08.06.2025

Market Insights – 8/5/25

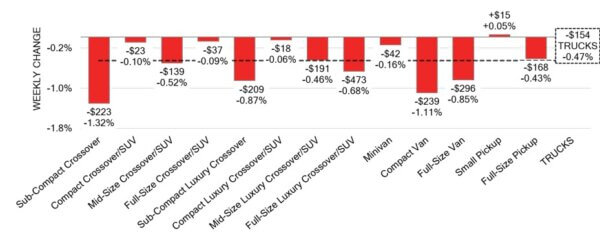

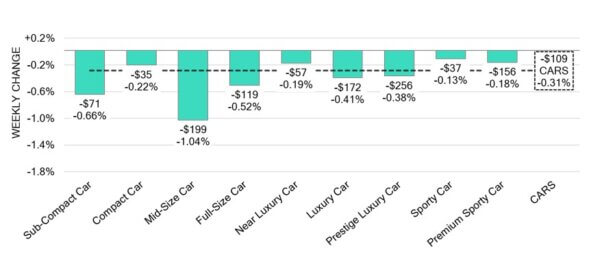

Wholesale Prices, Week Ending August 2nd, 2025

The Canadian used wholesale market saw a decline of -0.40% in pricing for the week. Car segments prices decreased by –0.31% while the Truck/SUV segments decreased by -0.47%. This Weeks positive segment has been Small Pickup at +0.05%. The largest declines in the Car segments were seen in Mid-Size Car at -1.04% and Sub-Compact Car with -0.66%. The largest declines in the Truck/SUV segments were Sub-Compact Crossover/SUV at -1.32% followed by Compact Van with -1.11%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.31% | -0.20% | -0.22% |

| Truck & SUV segments | -0.47% | -0.18% | -0.29% |

| Market | -0.40% | -0.18% | -0.25% |

Car Segments

- There was an overall depreciation of -0.31% seen in car segments last week. All nine categories echoed this movement.

- Segments with the most notable declines were Mid-Size Car (-1.04%), followed by Sub-Compact Car (-0.66%), Full-Size Car (-0.52%) and Luxury Car (-0.41%).

- Those with the smallest declines were Sporty Car (-0.13%) and Premium Sporty Car (-0.18%).

Truck / SUV Segments

- Last week truck segments showed an overall softening of-0.47%. Twelve of the thirteen categories reflected this movement.

- Segments with the largest declines were Sub-Compact Crossover (-1.32%), Compact Van (-1.11%), Sub-Compact Luxury Crossover (-0.87%) and Full-Size Van (-0.85%).

- One segment displayed an opposite shift with a small bump in values. That segment was Small Pickup (+0.05%).

Wholesale

The Canadian market’s decline in pricing continues with a decrease less pronounced than in its previous week. The decline in car segment values increased by 0.11% resting at -0.31%. The decline in truck segment prices also increased, this time by 0.29% bringing its change to -0.47%. Just over 59% of the market segments experienced an average value change of more than ±$100. Monitored auction sale rates ranged from 15.8% to 62.5% averaging at 32.1%. There has been a continuous fluctuation in sale rates across various auction lanes that can be attributed several factors including, economic uneasiness, political variants and sellers holding strong on floor prices. Even with supply remaining stable, upstream channels continue to gain early access to frontline ready vehicles. There remains a continued demand for inventory and high-quality vehicles at auctions on both sides of the border.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,700. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- The Bank of Canada kept its key interest rate steady at 2.75% in its July 2025

decision, as markets had anticipated. This marks the third time in a row the rate

has stayed the same after a total decrease of 2.25 percentage points over seven

straight decisions. - In May 2025, average weekly earnings in Canada increased by 3.3% compared

to the previous year, reaching $1,294. This growth rate was lower than the

revised 4.3% increase reported in April. - Canada’s total imports increased by 1.4% in June 2025, marking the first rise in

four months. This growth was seen in five out of eleven product categories. - The yield on the Canadian 10-year government bond decreased to 3.36%.

- The Canadian dollar is around $0.726 this Monday morning, down slightly from

$0.729 a week prior.

U.S. Market

- Depreciation in July surpassed typical seasonal levels, yet auction conversion rates remained steady nationwide. As a result, August began with moderating depreciation, down -0.37%, compared to the pre-pandemic average of -0.25%.

Industry News

- U.S. President Donald Trump signed another executive order that will raise import tariffs on Canadian goods from 25 to 35%, citing the lack of progress on the eliminating the transport of Fentanyl across Canadian borders as the main reasoning for the increase. USMCA compliant automakers were excluded from the order and will still be applied the10% tariff that was previously imposed on them.

- In other tariff news, Mexico had been threatened with 30% tariffs from President Donald Trump, but that has now been extended90 days to allow for negotiations between the two countries.

- Citing current market conditions as the reason, Mercedes-Benz has closed its order bank for its EQS and EQE electric models as it will pause production of them for the United States as of September 1st but will continue to build them for global export out of its assembly plant in Vance, Alabama.

- The Bank of Canada has decided on rates remaining unchanged as of July 30th, with the opportunity to start lowering rates again if overall growth slows more significantly. The continued pause on rates is not anticipated to impact new vehicle retail sales as manufacturers continue advertising lower lease and finance rates amidst building inventory.

- CanadaOne Auto Group and AutoCanada have both announced separate digital retailing partners with Canada One joining AutoTrader and AutoCanada joining CarGurus.

- JLR’s Global Head, Adrian Mardell is retiring after 35 years with the company and the last 3 as CEO. This comes at a time of uncertainty for the brand with no decision as to who replaces Mardell going forward. Mardell will retire from his post as of December 31st.