08.29.2023

Market Insights – 8/29/2023

Wholesale Prices, Week Ending August 26th

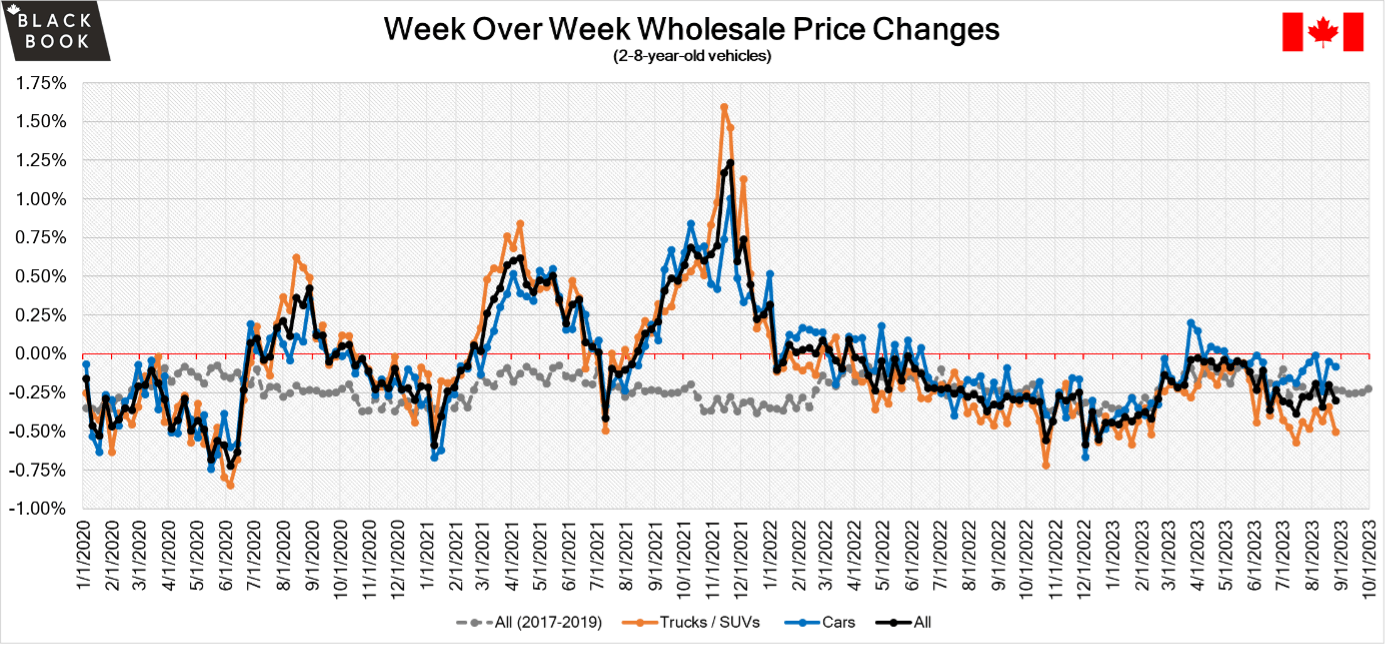

The Canadian used wholesale market saw a decline in prices for the week at -0.30%. The Car segment fell by -0.08% and the Truck/SUVs’ segment prices declined -0.50%. 4 out of 22 segments’ values have increased for the week. The Small Pickup segment was up 0.72% followed by the Full-Size Car segment at +0.55%. The segments with the largest declines were Compact Van, Full-Size Pickup and Full-Size Van which were all down -0.68%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.08% | -0.05% | -0.22% |

| Truck & SUV segments | -0.50% | -0.34% | -0.25% |

| Market | -0.30% | -0.20% | -0.23% |

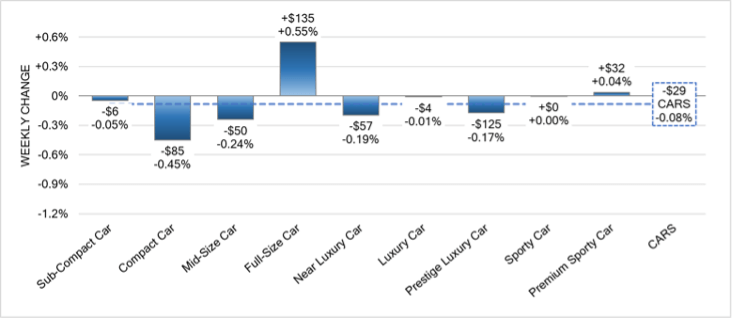

Car Segments

- Last week there was an overall decrease of -0.08% within the Car Segments

- Three of the nine segments showed an increase in pricing. The segments with the largest increase were Full-Size Car (+0.55%) followed by Premium Sporty Car at (+0.04%).

- The segment with the most significant decrease was Compact Car once again, this time sitting at (-0.45%). Mid-Size Car follows suite with (-0.24%), trailed by Near Luxury Car (-0.19%) and Prestige Luxury Cars at (-0.17%).

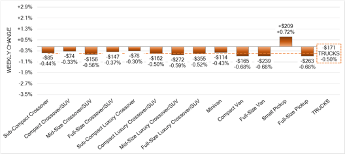

Truck Segments

- Last week there was an overall decrease of -0.50% in truck segments.

- All but one of the thirteen truck segments had decreases. Three segments had the same decrease which was also the largest across all truck segments. These segments were Compact Van, Full-Size Van and Full-Size Pickup (-0.68%)

- Like the previous week, the only segment to have an increase in pricing was Small Pickups (+0.72%).

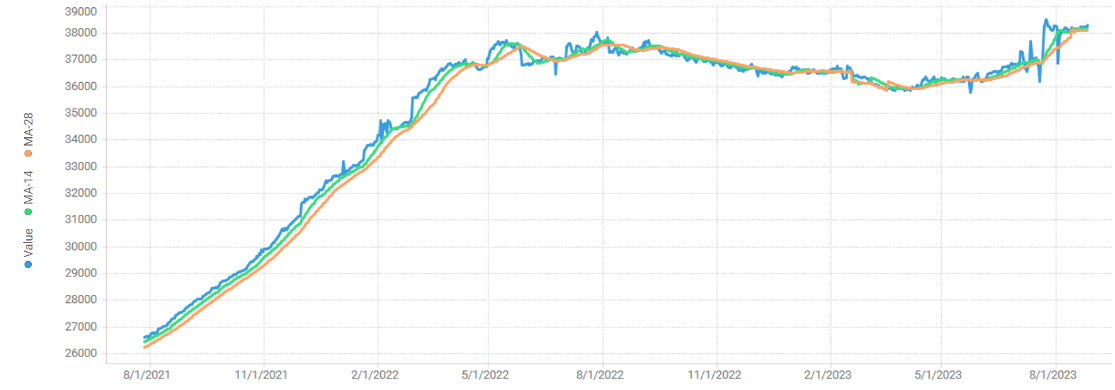

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,100. Analysis is based on approximately 190,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of more than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 16% but most were in the 35-45% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- The Canadian government budget surplus narrowed to 2.1 billion dollars in June 2023 down from 4.9 billion dollars in June 2022.

- Home prices declined by 0.1% month over month in July after two months of increases.

- Canadian 10-year bond yields fell to 3.7% in last week.

- The Canadian dollar is around $0.735 this Monday morning down from $0.738 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.86% last week; the prior week decreased by -1.52%.

Volume-weighted Car segments decreased -0.83%, compared to the prior week’s -1.73% decrease:

- The 0-to-2-year-old Car segments were down -0.37% and 8-to-16-year-old Cars declined -1.49%, compared with the prior week’s declines of -1.20% and -1.90%, respectively.

- Eight of the nine Car segments decreased last week and three of those had declines exceeding 1%.

- Premium Sporty Car increased +0.46% last week. The size of the segment is small and last week’s performance was heavily influenced by strength of the Chevrolet Corvette.

- For the three weeks the Compact Car segment was declining more than 2% each week, but this week the depreciation slowed to -1.37% and the highest depreciation went to the Sub-Compact Car segment that dropped -2.10%. Sub-Compact Car has now averaged -1.59% depreciation per week over the past four weeks.

Volume-weighted Truck segments decreased by -0.87%; the previous week decreased -1.43%:

- The 0-to-2-year-old models declined -0.73% last week, while the 8-to-16-year-olds declined -0.95%.

- All thirteen Truck segments declined last week, with five of the segments declining more than 1%.

- The Full-Size Crossover/SUV segment had the largest decline last week, down -1.49%. The segment has averaged a weekly decline of -1.50% over the past four weeks.

- Full-Size Pickups had a couple of weeks of large declines, primarily driven by drops in the 1500 series trucks, but the rate of decline slowed last week to -0.57%.

- Compact and Full-Size Vans continue to have the lowest depreciation, declining -0.39% and -0.46%, respectively, last week.

Industry News

- Acura recently released its fully electric luxury SUV, the ZDX, as an all-new take on the past nameplate that will use underpinnings from GM’s Ultium platform also to be seen under the Chevrolet Blazer EV. Honda and Acura also announced that their EVs will adopt the industry trending NCS connectors in 2025 that are currently used by Tesla.

- As the car market continues its transition away from small and inexpensive vehicles, another example has announced it will be discontinued for the 2024 model year. The Kia Rio has long been a mainstay in the subcompact car segment, but like many others in its class will also not return.

- The hotly awaited next generation Nissan Kicks will have to wait longer to reach the market now, as tooling equipment from its Mexico plant was stolen, forcing Nissan Motor Co. to delay production of the vehicle. Production, which was slated to originally start this December, will start in June 2024.

- Consumer electronics usage in vehicles has long been discussed, and as they grow in usage the battle between USB-A (the original USB introduced in 2006) and USB-C is progressing. Manufacturers are still mixed on excluding one or the other with consumers usually seeing both. At 240 watts, USB-C is the obvious choice as USB-A supports only 7.5 watts. But with a mix of consumers and their devices within cars, the choice is still not clearly defined.