08.27.2024

Market Insights – 8/27/2024

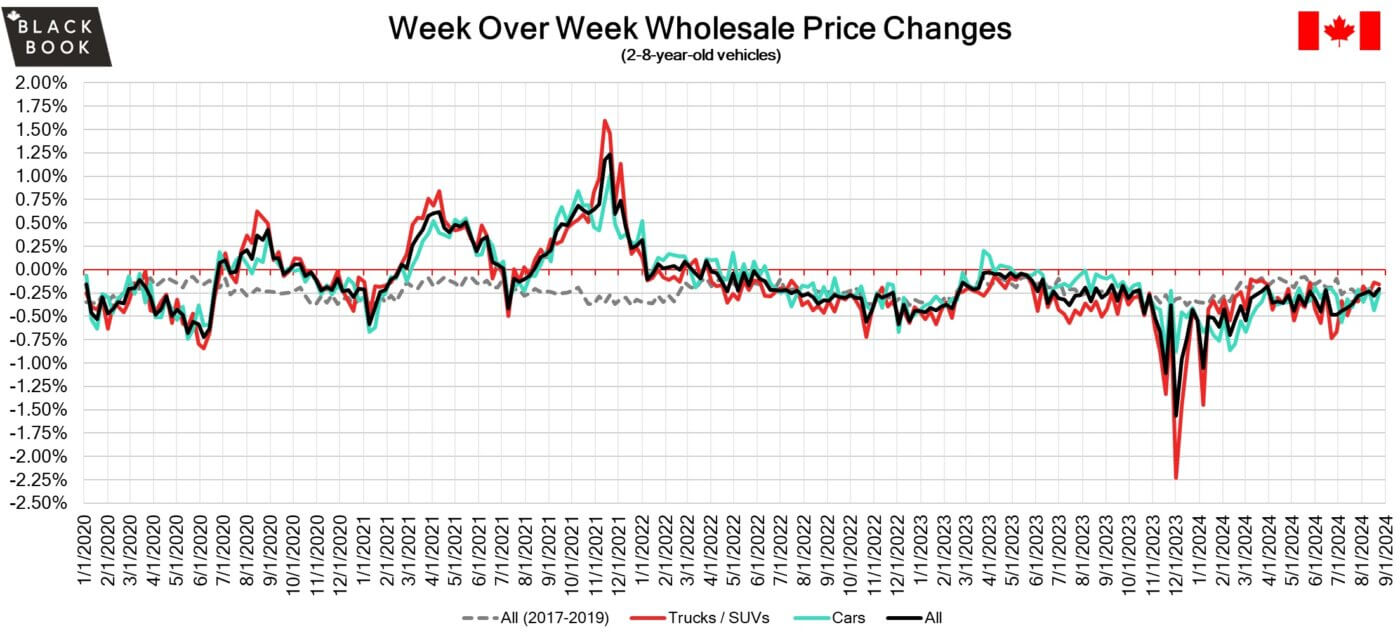

Wholesale Prices, Week Ending August 24th, 2024

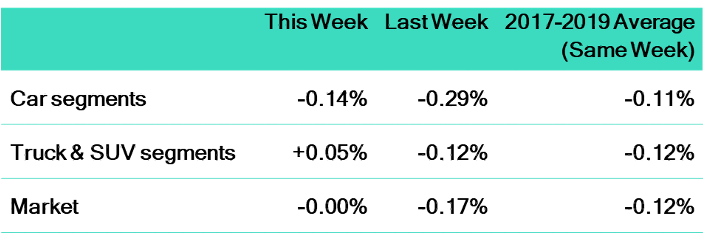

The Canadian used wholesale market saw less of a decline in prices for the week at –0.20%. The Car segments declined by –0.25% while the Truck/SUVs segment dropped -0.16%. Full-Size Pickups, Full-Size Crossovers/SUVs, and Sub-Compact Cars saw price increases of +0.77%, +0.27%, and +0.03%, respectively. The largest declines noted were seen in Full-Size Car with –0.60% followed by Full-Size Van at –0.58% and Mid-Size Luxury Crossover/SUVs at –0.51%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.25% | -0.44% | -0.22% |

| Truck & SUV segments | -0.16% | -0.14% | -0.25% |

| Market | -0.20% | -0.28% | -0.23% |

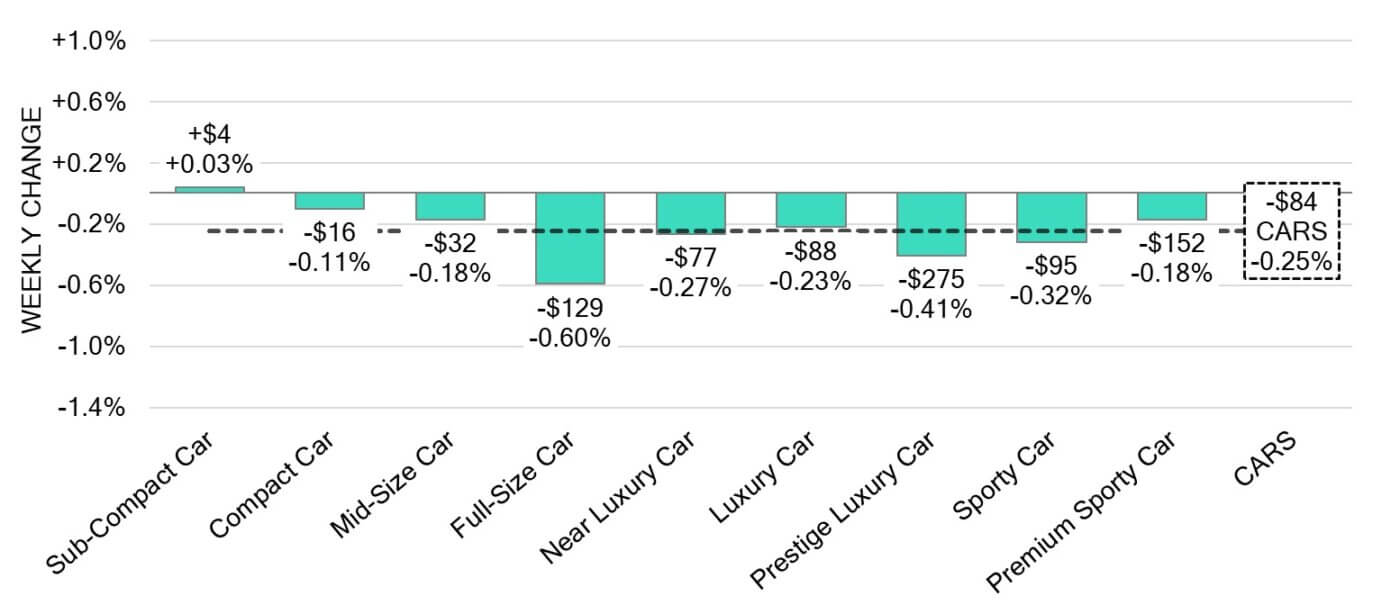

Car Segments

- Last week there was an overall decrease of -0.25% across Car segments. This decrease was noted across eight out of nine segments.

- The Sub-Compact Car segment (+0.03%) saw an increase, while Compact Car (-0.11%) and Mid-Size Car (-0.18%) showed the smallest declines.

- The largest decreases were seen from Full-Size Car (-0.60%), Prestige Luxury Car at (-0.41%) and Sporty Car at (-0.32%).

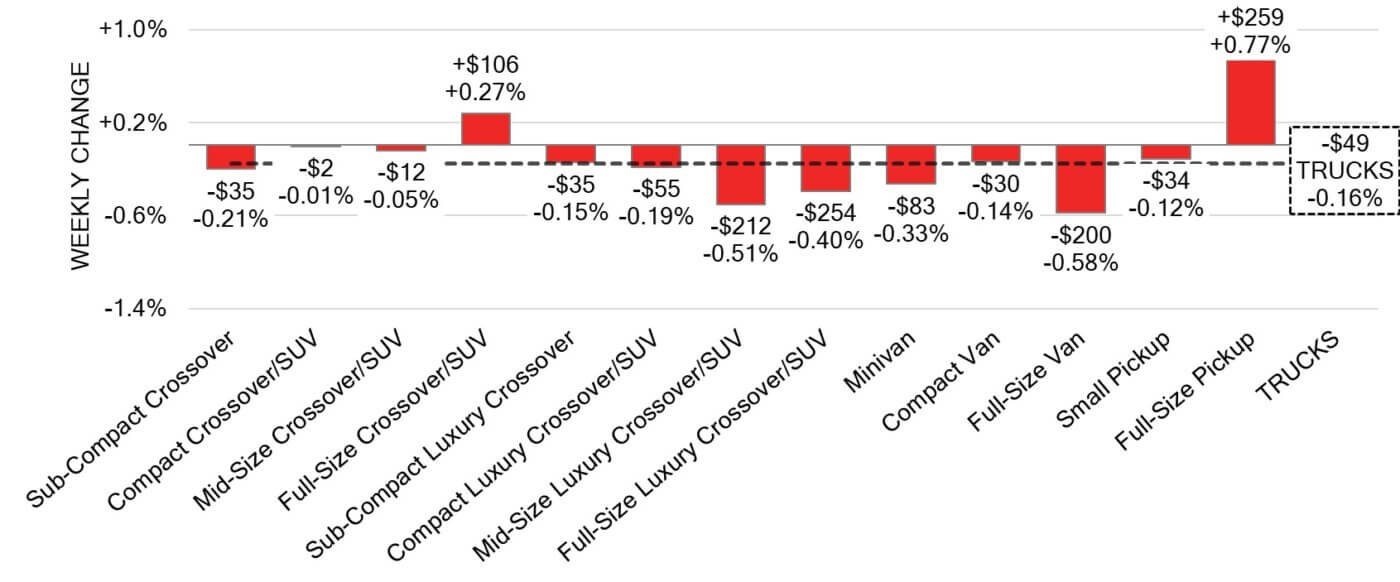

Truck / SUV Segments

- Last week there was an overall decrease of –0.16% in truck segments. This shift was seen within eleven of the thirteen segments.

- Segments with the largest declines were Full-Size Van (-0.58%) Mid-Size Luxury Crossover/SUV (-0.51%) and Full-Size Luxury Crossover/SUV (-0.40%).

- Two segments showed an increase. Full-Size Pickup (+0.77%) and Full-Size Crossover/SUV (+0.27%).

Wholesale

The Canadian market is still trending downward; however, the decline is less significant than it was the previous week. Over 36% of market segments experienced an average value change of more than ±$100, which is nearly the same as last week. Among these, Car segments experienced a 19% smaller decline compared to the previous week. Monitored auction sale rates ranged from 26% to 76%. The fluctuations in sale rates across various lanes can be attributed to the ongoing decline in floor prices. A reduction in supply entering the wholesale market has been observed as upstream channels continue to obtain early access. There continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

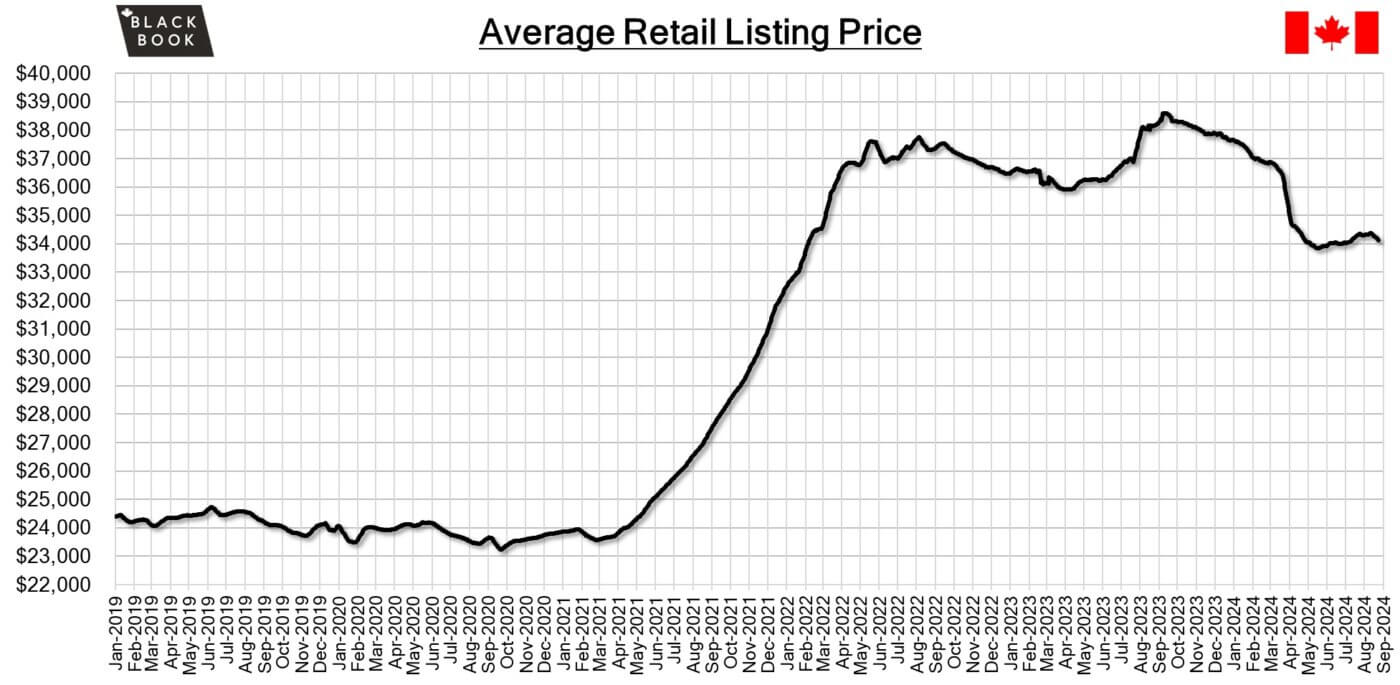

Used Retail Prices & Listing Volume

The average listing price for used vehicles is stable, as the 14-day moving average was at $34,200. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The yearly inflation rate in Canada dropped to 2.5% in July 2024 from 2.7% in the prior month, aligning with market forecasts. This marks the smallest rise in consumer prices since March 2021.

- In July 2024, the Raw Materials Price Index in Canada unexpectedly increased by 0.7% compared to the previous month, defying market expectations of a 0.7% decline. This rise comes after a downwardly revised 1.7% decline in the previous month.

- Retail sales in Canada are projected to have soared by 0.6% from the previous month in July of 2024.

- The yield on the Canadian 10-year government bond decreased slightly to 3.05%.

- The Canadian dollar is around $0.742 this Monday morning, representing an increase from $0.732 a week prior.

U.S. Market

- As we approach the last week of August and the Labor Day holiday, the market shifted, with the overall Truck market seeing an increase in values last week, and Car depreciation slowing to a typical seasonal decline for this time of year.

Industry News

- The two largest railways in Canada have been ordered by the Federal Government to restart operations after a lockout was announced and executed, the effects of which could decimate supply chains for fully assembled vehicles as well as auto parts from within and outside of North America.

- Ford realigns product plans as it cancels its 3-row electric Crossover and next generation electric Pick-up, incurring a $400 million charge-off as it pivots a $1.9 billion strategy that will allow it to move more swiftly to smaller and more affordable EV’s coming in 2027.

- The VW Group also changes pace on EV investments as it scales back plans for Battery Cell factories in Europe and North America as the global market slows on transitioning to EV’s.

- The struggling Stellantis business in North America will see its global CEO, Carlos Tavares visit headquarters in effort to reverse lagging profit as a mix of rising days’ supply and manufacturing issues put it in hot water as it is a significant source of revenue globally for the automaker.

- Stellantis has hired Rivian VP of Manufacturing, Tim Fallon to help improve manufacturing, especially as many new electric vehicles come online for the brands in the short-term.

- General Motors is cutting more than 1,000 technical jobs in its global software and services organization which includes some of the team at the Canadian Technical Centre in Markham, ON. The result is to improve speed through the goal of organizational simplicity.

- July iZEV rebates had another strong month of more than 20,000 claims which puts the current 2024 pace at more than double the rate of last year.