09.11.2024

Market Insights – 9/11/2024

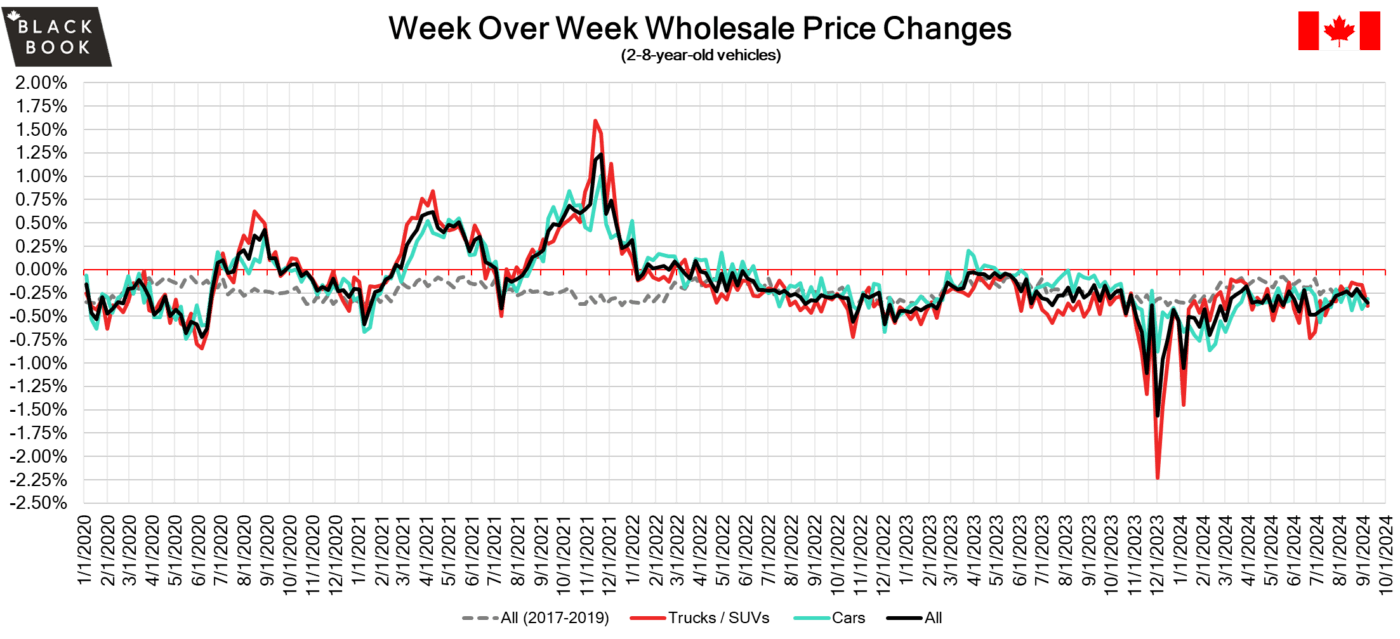

Wholesale Prices, Week Ending September 7th, 2024

The Canadian used wholesale market experienced a decline of –0.35% in pricing for the week. Car segments prices decreased by –0.31% while the Truck/SUVs segments dropped -0.39%. Full-Size Crossover/SUVs and Sub-Compact Cars both saw price increases of +0.04%. The largest declines noted were seen in Mid-Size Luxury Crossover/SUVs with –0.75% followed by Sporty Car at –0.69%, Mid-Size Car at –0.65% and Full-Size Luxury Crossover/SUVs at –0.63%.

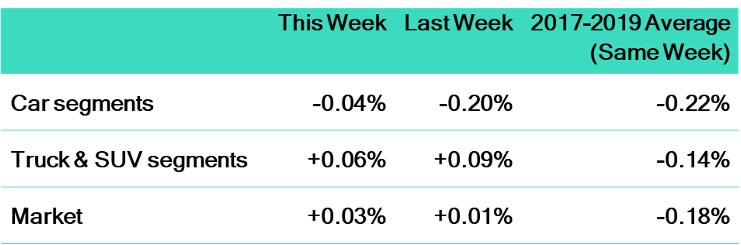

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.31% | -0.43% | -0.27% |

| Truck & SUV segments | -0.39% | -0.16% | -0.25% |

| Market | -0.35% | -0.29% | -0.26% |

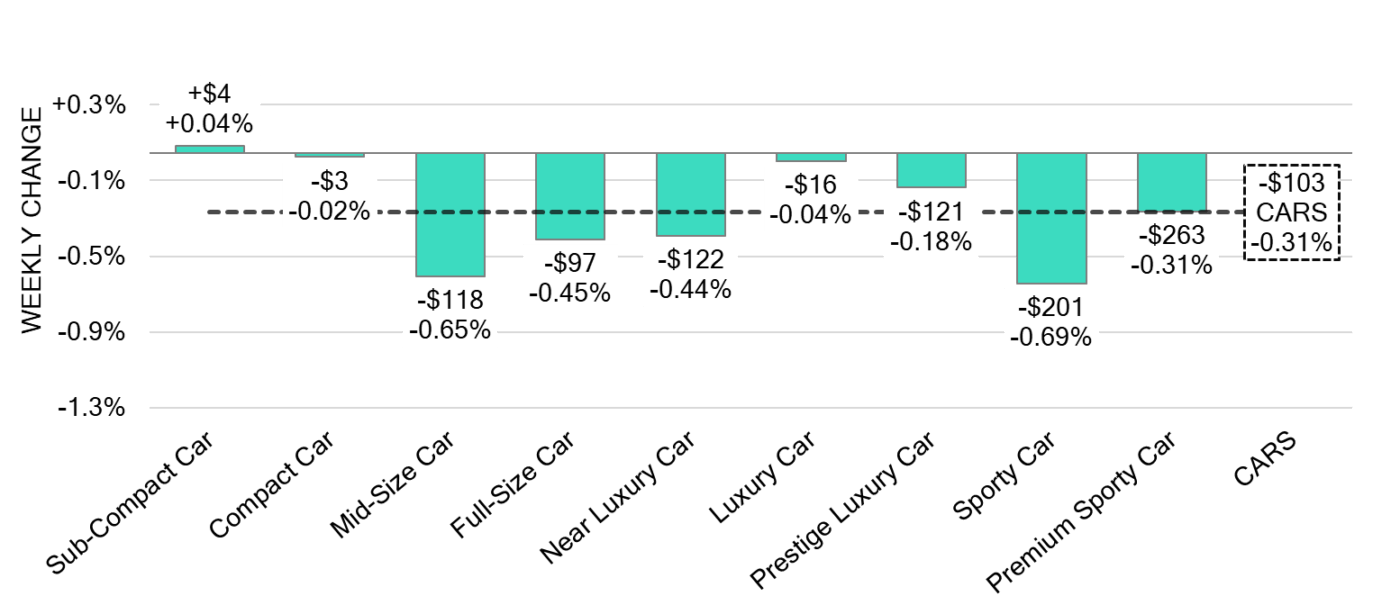

Car Segments

- Last week there was an overall decrease of -0.31% across Car segments. This decrease was noted across eight out of nine segments.

- The Sub-Compact Car segment (+0.04%) saw an increase, while Compact Car (-0.02%) and Luxury Car (-0.04%) showed the smallest declines.

- The largest decreases were seen from Sporty Car (-0.69%), Mid-Size Car at (-0.65%) and Full-Size Car at (-0.45%).

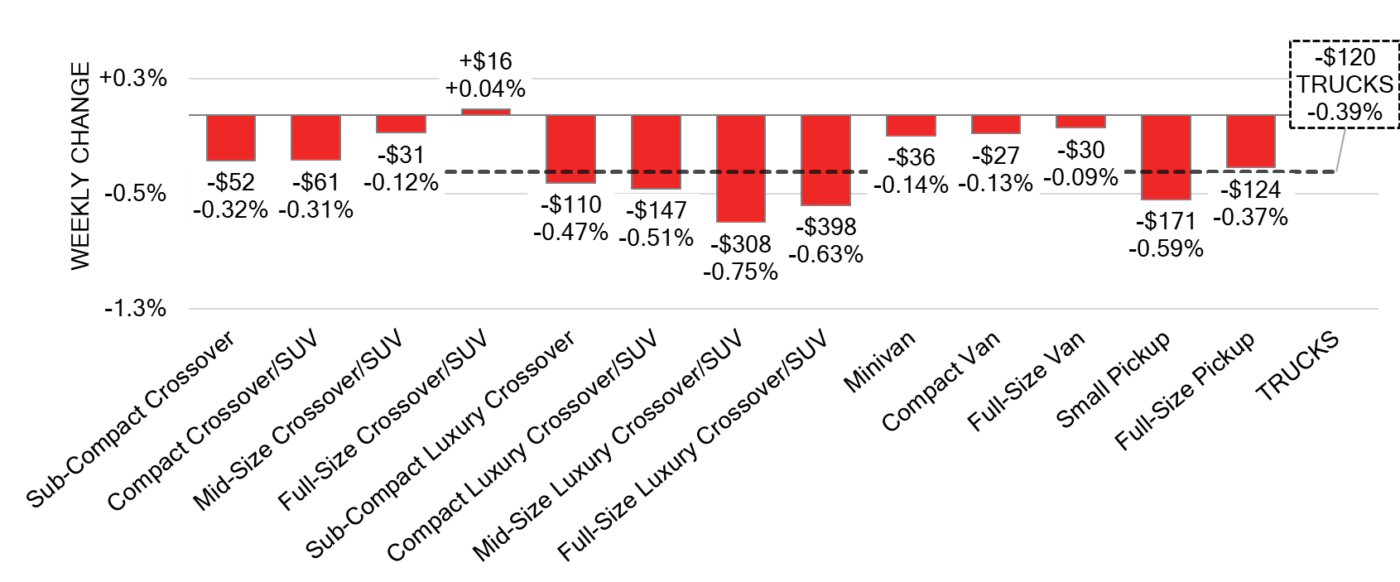

Truck / SUV Segments

- Truck segments reflected an overall depreciation of –0.39% last week. This was seen in twelve out of thirteen segments.

- Segments with the largest declines were Mid-Size Luxury Crossover/SUV (-0.75%), Full-Size Luxury Crossover/SUV (-0.63%), Small Pickup (-0.59%) and Compact Luxury Crossover/SUV (-0.51%).

- One segment showed a small positive change. That segment was Full-Size Crossover/SUV (+0.04%).

Wholesale

The Canadian market continues to trend downward, with a decline more pronounced than the previous week. Exactly 50% of market segments experienced an average value change of more than ±$100, indicating a higher rate than the previous week. Among these, Truck segments experienced a 23% larger decline compared to the previous week. Monitored auction sale rates ranged from 14% to 81% averaging at 53.4% The fluctuations in sale rates across various lanes can be attributed to the ongoing decline in floor prices. A decrease in supply entering the wholesale market has been noted as upstream channels continue to gain early access. There continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

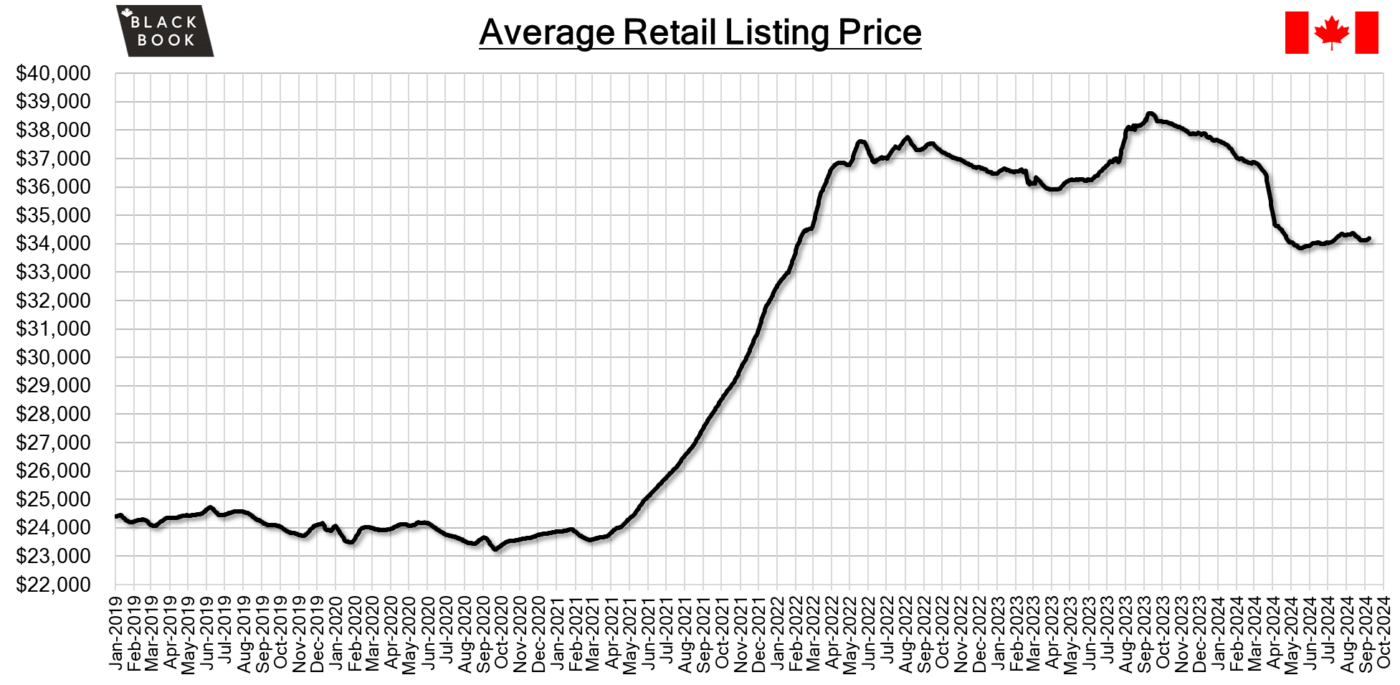

Used Retail Prices & Listing Volume

The average listing price for used vehicles is stable, as the 14-day moving average was at $34,100. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In its September 2024 meeting, the Bank of Canada lowered its key interest rate by 25 basis points to 4.25%, as anticipated. This decision marks the third consecutive cut of 25 basis points, following a period of maintaining the terminal rate of 5% for ten months during the previous hiking cycle.

- In August 2024, Canada’s unemployment rate increased to 6.6%, up from 6.4% the previous month. This marked the highest rate since October 2021 and exceeded market expectations of 6.5%.

- The S&P/TSX Composite Index turned around its initial gains and finished the day down by 0.9%, closing at 22,781 on Friday. This decline reflected a broader global selloff in risk assets, as concerns about a potential US recession were fueled by disappointing jobs data.

- The yield on the Canadian 10-year government bond decreased slightly to 3.03%.

- The Canadian dollar is around $0.738 this Monday morning, representing a slight decline from $0.741 a week prior.

U.S. Market

- The market continues to deviate from seasonal norms, with another week of increasing wholesale values. Ten of the twenty-two vehicle segments tracked by Black Book reported value increases last week. Meanwhile, a majority of the luxury segments continue to decline.

Industry News

- Desrosiers Auto Consultants predict new car sales to start to slow for the remainder of the year. August sales reached 5.6% greater than 2023, but in the months following, stronger sales began last year as recovering product volume made serious headway – expectations for the remainder of 2024 are estimated to fall short of YoY comparisons.

- Toyota has downgraded its 2026 EV output expectations from 1.5 million units to 1 million units as they join the host of OEMs scaling back electric vehicle production as global demand slows.

- Volvo has also just announced it has backed off its initial bullish EV target where it said it would only sell fully electric models by 2030. The Swedish car maker will look to sell a mix of mild hybrids, plug-in hybrids as well as some full electric models.

- The sole body-on-frame SUV in Nissan’s lineup, the Armada, receives a full redesign for 2025MY where it introduces an off-road trim under the brands PRO-4X name, as well as dropping its historical V8 powertrain in favour of turbocharged 6-cylinder propulsion. The engine change reflects the same changes to the luxury QX80 variant from Infiniti. But news of a possible additive hybrid system could make its way into the big Nissan.

- Audi refreshes its smallest model, the A3/S3 sedan with upgraded looks and power figures from its 2.0T engine which will arrive at dealers in Q4.

- As consumers battle increased car prices, insurance premiums and gas prices, J.D. Power has released data on how high dealership maintenance costs have increased as well, siting $465 on average paid every visit, a 7.6% increase over last year.