09.17.2024

Market Insights – 9/17/2024

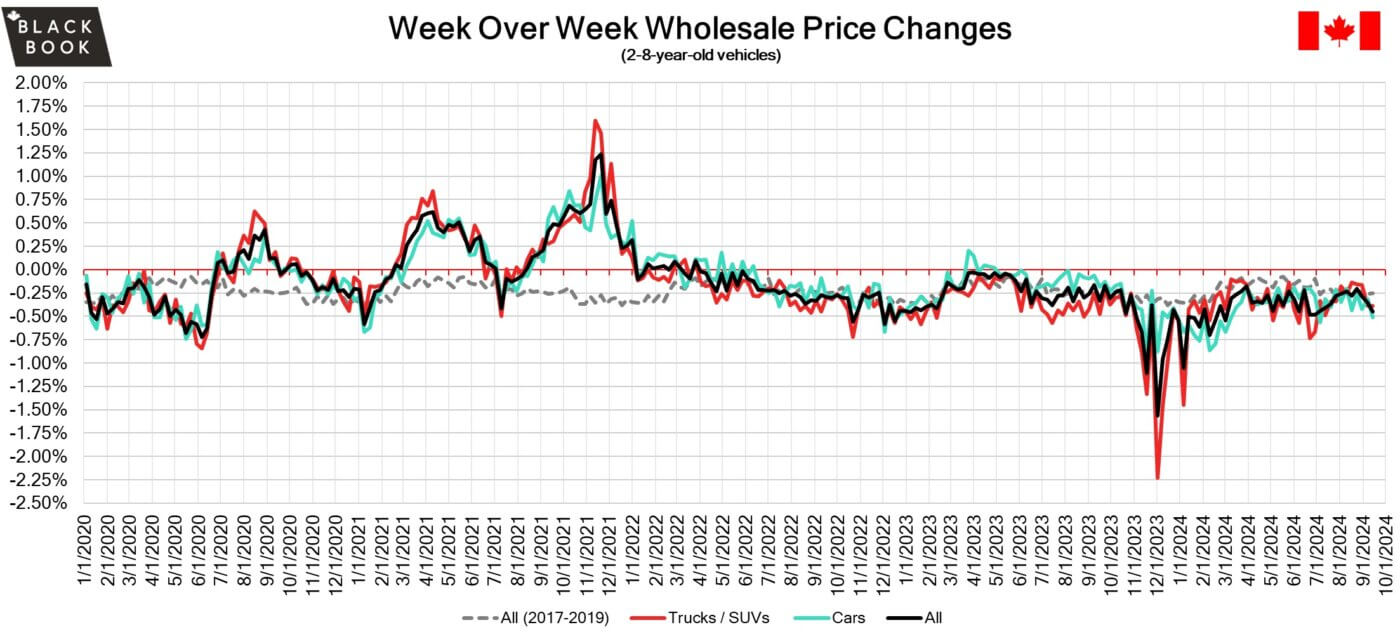

Wholesale Prices, Week Ending September 14th, 2024

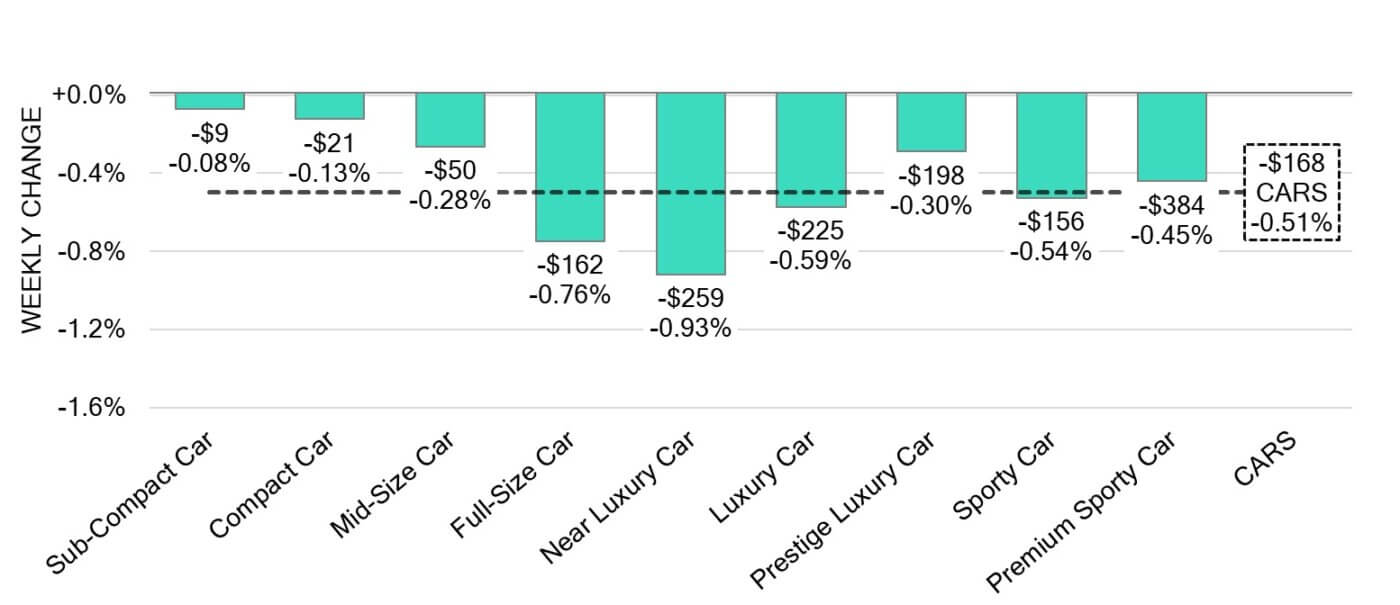

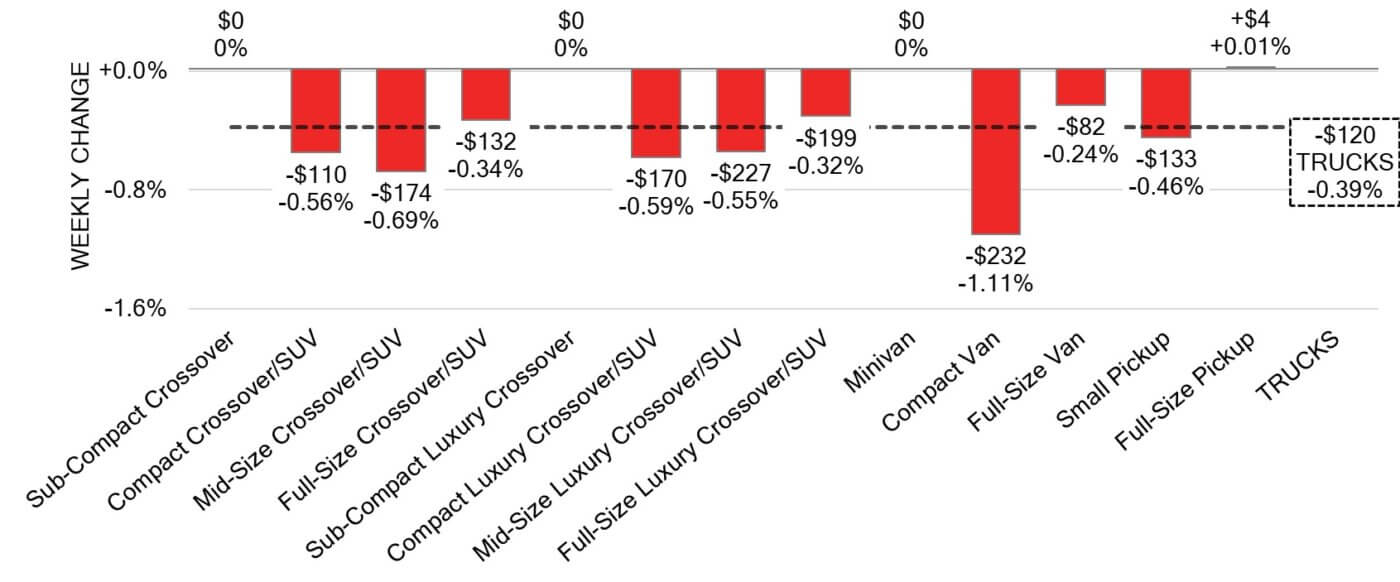

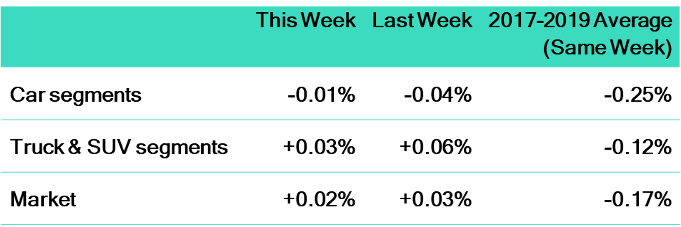

The Canadian used wholesale market experienced a decline of –0.45% in pricing for the week. Car segments prices decreased by –0.51% while the Truck/SUVs segments dropped -0.39%. Full-Size Pickup was the only segment with price increase of +0.01%. The largest declines in the car segments were seen in Near Luxury Car with –0.93% followed by Full-Size Car at –0.76%. The largest declines in the Truck/SUV segments were Compact Van at -1.11% and Mid-size Crossover/SUV -0.69.

| This Week | Last Week | 2017-2019 Average (Same Week) | |

| Car segments | -0.51% | -0.31% | -0.25% |

| Truck & SUV segments | -0.39% | -0.39% | -0.26% |

| Market | -0.45% | -0.35% | -0.25% |

Car Segments

- Last week there was an overall decrease of -0.51% across Car segments. This decrease was noted across all nine segments.

- The Sub-Compact Car (-0.08%), Compact Car (-0.13%) and Mid-Size Car (-0.28%) segments showed the smallest declines.

- The largest decreases were seen from Near Luxury Car (-0.93%), Full-Size Car at (-0.76%) and Luxury Car at (-0.59%).

Truck / SUV Segments

- Truck segments reflected an overall depreciation of –0.39% last week, same amount as the previous week. This was seen in nine of the thirteen segments.

- Those with the largest declines were Compact Van (-1.11%), Mid-Size Crossover/SUV (-0.69%), Compact Luxury Crossover/SUV (-0.59%) and Compact Crossover/SUV (0.56%).

- Full-Size Pickups showed a very small positive change (+0.01%).

Wholesale

The Canadian market continues a downward trend, with a decline slightly more pronounced than the previous week. Just over 63% of market segments experienced an average value change of more than ±$100, indicating a higher rate than the previous week. Among these, Truck segments experienced a 20% larger decline compared to the previous week. Monitored auction sale rates ranged from 9% to 95% averaging at 42.4% The fluctuations in sale rates across various lanes can be attributed to the ongoing decline in floor prices. An increase in supply entering the wholesale market has been noted, despite upstream channels continuing to gain early access. There continues to be a high demand on both sides of the border for increase in inventory and vehicles at auctions.

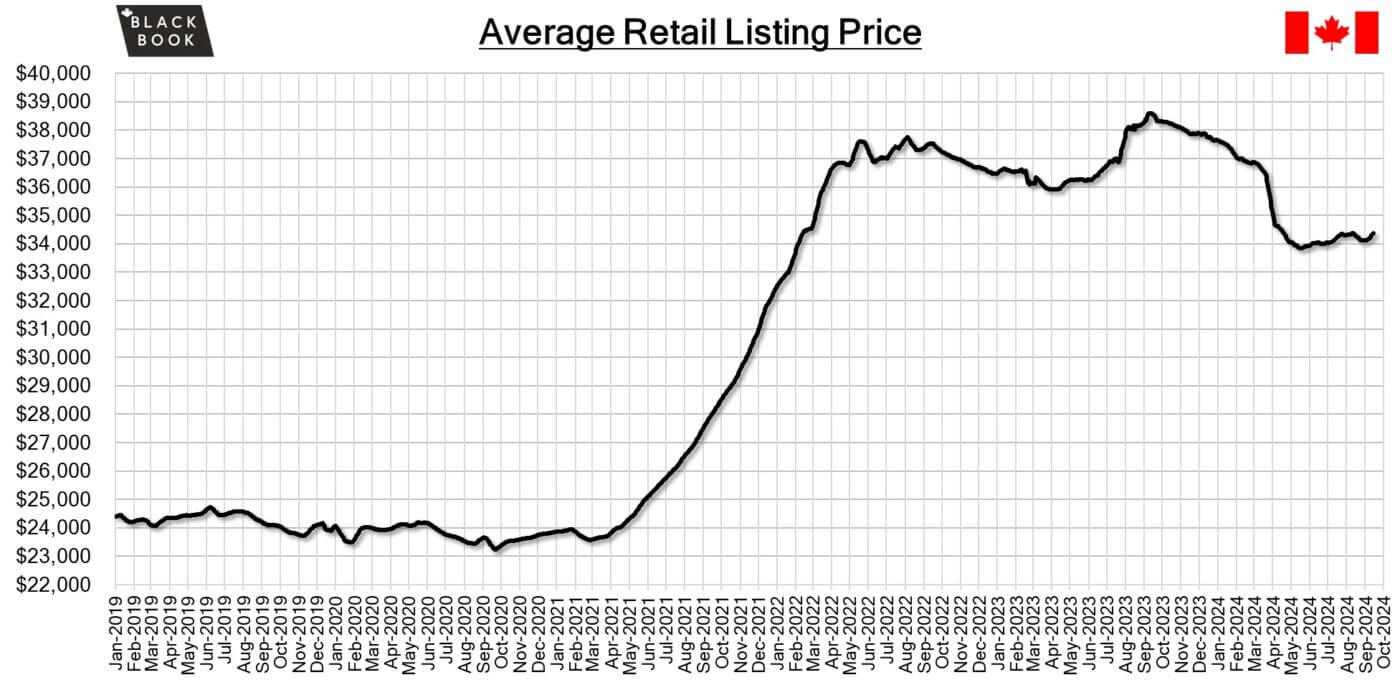

Used Retail Prices & Listing Volume

The average listing price for used vehicles is stable, as the 14-day moving average was at $34,300. This analysis is based on approximately 220,000 used vehicles listed for sale on Canadian dealer lots.

Market Insights

Economics & Government

- In August 2024, Canada’s annual inflation rate slowed for the third consecutive month, dropping to 2%. This marks the lowest rate since February 2021 and falls just short of the expected 2.1%. Importantly, it also meets the central bank’s target for the first time in over three years.

- On Friday, the S&P/TSX Composite Index rose by 0.5%, reaching a new high of over 23,580. This increase marked a weekly gain of more than 3%, driven by strong performances from commodity producers, financial institutions, and technology stocks that supported the market.

- The yield on the Canadian 10-year government bond decreased slightly to 2.88%.

- The Canadian dollar is around $0.735 this Monday morning, representing a slight decline from $0.738 a week prior.

U.S. Market

- Affordability is crucial for success in the wholesale lanes right now. Though the overall market remains stable, the strength lies in affordable segments like Mid-Size Cars and Small Pickups, which had the largest increases last week. Interestingly, even older Prestige Luxury Cars showed gains, primarily driven by models priced under $30,000.

Industry News

- ZEV registrations continue to trend upward in Q2, with 65,733 or 12.9% of the total market, up from 10.1% a year ago and 11.3% last quarter.

- British Columbia is anticipating the completion of an “electric highway” by the end of this month. The EV charging project will provide a network of 310 fast chargers, located within 150km of each other on major highways throughout the province.

- General Motors and Hyundai Motor Co. have agreed to work together on future partnerships in vehicle development and production as well as multiple powertrain technologies – a decision that helps allow each organization the opportunity to increase scale and decrease costs.

- As the Bank of Canada continues decreasing interest rates, this helps the affordability for both consumers and car dealers as Grant Simons, Vice-president and Head of RBC Automotive Finance said, “For every quarter point the Bank of Canada drops rates, that frees up somewhere between $7 and $8 billion in purchasing power for Canadian households”, to Automotive News Canada last week.

- As Lucid prepares to launch its first 3-row electric crossover later this year, it has just teased a new mid-size crossover poised to take on the likes of Tesla’s Model Y in roughly 2 years’ time, with a smaller battery and price that will meet segment leading offerings.

- With other Asian manufacturers well underway on EV’s, Japanese carmakers are now looking to catch up through billions in government support money. Toyota, Subaru, Mazda, and Nissan are accelerating electric vehicle programs and new battery factories to increase the development of new technologies to reach parity with global market leaders.