09.12.2023

Market Insights – 9/12/2023

Wholesale Prices, Week Ending September 9th

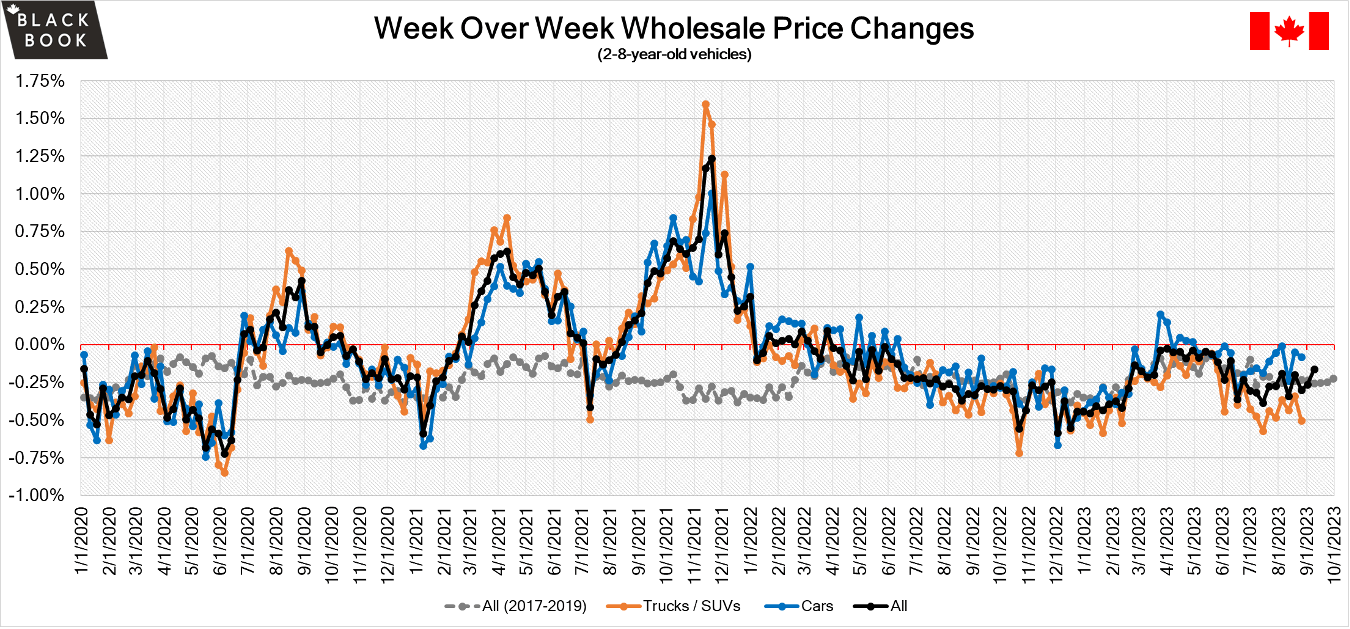

The Canadian used wholesale market saw a decline in prices for the week at -0.16%. The Car segment fell by -0.06% and the Truck/SUVs’ segment prices declined -0.25%. 4 out of 22 segments’ values have increased for the week. The Small Pickup segment was up 1.30% followed by the Sub-Compact Car segment at +0.07%. The segments with the largest declines were Full-Size Crossover/SUV at –0.64% followed by Full-Size Luxury Crossover/SUV at –0.61%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.06% | -0.09% | -0.27% |

| Truck & SUV segments | -0.25% | -0.42% | -0.25% |

| Market | -0.16% | -0.26% | -0.26% |

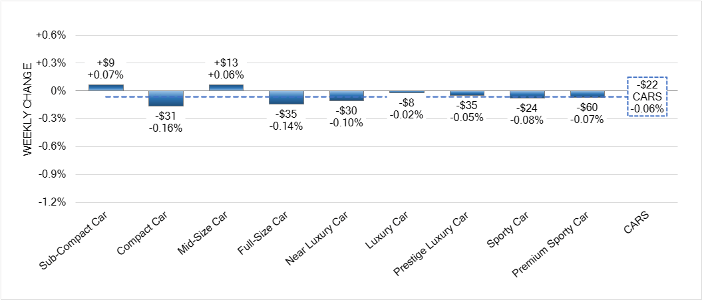

Car Segments

- There was an overall decrease of -0.06% within the Car Segments last week.

· Seven of the nine segments showed a drop in pricing. The segments with the largest decline were Compact Car (-0.16%) followed by Full-Size Car (-0.14%) and Near Luxury Car (-0.10%). - The two segments with an increase were Sub-Compact Car (+0.07) and Mid-Size Car (+0.06%).

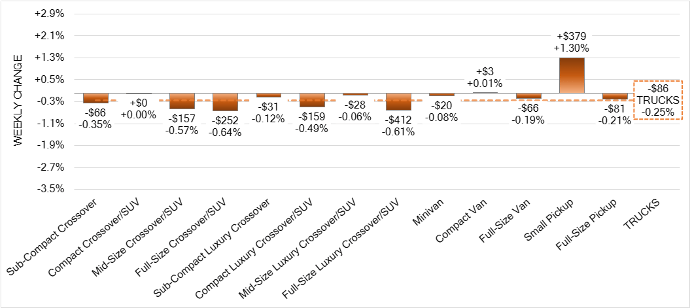

Truck Segments

- Truck segments showed an overall decrease of -0.25% last week.

- Eleven of the thirteen truck segments showed a decline. Full-Size Crossover/SUV had the largest drop (-0.64%), followed by Full-Size Luxury Crossover/SUV (-0.61%) and Mid-Size Crossover/SUV (-0.57%).

- Segments with an increase in value were Small Pickup (+1.30%) and Compact Van (+0.01%).

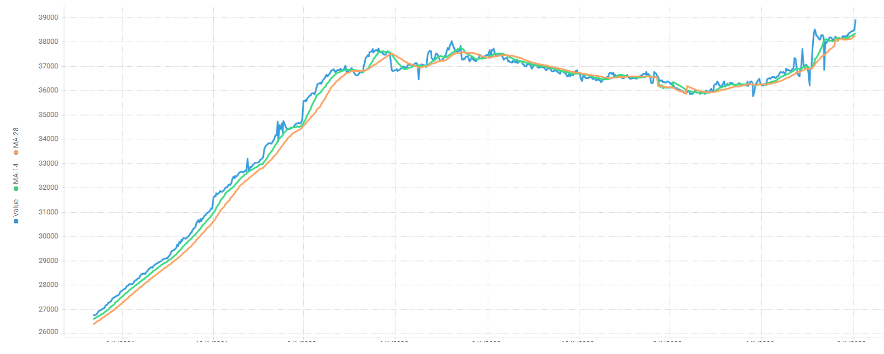

Used Retail Prices & Listing Volumes

The average listing price for used vehicles was consistent week-over-week, as the 14-day moving average was at roughly $38,250. Analysis is based on approximately 189,000 vehicles listed for sale on Canadian dealer lots.

Wholesale

The Canadian market continued to decrease, and the overall decrease was similar to the historical average. Supply remains low with high demand for more recent and clean condition vehicles on both sides of the border. Upstream channels continue to tap supply before it can be available to wholesale markets. Many segments saw a change in average value of less than $100 this week as the Truck and SUV segments fell the most. Conversion rates were quite varied. Some observed sell rates were as low as 16% but most were in the 35-55% range. Last week we saw less sellers dropping floors, which has been contributing to lanes with lower sell rates.

Canadian Black Book’s Market Insights

Economics & Government

• The Bank of Canada held interest rates at 5% in its September meeting as expected after GDP numbers were announced the prior week.

• Canada added 39,900 jobs in August which exceeded market expectations of 15,000.

• Canadian 10-year bond yields rebounded to 3.67% in last week after falling from weak GDP numbers.

• The Canadian dollar is around $0.736 this Monday morning up from $0.734 a week prior.

U.S. Market

In the U.S., overall, Car and Truck segments decreased -0.75% last week; the prior week decreased by -1.40%.

Volume-weighted Car segments decreased -0.89%, compared to the prior week’s -1.44% decrease:

- The 0-to-2-year-old Car segments were down -0.54% and 8-to-16-year-old Cars declined -1.09%.

- Eight of the nine Car segments decreased last week, with two of those reporting declines exceeding 1%.

- Compact Car (-1.21%) and Mid-Size Car (-1.10%) had the largest declines last week. Compact Car has now had six consecutive weeks of declines with an average weekly depreciation of -1.81%.

- Premium Sporty Car increased for a third consecutive week, up +0.28%. In smaller segments like Premium Sporty Car, changes on individual models can have a big impact on the overall segment change week-to-week. The strength seen here is mainly being driven by demand for the Chevrolet Corvette.

Volume-weighted Truck segments decreased by -0.69%; the previous week decreased -1.38%:

- The 0-to-2-year-old models declined -0.47% last week, while the 8-to-16-year-olds declined -0.73%.

- All thirteen Truck segments declined last week, and four of the thirteen had declines exceeding 1%.

- Sub-Compact Crossover had the largest decline last week, down -1.35%, compared with -1.55% the week prior. Sub-Compact Luxury Crossovers are also seeing large depreciation rates, down -1.34% last week, compared with -1.55% the week prior.

- Full-Size Truck depreciation has dramatically slowed down, with the segment declining by -0.30% last week, compared with the prior week’s decline of -1.12%.

Industry News

- August sales increased 18.3% over last year, as the momentum from increased new car production has continued to aid the car market. This now marks 10 consecutive months of growth in sales volume compared to last year, but August of last year was particularly weak; judging against August 2019 shows this year’s market still down 17.7%.

- As the market for suppliers manufacturing EV’s continues to develop, Magna International Inc. has identified a battery enclosure market that could net them a possible $2.5 Billion in revenue generation by 2027. Enclosures have seen a major area of growth for the global supplier with business coming from multiple manufacturers totaling 7 future models.

- Volvo Cars will be cutting jobs and minimizing expenses as it prepares itself for further EV investment. These changes will affect every department of the brand in North America and see 10% of its roughly 1,000 staff cut from the organization as it looks to tighten spending and become more efficient.

- The Ford Mustang Mach-E will be adding a new trim to its lineup, as the Mach-E Rally will receive a special two-motor layout producing at least 480hp and 650lb.ft. of torque, and as the name suggests will bring the Mach-E into the off-roader realm with special wheels and undercarriage protection. Canadian pricing has not yet been released.