09.16.2025

Market Insights – 9/16/25

Wholesale Prices, Week Ending September 13th, 2025

The Canadian used wholesale market saw a decline of -0.23% in pricing for the week. Car segments prices decreased by –0.23% while the Truck/SUV segments decreased by -0.22%. This Weeks positive segment was Minivan at +0.03%. The largest declines in the Car segments were seen in Full-Size Car at -1.62% and Prestige Luxury Car with -0.41%. The largest declines in the Truck/SUV segments were Full-size Luxury Crossover/SUV with -0.61% followed by Compact Van at -0.44%.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.23% | -0.19% | -0.27% |

| Truck & SUV segments | -0.22% | -0.37% | -0.25% |

| Market | -0.23% | -0.29% | -0.26% |

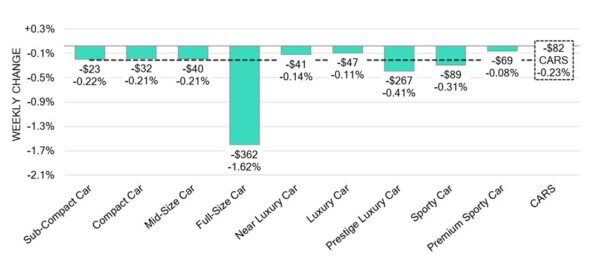

Car Segments

- Car segments experienced a depreciation of -0.23% last week. All nine categories reflected this movement.

- Those with the most notable declines were seen in Full-Size Car (-1.62%), Prestige Luxury Car (-0.41%), and Sporty Car (-0.31%).

- The smallest depreciations were seen in Premium Sporty Car (-0.08%), Luxury Car (-0.11%), and Near Luxury Car (-0.14%).

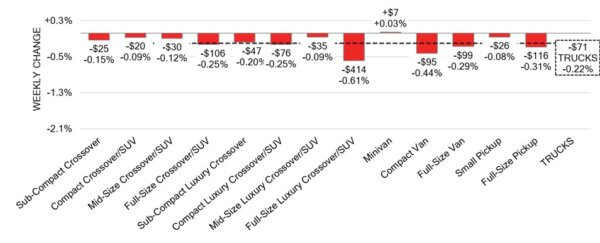

Truck / SUV Segments

- An overall devaluation of -0.22% was seen in truck segments last week. Twelve of the thirteen categories followed this direction.

- The largest declines were noted in Full-Size Luxury Crossover/SUV (-0.61%), Compact Van (-0.44%), Full-Size Pickup (-0.31%) and Full-Size Van (-0.29%).

- Segments with the smallest depreciations were Small Pickup (-0.08%), Compact Crossover/SUV and Mid-Size Luxury Crossover/SUV (-0.09%).

Wholesale

The Canadian market continues to trend downwards, with a trajectory showing a decline less steep in comparison to previous week. Car segments experienced a 0.04% adjustment, resulting in a drop of –0.23%. Truck segment values recorded a 0.15% change bringing the total decline to –0.22%. Just under 23% of market segments recorded an average value change exceeding ±$100. The week’s monitored auction sale rates ranged from 18.8% to 53.3%, averaging 39.3%. Sales rates across auction lanes have shown ongoing fluctuations, influenced by economic uncertainty, political factors, and sellers maintaining firm floor prices. Supply levels remain stable; however, upstream channels are still gaining priority sale access to inventory. Demand for inventory and high-quality vehicles persist at auctions on both sides of the border.

Used Retail Prices & Listing Volume

The average listing price for used vehicles is slightly decreasing, as the 14-day moving average was at $37,700. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- Canada’s industrial capacity utilization fell to 79.3% in Q2 2025, down from a

downwardly revised 79.9% in the previous quarter, yet remaining above market

expectations of 78.8%. - The total value of building permits in Canada slipped 0.1% month-over-month to

$11.9 billion in July 2025, following a sharp 9% decline in June. - Canada’s wholesale sales rose 1.2% month-over-month to $86.0 billion in July

2025 — the fastest pace since January — accelerating from a revised 1.0% gain in

June, though slightly below market forecasts of a 1.3% increase. - The yield on the Canadian 10-year government bond decreased to 3.12%.

- The Canadian dollar is around $0.725 this Monday morning, up slightly from

$0.724 a week prior.

U.S. Market

- Wholesale prices declined again last week, with Cars down -0.28% and Trucks/SUVs falling -0.34%. Market softness was broad, though a couple premium and crossover segments showed resilience. In contrast, smaller cars and entry-level luxury crossovers led declines, reflecting ongoing seasonal pressure and selective buyer demand. Auction conversion rates eased post-Labor Day, but remain over 60%, while retail conditions remained steady, with days-to-turn in the mid-30s.

Industry News

- Sales in Canada reached 8.6% zero-emission vehicles in Q2 2025, with a slight decline against Q1 there has been a shift away from battery-electric vehicles, now down to 5.4% from 6.2%, while plug-in hybrids are up to 3.2% from 2.5%.

- Ontario Economic Minister, Vic Fedeli said that Canada is looking for growth and sustainability opportunities away from the U.S. and towards the EU and United Kingdom, as an effort to find more reliable partners in the future.

- The Federal government has been looking at reducing the 100% tariff imposed on China to let Chinese EVs into the Canadian market as well as getting China to drop current agriculture tariffs imposed on Canada.

- Scout Motors has confirmed that it will source its EV batteries from VW Group’s subsidiary PowerCo from its facility in Canada. It will support production of the Terra and Traveler models coming out as the brands first vehicles to market.

- As demand slows for EVs in North America, Ram has decided to cancel its electric Ram 1500 pickup truck. The brand still plans to bring an electrified hybrid pickup to market, renaming it from Ramcharger to the original EV pickups ‘1500 REV’ name.

- As Lucid Motors prepares to sell its Gravity crossover in Canada, it’s said it anticipates bringing a lower priced base model in the U.S. late this year, while in 2026 it looks to bring a more affordable compact crossover to market for North America.