the Audi brand that just announced price increases between $800-$4,700USD, or 1.6%-4.8% higher price, with more 2026MY price releases to come.

Canada is expected to drop reciprocal tariffs on U.S. goods covered by USMCA free trade deal, but not on auto, steel, or aluminum. - Pebble Beach Concours D’Elegance in Monterey, CA concluded after last week and has become a premiere global event for automotive culture and manufacturer releases. As such, the event displayed concepts like the Lexus Sport concept, Acura’s electric RSX crossover, Karma Automotive’s Amaris coupe, Lamborghini’s Fenomeno, Ford’s Bronco Roadster concept, Lucid’s Gravity X concept, and Maserati’s MCPura Cielo.