08.09.2023

Market Insights- 8/9/2023

Wholesale Prices, Week Ending August 5th

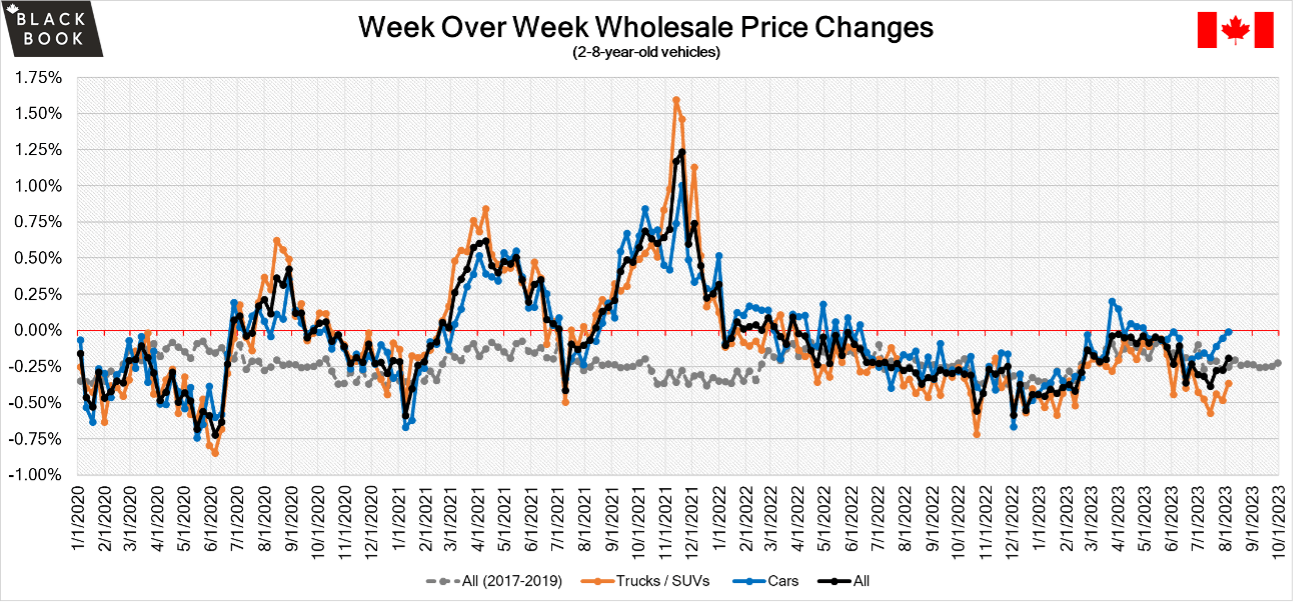

The Canadian used wholesale market saw a decline in prices for the week at -0.19%. The Car segment fell by -0.01% and the Truck/SUVs’ segment prices declined -0.36%. 6 out of 22 segments’ values have increased for the week. The Compact Van segment was up 0.64% followed by the Mid-Size Car segment at +0.32%. The segments with the largest declines were Full-Size Pickup (-0.58%) followed by Mid-Size Crossover/SUV (-0.57%).

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.01% | -0.05% | -0.22% |

| Truck & SUV segments | -0.36% | -0.48% | -0.29% |

| Market | -0.19% | -0.27% | -0.25% |

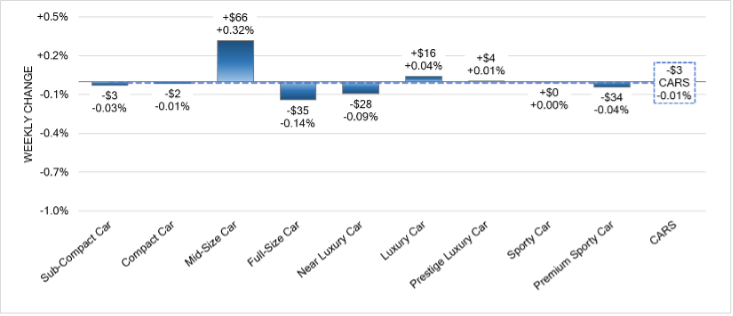

Car Segments

- Last week there was an overall decrease of -0.01% seen within Car Segments.

- Four of nine segments showed an increase in pricing. The segment with the largest increase was Mid-Size Car (+0.32%), followed by Luxury Car at (+0.04%) and Prestige Luxury Car at (+0.01%).

- The segments with the largest decreases in pricing were Full-Size Car at (-0.14%) and Near Luxury Car at (-0.09%).

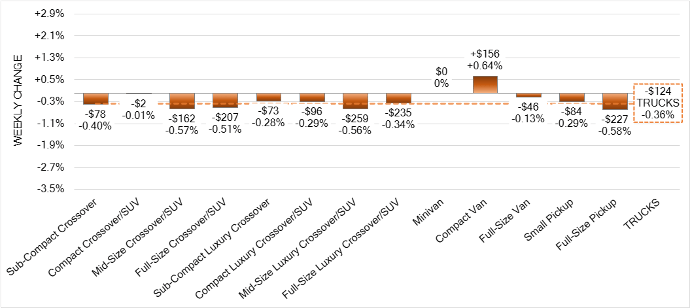

Truck Segments

- Overall truck segments decreased on average by -0.36% last week.

- Eleven of the thirteen truck segments had decreases. Full-Size Pickup had the largest drop (-0.58%), followed by Mid-Size Crossover/SUV (-0.57%) and Mid-Size Luxury Crossover/SUV (-0.56%).

- One segment had an increase. That segment was Compact Van (+0.64%).

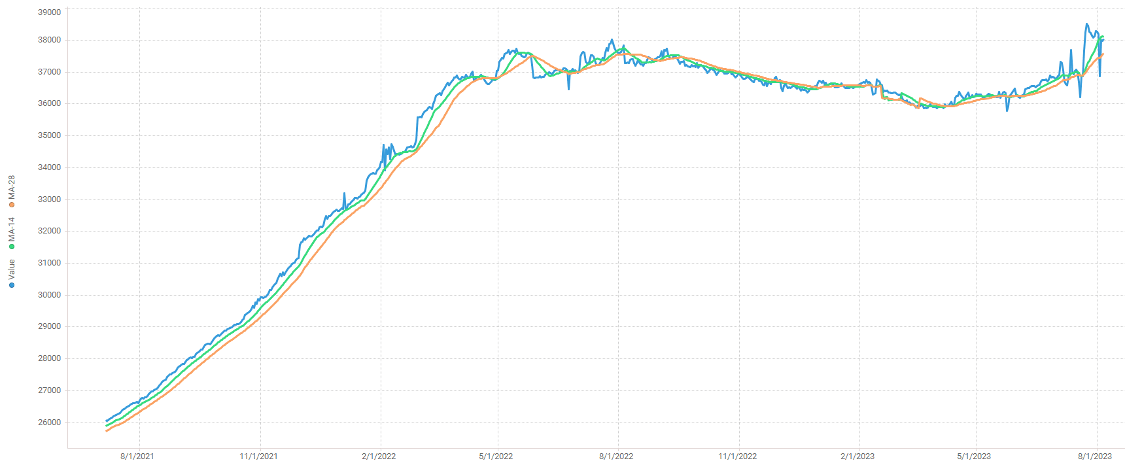

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,000. Analysis is based on approximately 187,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of less than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 18% and as high as 56% but most were in the 20-40% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

- Canada’s unemployment rate increased to 5.5% in July from 5.4%in the previous month.

- S&P’s Global Canada Manufacturing PMI rose to 49.6 in July of 2023 from 48.8 in June, beating market expectations of 48.9 but marking a third consecutive month of contraction in the Canadian manufacturing sector.

- Canadian 10-year bond yields climbed to 3.7% in August.

- The Canadian dollar is around $0.744 this Monday morning down from $0.756 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -1.10% last week; the prior week decreased by -0.37%.

Volume-weighted Car segments decreased -1.36%, compared to the prior week’s -0.27% decrease:

- The 0-to-2-year-old Car segments were down -1.13% and 8-to-16-year-old Cars declined -1.02%.

- All nine Car segments decreased last week.

- Compact Car had the largest decline last week, down -2.12%, compared with the prior week’s change of -0.66%. The segment has now had eleven consecutive weeks of declines with an average weekly change of -0.67%.

- Premium Sporty Car had the smallest drop last week, down -0.59%. However, it was the largest drop for the segment since February.

Volume-weighted Truck segments decreased by -0.98%; the previous week decreased -0.41%:

- The 0-to-2-year-old Truck segments reported a smaller decline last week (-0.97%), but the 8-to-16-year-olds declined more, depreciating by -0.55%.

- All thirteen Truck segments reported a decrease last week.

- The Full-Size Crossover segment depreciated -2.25% last week. This was significantly more than the older 8-to-16-year-old Full-Size Crossovers that declined -0.73%.

- The Small Pickup segment also had a large decline last week, down -1.64%. This compares with the prior six weeks that have averaged -0.37% depreciation each week.

Industry News

- 140,942 vehicles were sold in July, according to Desrosiers Automotive Consultants, lifting the year-over-year comparison in July to 8% above 2022. Compared to 2019, almost all manufacturers are still well below previous results with Subaru as the only carmaker bucking that trend with sales resulting almost equal to that of 2019.

- For the first time since 1989, the Toyota Land Cruiser will return to Canadian soil in its new generation set to release as a 2024MY. The Land Cruiser has been a cult classic in North America ever since, with the new generation building on its previous success now marketing itself as a more accessible mainstream product that moves into the electrified space with a Land Cruiser first – 4-cylinder hybrid powertrain.

- Canadian EV registrations have now been calculated on average reaching 4,200 Federal rebates per month as the metric was measured from May of 2019, marking a positive sentiment as the recent Q1 ZEV market share declined from the previous quarter. This metric has recently been on a huge upswing as plug-in hybrid market share continues to increase in the wake of BEV declines.

- The latest update on semiconductor shortages shows a recent increase in production cuts as continued positivity is cited around this issue weakening; but the focus around the uptick in cuts is around South American production amounting to 57,000 of the roughly 104,000 unit increase in AutoForecast Solutions most recent numbers.